How will Chainlink [LINK] fare in the next quarter? This data suggests…

![How will Chainlink [LINK] fare in the next quarter? This data suggests...](https://ambcrypto.com/wp-content/uploads/2023/03/AMBCrypto_A_futuristic_cityscape_is_visible_in_the_background_w_9610ed28-6029-48af-8f79-b043afe1bd46-e1679479841975.png)

- Chainlink planned to add new developments to its range of products.

- Demand for certain products declined, while the token continued to get impacted.

Over the last few months, Chainlink [LINK] has built many products and services to integrate with different systems in the crypto space. However, LINK has seen little growth despite the developments made by the network.

Is your portfolio green? Check out the Chainlink Profit Calculator

Over the last month, the price of LINK fell by 7.21%, according to Messari.

New developments

This price of LINK, however, could be positively impacted by Chainlink’s plans for the future. According to their recent announcement, new developments are being made for their line of products, including VRFs (Verifiable Random Functions), CCIPs (Cross-Chain Interoperability Protocol), and Price Feeds.

In this update, Chainlink Labs Chief Product Officer @kelmoujahid covers recent deployments and what's next for #Chainlink's wide range of #Web3 services, including:

-Data Feeds

-Functions

-Proof of Reserve

-DECO

-Automation

-VRF

-FSS

-CCIPDive in?https://t.co/kU2g31ut4y

— Chainlink (@chainlink) March 21, 2023

If these additions improve the state of their products, it could attract more users to the Chainlink network.

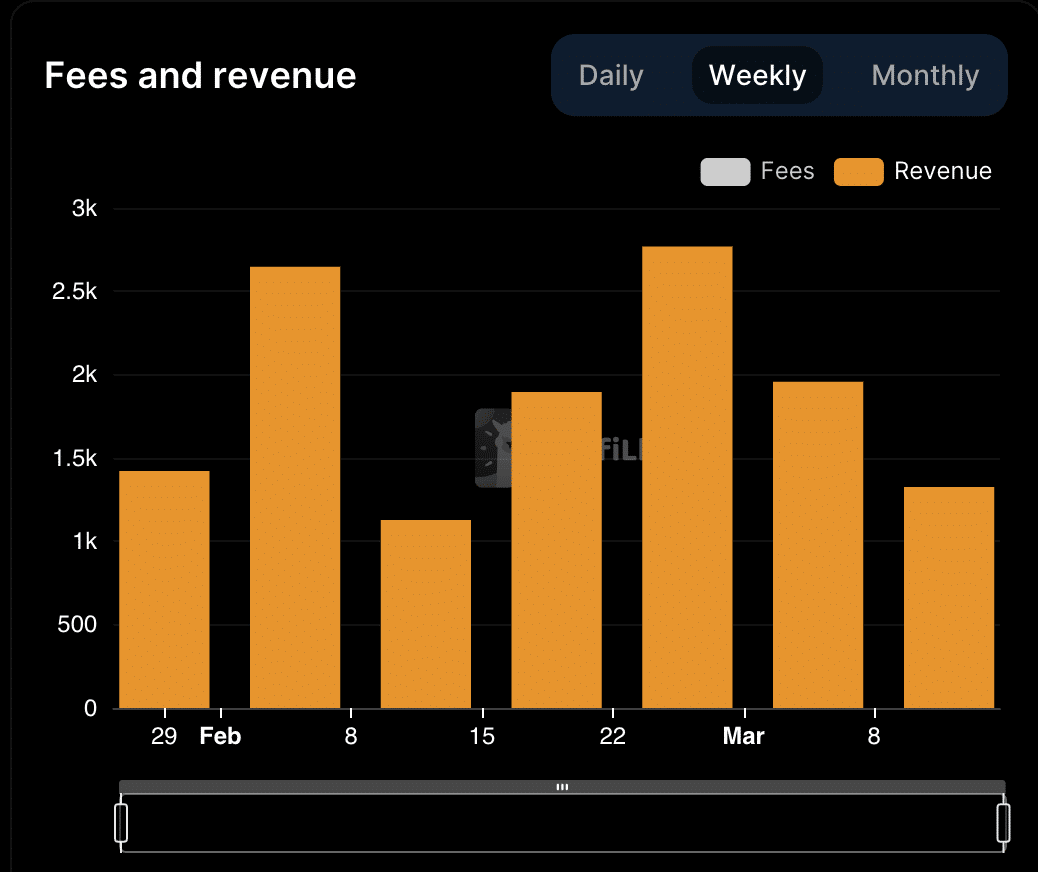

However, at press time, the overall demand for one of Chainlink’s popular products, VRF, started to fall. According to Dune Analytics’ data, the number of requests for VRF on the Binance Smart Chain decreased from 21,378 to 10,892 over the last three months.

It remains to be seen whether the new upgrades will be enough to regenerate interest in the protocol.

The declining interest in Chainlink products also impacted the token’s revenue. According to Defi Llama’s data, the week-on-week revenue generated by Chainlink fell materially.

The social angle

In terms of social hype, Chainlink wasn’t able to keep up, either. According to data provided by Lunar Crush, the number of social mentions and engagements for Chainlink dropped by 8.9% and 9% respectively.

Realistic or not, here’s LINK’s market cap in BTC’s terms

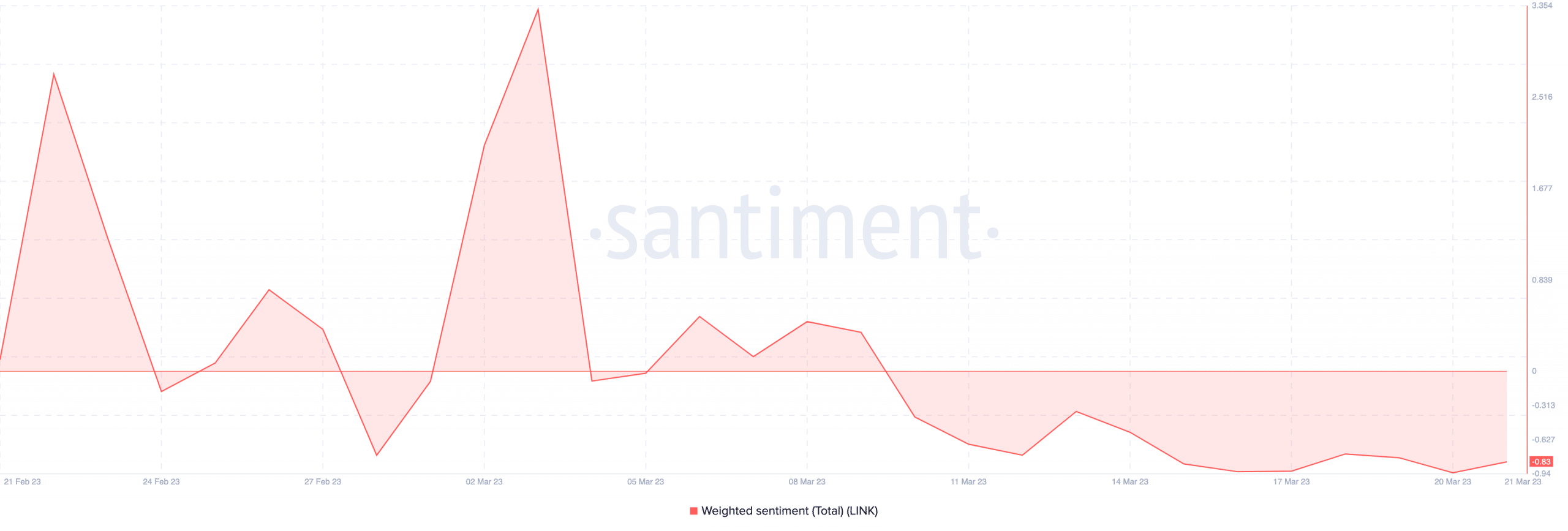

The weighted sentiment for LINK also declined during this period, suggesting that the crypto community had more positive than negative things to say about LINK.

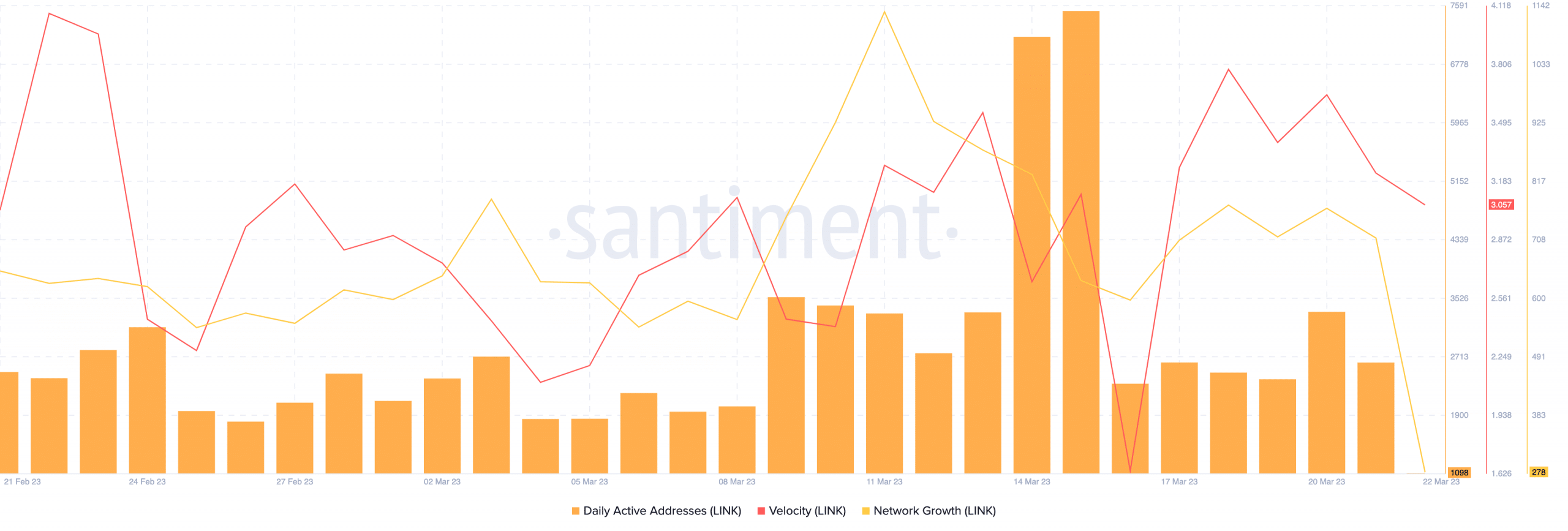

Coupled with that, the daily active addresses on the network fell over the last few weeks. This was also indicated by the falling velocity of LINK. The network growth for LINK also decreased during this period, suggesting that new addresses were not as interested in LINK at the press time price.