Stablecoins

How USDT, USDC played a part in Bitcoin, crypto-market’s fall and recovery

Stablecoins might have dictated how the past week played out for crypto holders.

- USDT and USDC grew almost $3 billion amidst crypto market’s downturn

- Tether’s USDT recorded $1.5 billion deposits while Circle’s USDC noted figures of $820 million

Despite positive performances preceding it, the larger crypto market crumbled on Monday. The start of this week saw all cryptocurrencies decline amid a global stock crash. However, stablecoins defied all market odds throughout the week.

In fact, the stablecoin sector grew in market cap and supply, led by USDT and USDC.

USDT & USDC’s $3B supply in a week

Over the past week, the supply of Tether’s USDT and Circle’s USDC grew exponentially to $3 billion. Since crypto markets were experiencing a sustained decline, the rise in supply indicated a greater need to buy the dip. Thus, most investors rushed to buy the dip as crypto prices declined.

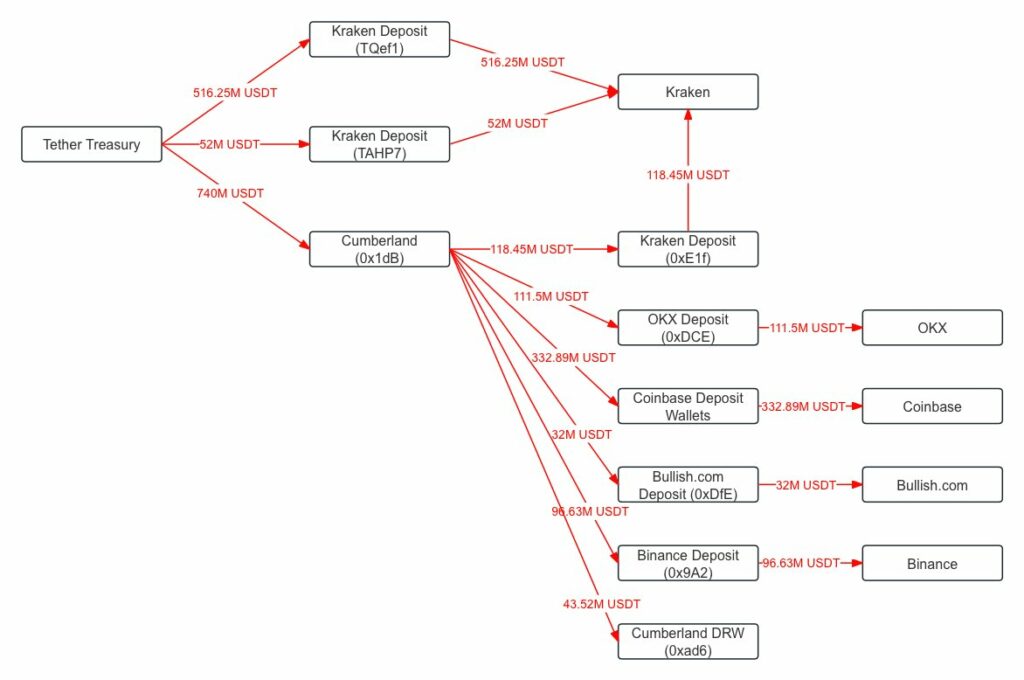

According to data shared on X by Lookonchain, Tether transferred $1.3 billion to exchanges and market markers since the Monday crash. Lookonchain noted,

” 1.3b of USDT has been transferred from Tether treasury to exchanges since the market crash on Aug 5.”

The sudden surge in stablecoins has risen since the start of the crypto market tumble, which resulted from traders’ transfers to exchanges. In fact, Cryptoquant’s data revealed that USDT inflows into exchanges spiked by 181% between 3 August and 6 August during the market crash.

Equally, data from defiLlama suggested that Binance registered exponential growth in USDT deposits hitting $1.5 billion.

Additionally, USDC deposits into Binance hit a record of $820 million within just 3 days.

Simply put, the data shows that the recent market downturn presented a buying opportunity with all stakeholders turning into net buyers.

The increased buying pressure’s impact was witnessed after 48 hours when markets started to recover with significant gains across the board.

Market Cap growth to record high

The market cap also surged as the supply grew during the market downturn. Tether’s USDT market cap grew to a record high of $115.4 billion after experiencing sustained growth over the last 3 months. Equally, USDC has maintained its growth since Circle complied with MICA. Over the past week, USDC increased its numbers by $1.6 billion to $34.48 billion.

Now, USDC is at its yearly high since the collapse of SVB in 2023.

This surge was further noted by other crypto analysts, with David Alexander sharing his analysis on X by stating,

“Interesting $USDC movements this week as total circulating supply has increased by $1.56B (4.8%) after experiencing a sharp decline ahead of broader market headwinds. Much of these inflows occurred on Ethereum ($1.34B) and Solana ($356M).”

Source: Defillama

Over the past year, stablecoins have seen consistent growth from $124.6 billion on 10 August 2023 to $165.4 billion, at press time. This can also be seen as a sign of greater adoption, interest, and usage, translating into USDT’s and USDC’s growth.