How this Ethereum event will impact prices

Ethereum made a lot of investors happy over the last few days. In fact, despite a minor red close yesterday, the second-generation coin has been in the green for the last 8 days. At the moment, a plethora of investors are hedging for and against Ethereum. And, with the crypto trading at $2312.23 at press time, much of their hedging might be coming to an end too.

If you wonder how ETH would be impacted by that, these metrics will help you understand how.

Ethereum Options – A good option?

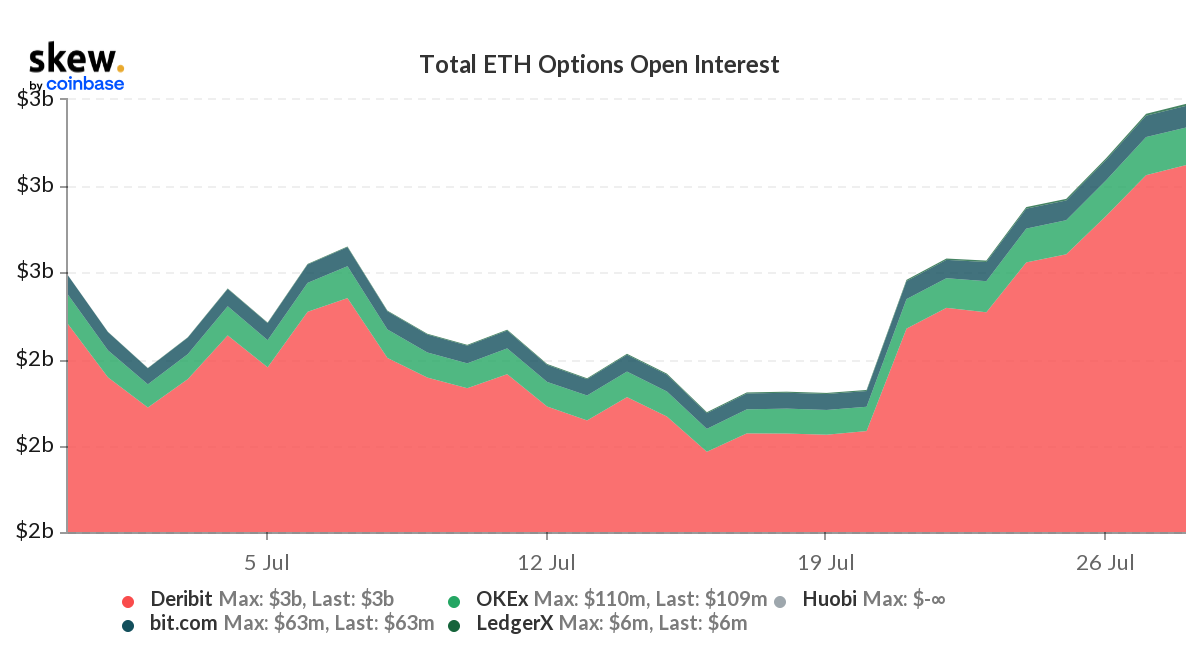

Well, based on the latest hike in ETH Options’ Open Interest (OI), it does seem to be the case. Over the last 8 days as the price went up, OI went up as well. Rising by $800 million, the OI stood at $2.8 billion, at the time of writing.

This was a 27% hike, also the highest such hike in almost a month. The consistent growth of the OI, however, did not align with the Options Volumes as the latter has been strictly decent. While a spike was seen on 26 July, for the most part, these volumes have been dormant.

Ethereum Options Open Interest at monthly high | Source: Skew – AMBCrypto

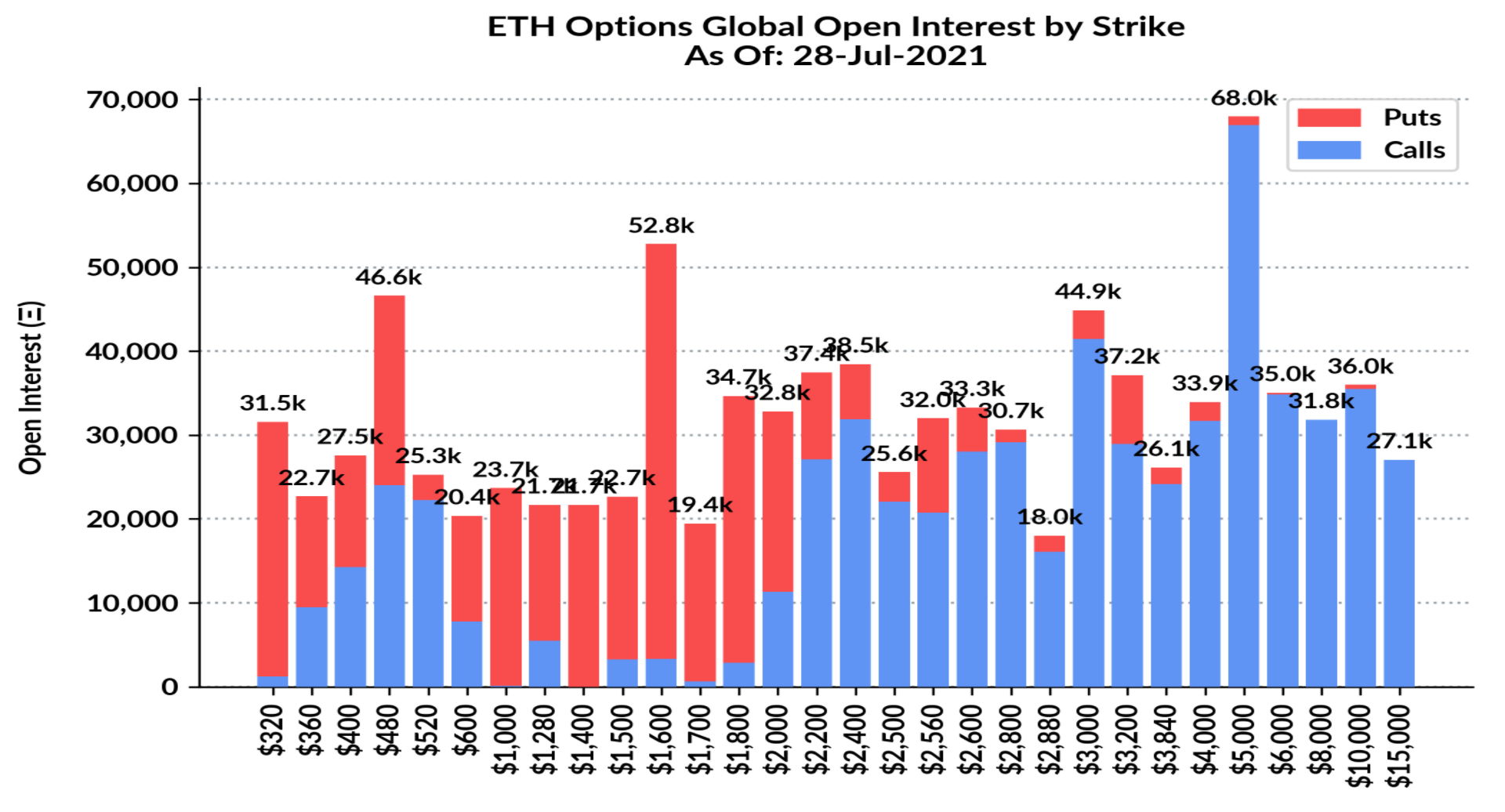

The interesting observation, however, comes from the Ethereum Options OI by Strike. Put simply, this metric indicates the number of hedge contracts placed at different prices.

Puts represent a fall to that specific price, whereas Calls are an indicator of such a rise. If you notice the chart, you can see that the market seems very positive about a price rise. Calls contracts have been dominating Puts contracts throughout the $2200 – $4000 range. Additionally, over 230k contracts were placed for the $5000 – $15000 range. And, these numbers aren’t small either.

ETH Options by Strike indicate bullish sentiment | Source: Skew – AMBCrypto

$5000 alone has the highest number of hedged contracts – 68k, with over 90% Calls. This is an indication of just how bullish investors are about Ethereum. Also, if you consider the dates when these contracts expire, this potential price rise might seem plausible.

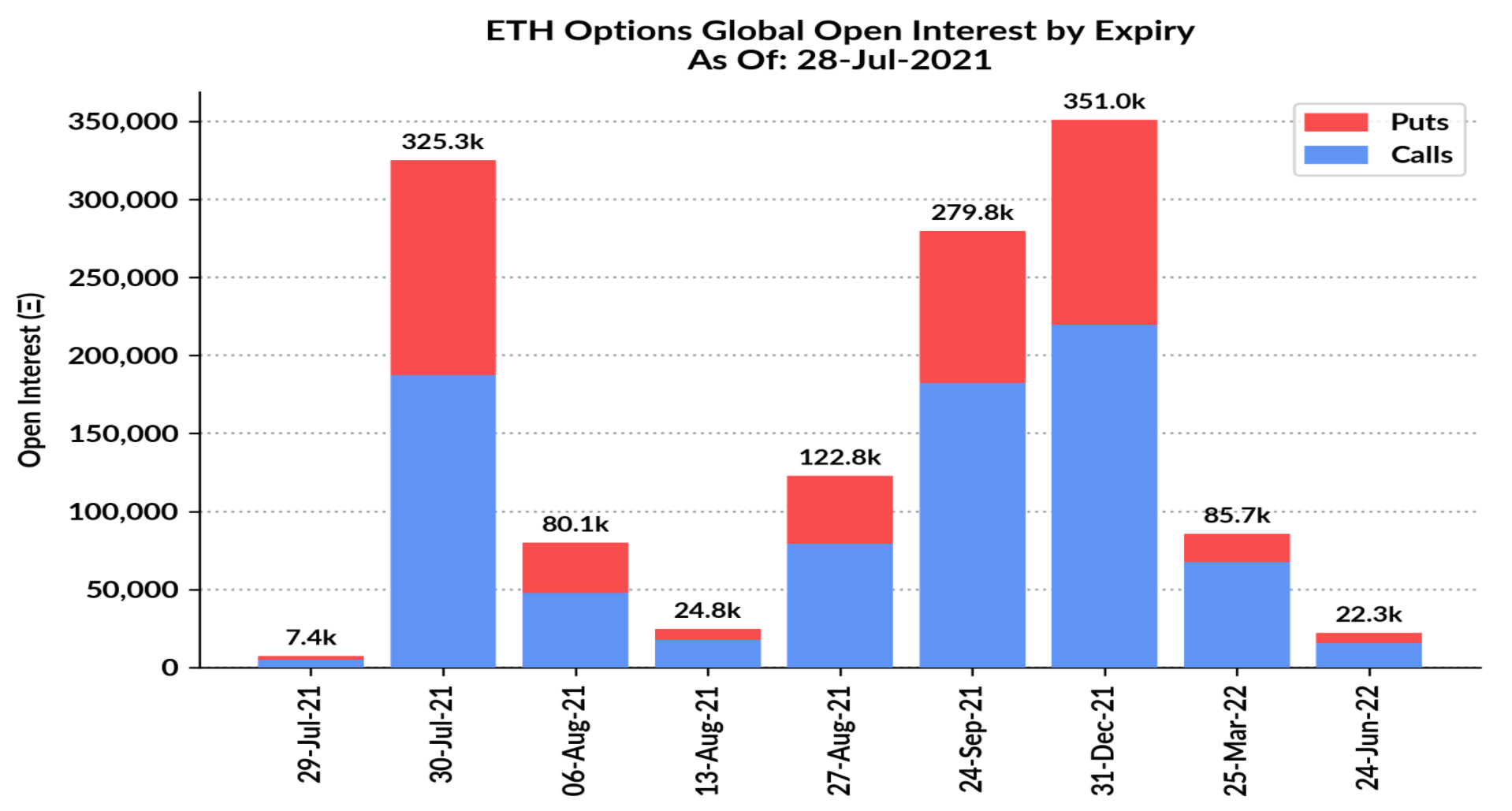

ETH Options contracts expiry

The expiry is an important signal in terms of understanding price movement. Depending on when the contracts are placed and based on the kind – Puts or Calls – dominating, prices can be estimated. As for Ethereum, this may come as a blessing. Most OI expiries are placed between September and December 2021.

This year-end hedge exhibits investor sentiment as people are expecting a major price difference by the end of the year. Probably, a price rise since the range of most Options contracts is in the bullish direction along with the already active rally.

ETH Options Expiry also appear bullish | Skew – AMBCrypto

Also, over 325k contracts expire tomorrow. Thus, it will be interesting to see if last week’s rally put investors in profits or losses as a bunch of Puts orders were placed for Ethereum falling to the $1000 – $1800 range.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/08/Bitcoin-BTC-400x240.webp)