How Uniswap has contributed to Optimism’s growth

- Uniswap’s incentives on Optimism showed short-term liquidity improvements.

- Optimism protocol experienced a surge in daily activity, but the DeFi sector faced challenges.

Cumulatively, the Optimism Foundation has helped fund over 127 projects, valued at 127 million OP, since its inception. One notable project included the deployment of Uniswap’s incentive program on Optimism’s [OP] pools, which aimed to drive liquidity and growth.

Is your portfolio green? Check out the Optimism Profit Calculator

New incentives

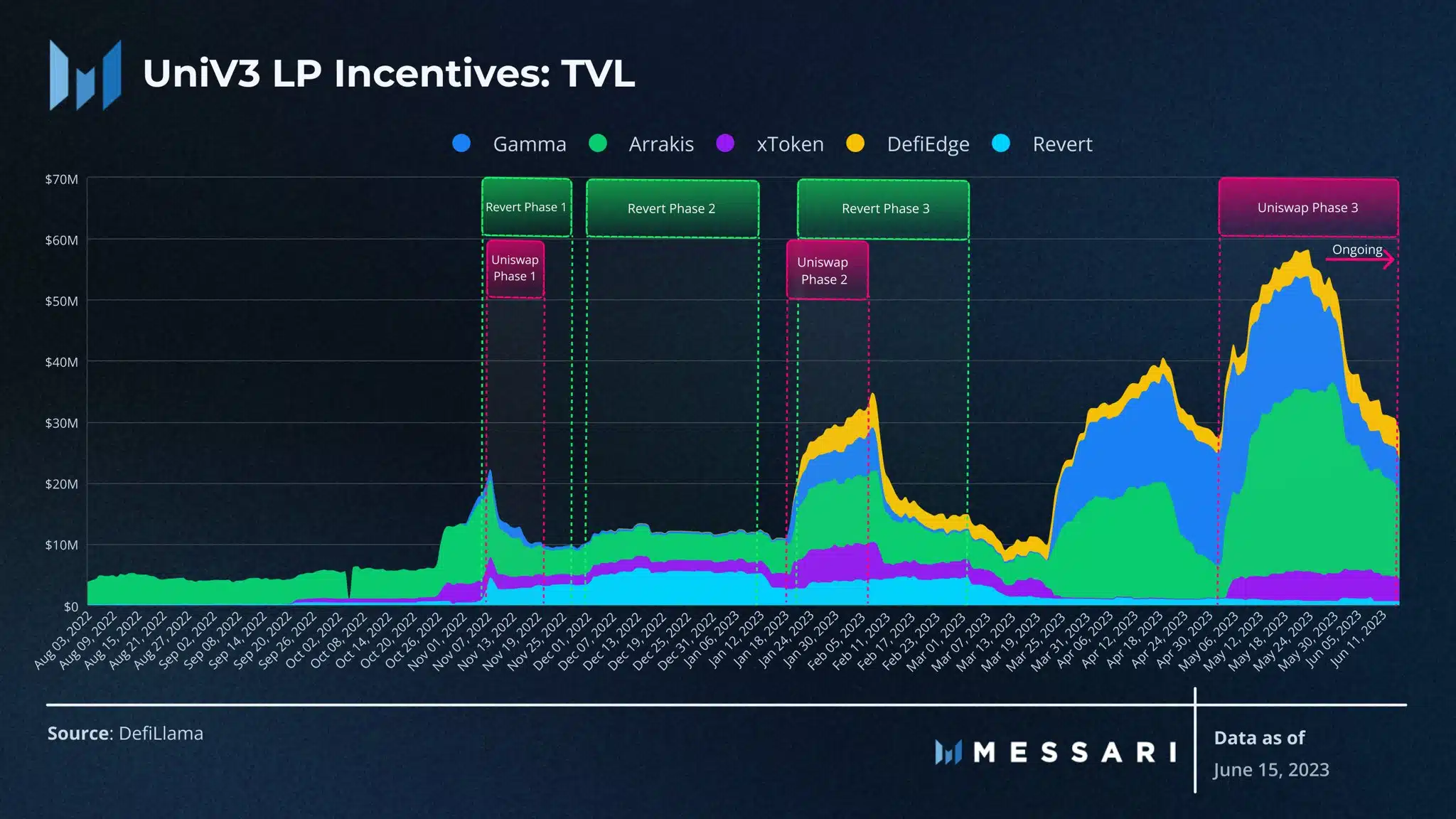

Uniswap carried out an incentives experiment in 2022 and 2023, during which they distributed UNI incentives to liquidity providers (LPs) of specific Uniswap pools on Optimism.

The experiment comprised two distinct phases: Phase 1 took place in November 2022 for two weeks, targeting specific LP pools, while Phase 2 occurred in January 2023 for three weeks, focusing on different LP pools.

The outcomes of the experiment yielded mixed results. In both phases, the liquidity in the relevant pools increased during the incentive period and decreased after the incentives concluded. While short-term improvements in liquidity were observed, the sustained impact of these incentives appeared to diminish with time.

However, the later part of Uniswap’s liquidity incentives on Optimism showcased an upward trend in the Total Value Locked (TVL) on the Optimism protocol. This suggested that, despite the long-term impact on liquidity, the incentives contributed to overall growth and engagement on the platform.

According to Uniswap’s data analysis, liquidity mining has the potential to create short-term improvements in liquidity for relevant pools. However, sustaining long-term liquidity growth necessitates exploring additional strategies and mechanisms.

Recent weeks have seen a significant surge in daily activity on the Optimism protocol, accompanied by a notable increase in the number of transactions occurring on the network. Transaction volume rose from 499,000 to 567,440 during this period, indicating a heightened level of engagement and usage.

However, Optimism did not experience the same level of success in the DeFi sector. The network’s TVL declined materially over the past week, potentially because of the decrease in DEX volumes on the network.

This decline in DEX volumes highlights the need for continued efforts to drive liquidity and activity in the DeFi space.

Realistic or not, here’s OP’s market cap in BTC’s terms

State of Optimism

At press time, OP was trading at $1.367, having appreciated over the last few days. The MVRV ratio for OP was negative, suggesting less selling pressure. However, the decreasing long/short difference for OP raised concerns, as it meant that new addresses outnumbered the old ones.

This situation could potentially impact OP negatively, particularly if these new addresses decided to sell their holdings once they turned profitable.