How Tron dominated USDT volumes despite TRX’s slow moves

- The Tron network is dominating USDT payments, with Q2 settlement volumes hitting $1.25 trillion.

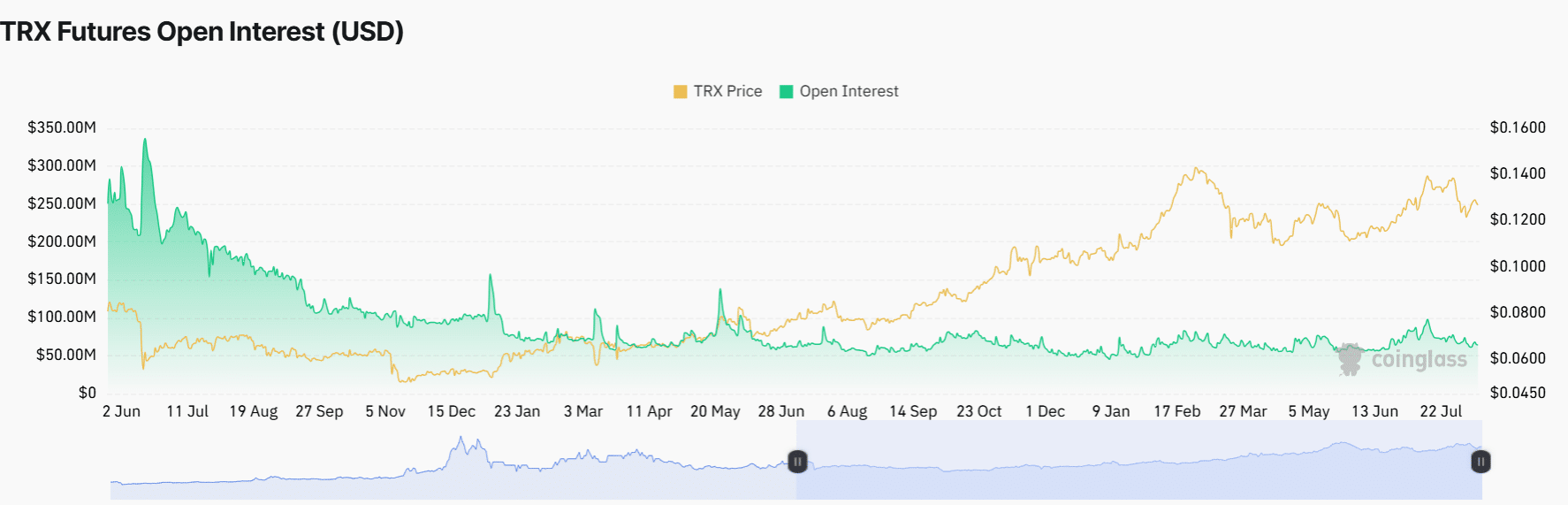

- TRX has seen relatively stable volatility this year amid declining Open Interest.

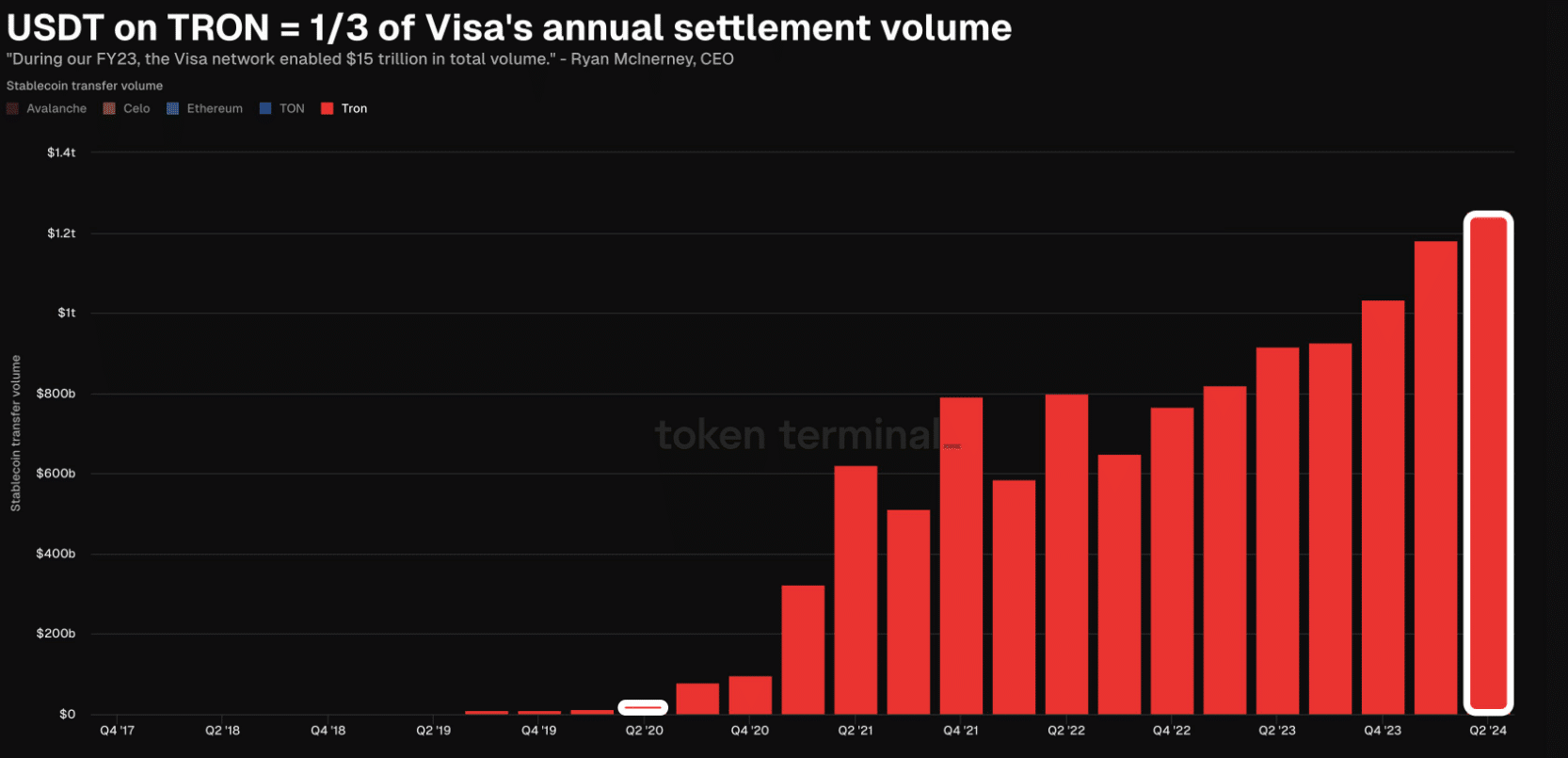

Tron [TRX] is emerging as a major competitor to digital payments giant Visa, with USDT settlement volumes on the network in Q2 2024 reaching $1.25 trillion.

According to Token Terminal, USDT volumes on the Tron blockchain hit a third of Visa’s annual settlement volumes. USDT transactions on the network have increased five-fold from around $25 billion in 2020.

Tron’s rising network activity

USDT volumes on Tron spiked from $4.2 billion to $16 billion in 2023, per AMBCrypto’s look at Dune Analytics data.

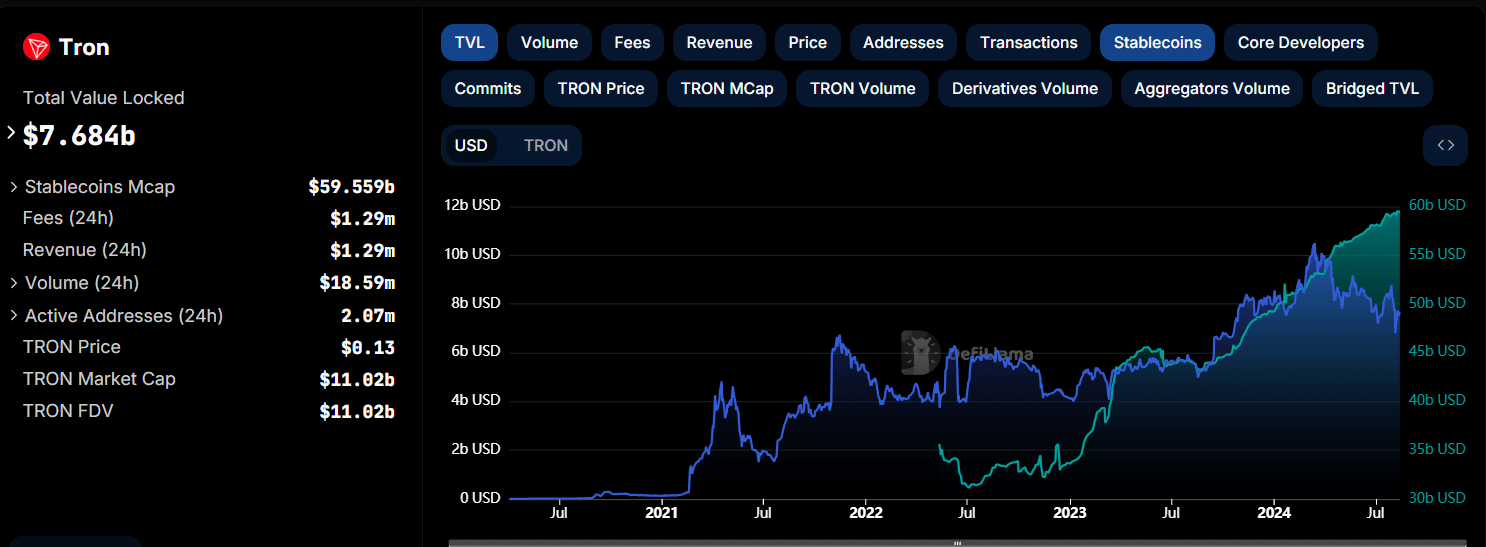

The total market cap for stablecoins on the network also stood at $60 billion, according to DeFiLlama, suggesting that the blockchain has become the defacto settlement network for USDT.

Besides being the most preferred network for transactions, Tron was also emerging as a formidable rival in the decentralized finance (DeFi) industry.

Tron is the second-largest blockchain after Ethereum [ETH] by Total Value Locked (TVL). Its TVL has increased from around 5 billion in August 2023 to $7.68 billion at press time, according to DeFiLlama.

However, Tron’s network growth pales in comparison to Solana [SOL], which has seen its TVL grow over tenfold to $4.76 billion at press time from around $300M last year.

Is TRX reflecting Tron’s growth?

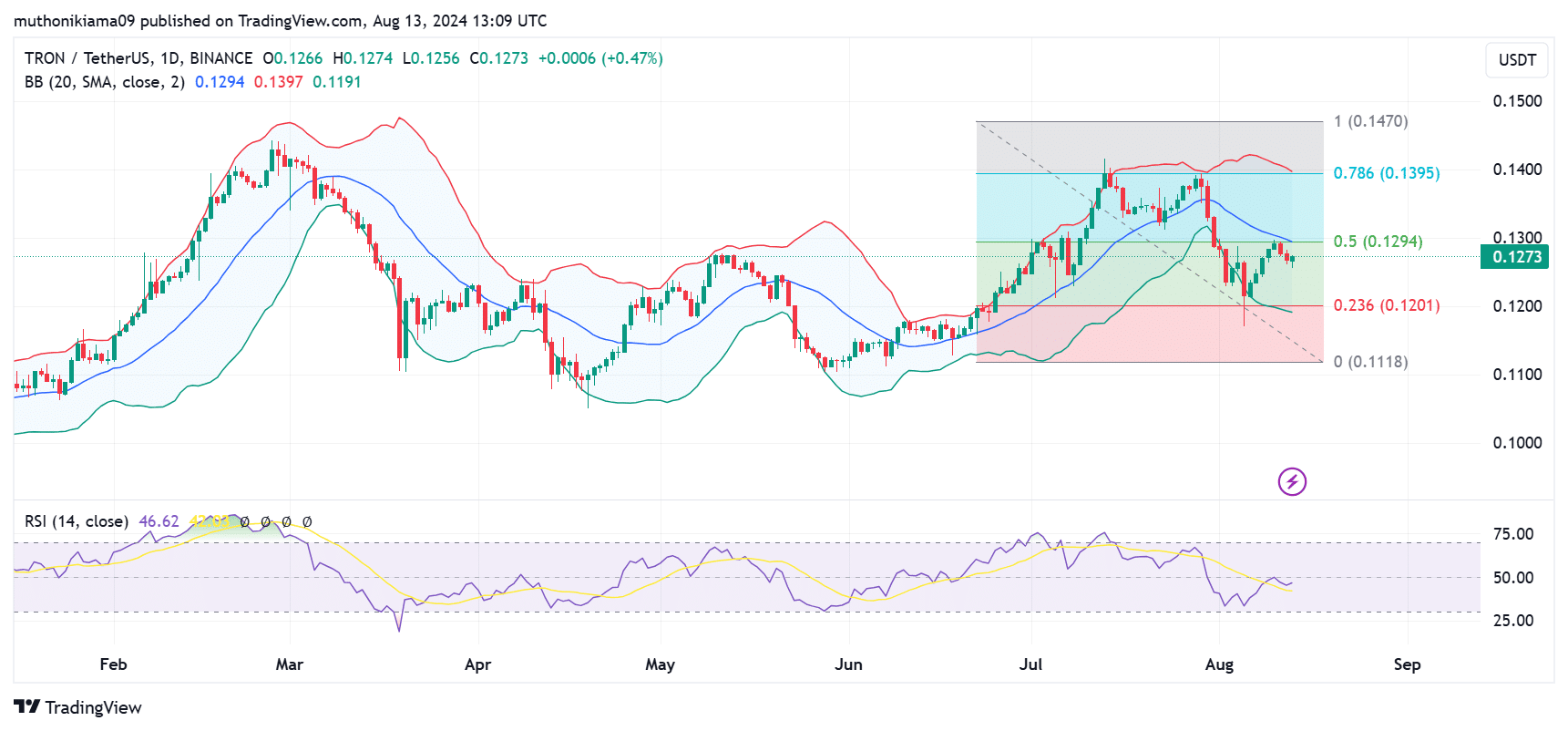

At the time of writing, TRX was up by around 20% year-to-date, having traded within $0.14 and $0.10 for most of the year. It has also moved within the Bollinger bands, pointing towards relatively stable volatility.

The buying behavior also showcased moderate interest, with few instances of TRX being overbought or oversold.

A look at the short-term price action showed that the Relative Strength Index (RSI) has made a higher high and bounced, suggesting further gains.

A key resistance level lies at $0.139, also the 0.786 Fib level. Hitting this target will pave the way for a rally to record highs.

Realistic or not, here’s TRX market cap in BTC’s terms

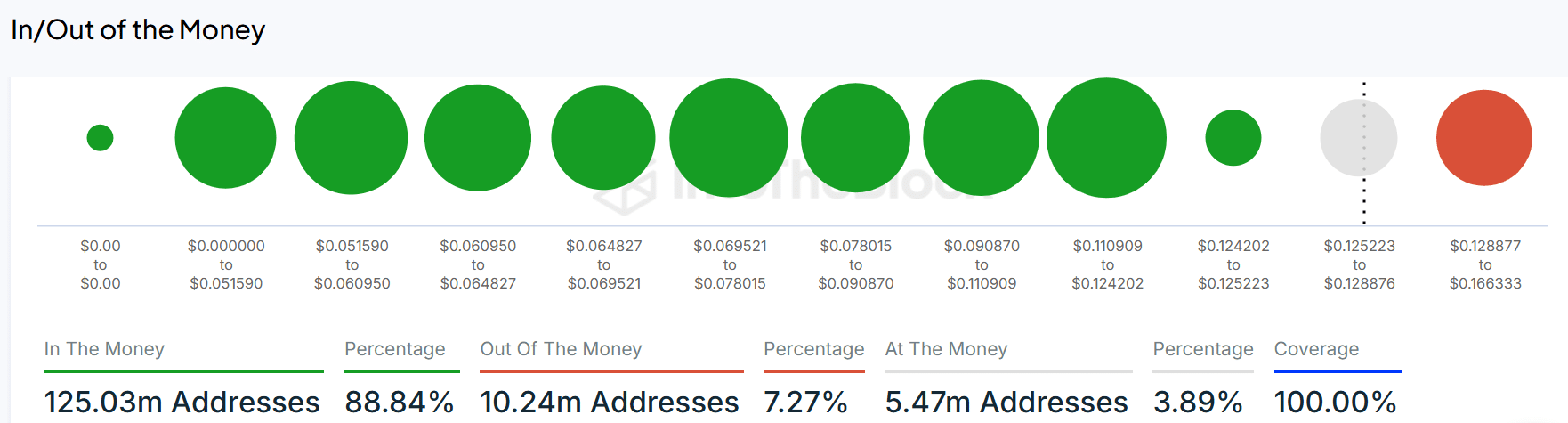

Data from IntoTheBlock showed that 88% of TRX holders, equivalent to 125 million addresses, were “In the Money” at press time, suggesting an overall bullish sentiment.

However, the Futures market showed skewed sentiment around TRX. The declining Open Interest explained the mild price volatility and a decline in overall market participation.