Huobi Futures offers suite of crypto derivatives products to ride the bear market

The price of the world’s largest cryptocurrency, Bitcoin, has plummeted to below US$18,000 this month to test its lowest level in two years. Despite having rebounded slightly to around US$21,000 in the last few days, this figure is a far cry from the peak of US$69,000 observed in November last year.

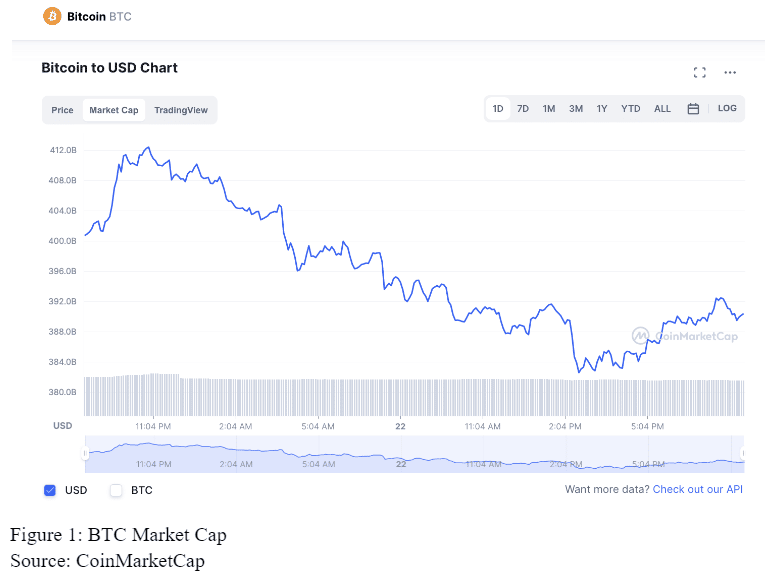

According to CoinMarketCap data, on June 20, the overall market value of global cryptocurrencies fell from US$2.97 trillion at its highest to around US$845 billion — in other words, some US$2.1 trillion was lost. For perspective, this is approximately Apple’s total market value.

Does the fall in the price of BTC present a rare opportunity for bargain hunters? Some analysts believe that the price of Bitcoin may fall by more than 80% from its all-time high based on the events observed in previous bear markets, indicating an eventual price as low as US$13,800.

Indeed, there were increasing calls by traders to “go short” after the price of Bitcoin fell from US$40,000 to US$30,000. A bear market, however, does not guarantee healthy trading profits even if going short. On the contrary, volatile market conditions mean traders can hit rock bottom if due caution is not exercised. What then, are the common pitfalls to avoid when trading derivatives during a bear market?

- Open an appropriate position

For novices who have no experience with derivatives trading, it is not recommended to open with a heavy position comprising your entire net worth. Derivatives trading carries a much higher risk than that of spot trading, and opening a large position amplifies risk. Doing so would be tantamount to walking around the fire with a full gas tank. Severe destruction could happen, and it could happen fast.

- Use low leverage

Higher leverage means you can invest less for a high return. However, the risk is magnified at the same time. Should your price prediction go the wrong way, the loss that comes along will also be leveraged. Beginners who are new to the market should not be overly greedy – low leverage is the way to go.

- Preprare sufficient margin

Users who prefer coin-margined futures or swaps trading should choose a contract whose underlying asset they have the ability to increase if necessary. Inability to add to margin means one could helplessly watch while positions are being liquidated. Should the price of the asset increase constantly under a short position, the margin will need to be supplemented, which equates to a higher cost for the trader.

- Choose a reliable futures exchange

In a bear market, choosing a reliable futures exchange indicates you should never worry about asset security and system operations. A stable exchange will also protect you from unnecessary liquidations during an extremely volatile market. In addition to advanced risk-control systems, they usually feature advanced professional functions, enabling users to capitalize on price volatility even during a bear market.

Why Huobi Futures?

Future, Swaps and Options to choose from

Huobi Futures provides a suite of crypto derivatives products, including USDT-margined futures, coin-margined futures, USDT-margined swaps, and coin-margined swaps. Futures contracts have a delivery date while swaps contracts do not. USDT-margined contracts uses the stablecoin USDT as the margin while coin-margined contracts use coins as the margin. Both have their advantages — users can choose either of them based on their preferences.

The platform also rebranded its derivatives warrant as Huobi Options earlier this year, offering traders additional hedging and arbitrage opportunities. Huobi Options traders can buy or sell an asset at a predetermined price, either before or on a specified date.

All of the above contracts enable users to speculate on future price movements of an underlying asset for income at a much lower cost than the asset itself, or hedge the risk exposure of their existing positions.

The platform has listed more than 110 assets for these contracts, covering DeFi, GameFi, NFT, storage, and more.

Safe and smooth system to cope with extreme cases

The Huobi Futures system has now been upgraded to V7.0.6, and the response speed for placing orders has been doubled, greatly increasing the efficiency of the system to cope especially with ever-changing market conditions. Huobi attaches high importance to users’ asset security. For example, the platofm protects users’ assets through multiple methods such as hot and cold wallet separation, multi-signature, professional distributed architecture, and anti-DDOS attack system.

Three-phase liquidation system

The majority of Huobi Future’s management and staff come from leading investment banks and have extensive experience with derivatives products. In the second year of its establishment, the platform introduced the three-phase liquidation protection mechanism, helping users avoid sudden, forced liquidations:

- When liquidation is about to be triggered, the system will cancel all open orders of the asset first;

- If the margin ratio is still ≤0, the long and short positions of the same contracts will be filled in with each other;

- If the margin ratio is still ≤0, the liquidation will be triggered and the system will decrease the position to a certain extent;

- Unlike other platforms that charge extra fees when liquidation is triggered, Huobi Futures charges zero liquidation fees.

In addition, the platform uses the moving average of the EMA index as one of the elements to determine liquidation reference price during liquidation. When both the moving average of the EMA index and the margin rate calculated from the latest price are less than or equal to zero, the user’s position will be liquidated. This can help avoid liquidation caused by abnormal prices and the subsequent liquidations that may be triggered.

Zero clawback since launch

Huobi Futures promises that the clawback will not be triggered when the insurance fund is positive. All contracts under Huobi Futures have maintained a record of zero clawback since its launch in 2018.

Professional features

For veteran traders, professional trading features not only save time but allow traders to do more with less. Huobi Futures has introduced a series of features such as grid trading, trailing stop, “follow a maker” and “taker”; these enable users to execute more advanced strategies while saving time and effort.

Bottom Line

Bull markets do not happen overnight, nor do bear markets — rebounds will occur constantly. While current internal and external environments are not able to save crypto within a short time frame, we can still hold confidence in the long-term future of the crypto market.

Be it technology, applications, or talents, the crypto industry is burgeoning with talent and potentially more than ever before. The current bear market not only serves as a testbed for budding crypto projects but also serves as a good opportunity for practitioners to think and learn. Opportunities and returns will reward those who follow the cycle, trade rationally, and persistently learn in this gloomy environment.

Disclaimer: This is a paid post and should not be treated as news/advice.