How Terra [LUNA] buyers can leverage this strategy to optimize their returns

Disclaimer: The findings of the following analysis are the sole opinions of the writer and should not be considered investment advice.

Terra’s recovery efforts by the team and its community over the last month rekindled positive investor sentiment, especially during the start of this month.

These improvements aided its native token LUNA to record an over 250% growth towards its $7.5-mark highs. Since then, however, a correction has set in while LUNA fell below the bounds of its four-hour 20/50/200 EMA.

The price action’s recent plunge flipped its previous support to an immediate resistance. The coin could see a sustained setback in the near-term before picking itself up in the coming sessions.

At press time, LUNA was trading at $2.46, down by 4.2% in the last 24 hours.

LUNA 4-hour Chart

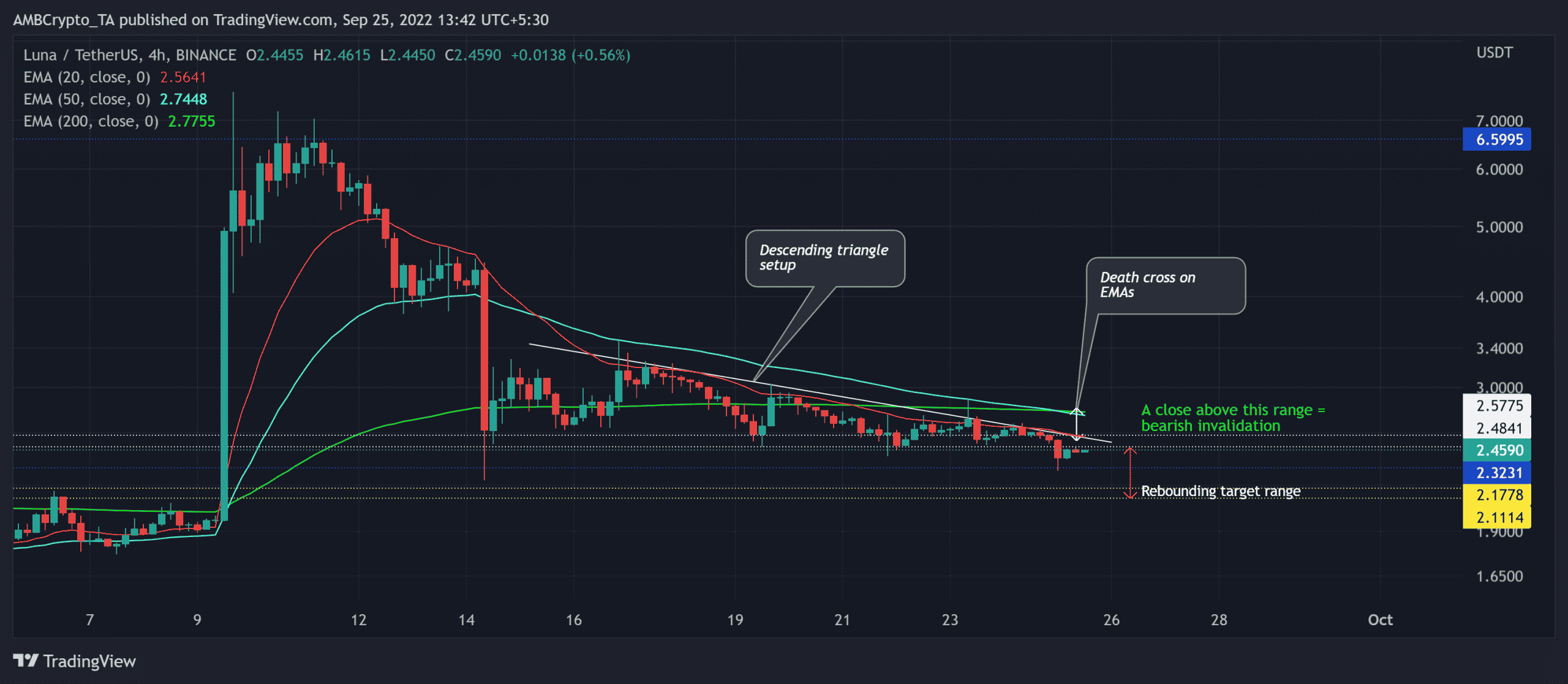

Since its all-time low on 29 August, LUNA turned the tables to bag exponential gains over the next few days. This regained momentum set the stage for a triple-digit rally towards the $6.5-resistance.

After testing this resistance multiple times, the bears were quick to undermine the over-extended bull run. The altcoin witnessed a solid descent, one that inflicted a bearish crossover of the 20/50 EMA with the 200 EMA (green).

Meanwhile, LUNA marked a descending triangle breakdown on this timeframe. The decline below the $2.4-$2.5 range reaffirmed the selling edge. A reversal from the $2.4-resistance would position LUNA for a test of the $2.11-$2.17 range before a likely reversal.

On the other hand, an eventual or immediate recovery above the 20/50 EMA would confirm a bearish invalidation.

Rationale

The heightened selling pressure has kept the Relative Strength Index (RSI) in the bearish zone. A recovery towards the 40-50 range could induce a rather slow-moving compression phase on the chart.

Also, the DMI lines exhibited a strong bearish inclination. The ADX displayed a substantially weak directional trend for LUNA.

Furthermore, to gauge the altcoin’s recovery chances, traders can look for a revival on the Chaikin Money Flow (CMF) above the -0.1 level.

Conclusion

Given the descending triangle setup alongside the death cross on the EMAs, LUNA had slim recovery chances. Any improvement in investor sentiments leading to a close above the 20/50 EMA could confirm bearish invalidation. In either case, the targets would remain the same as discussed.

Finally, investors/traders must keep a close watch on Bitcoin’s movement. The latter could potentially affect the broader market sentiment.