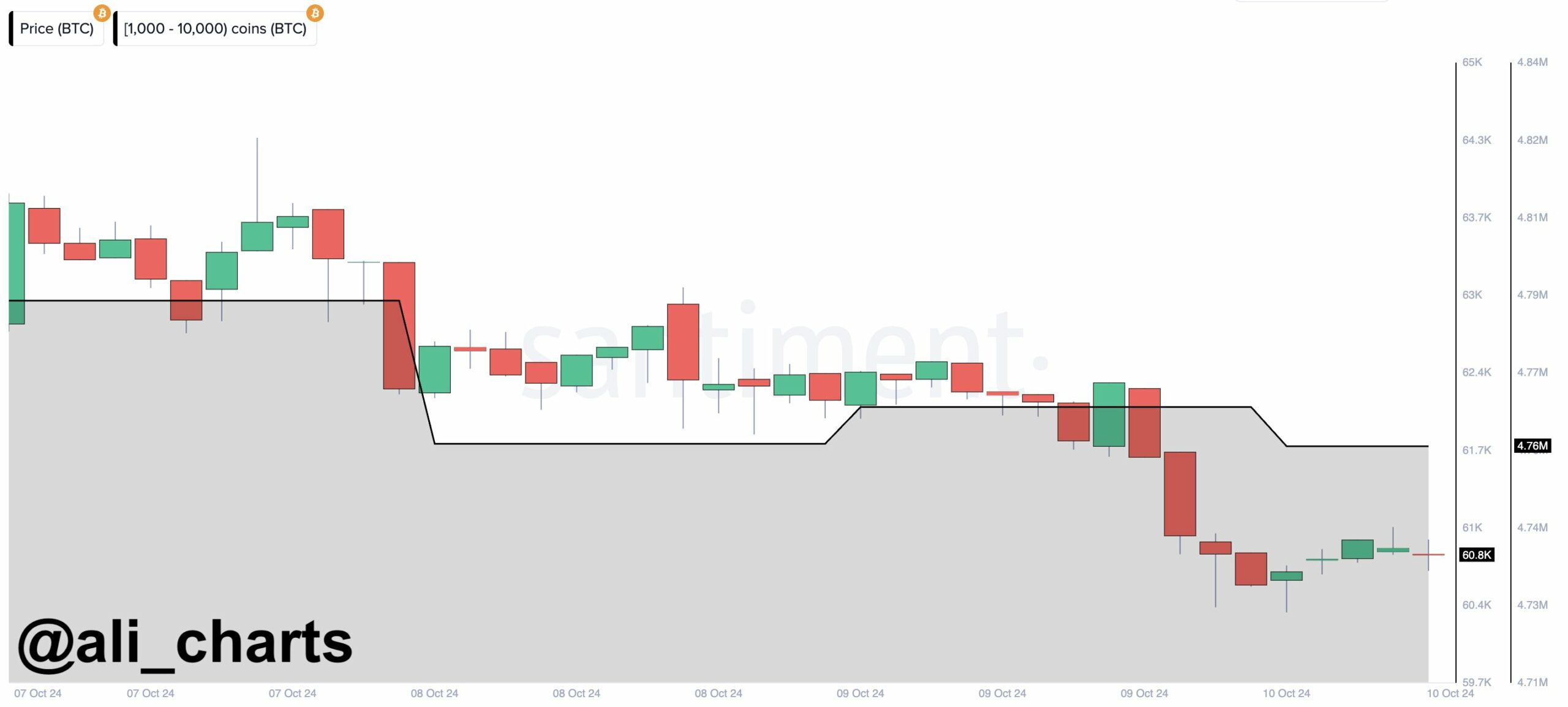

Identifying the impact of Bitcoin whales offloading $1.83 billion in BTC

- Bitcoin whales offloaded 30,000 BTC worth $1.83 billion

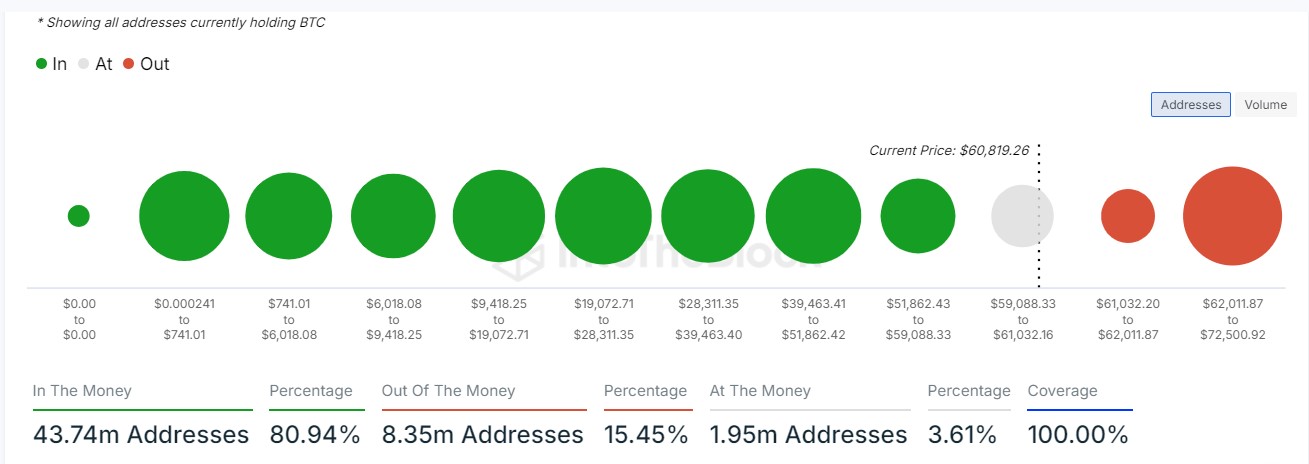

- Despite a 23% dip in large transactions, 80% of holders were still in profit at press time

Bitcoin’s price has become highly volatile over the last few days. As expected, this volatility precipitated some interesting behaviour from many of the market’s holders.

Consider this – A popular analyst recently revealed that a number of whales reportedly sold or redistributed around 30,000 BTC worth $1.83 billion, in the last 72 hours alone.

In light of the scale of such movement, there is bound to be speculation about Bitcoin’s next move. Hence, the question – Will BTC continue to fall or is this simply a fake-out before the crypto rallies for real?

Whales make waves, but profit saves

As far as the market’s attention is concerned, whale movements always take center stage. And, this week is no exception to that rule.

The sale or redistribution of 30,000 BTC within just 72 hours has sent ripples throughout the market. As expected, many are now speculating that this could lead to further downside pressure.

A significant $1.83 billion worth of Bitcoin changed hands, and market participants are trying to figure out if this is part of a larger strategy.

However, it is important to note that this massive redistribution came at a time when 80% of Bitcoin holders were still in profit.

This simply means that despite the sell-off, many investors acquired BTC at lower prices. Consequently, this gives them less incentive to sell in panic.

Large transactions decline, while Bitcoin holders stay strong

AMBCrypto further analysed IntoTheBlock’s large transaction data to track the whale dynamics on this crucial market phase. The data indicated a 23% dip in large Bitcoin transactions, which typically means reduced market activity among institutional players and high-net-worth individuals.

Despite this, however, a majority of Bitcoin holders remain in profit. This can be interpreted as a sign of holders’ reluctance to sell in this market environment.

Now, while large transactions might have slowed down, there is no sign of major panic among the broader holder base.

Inflation adds fuel to speculation

Complicating matters further, U.S. inflation recorded a higher rate than expected at 2.4%. As a rule of thumb, when stronger inflation occurs, investors usually flock to safe-haven assets like Bitcoin.

This could offset the near-term selling pressure by whales and fuel speculation that this recent dip may be a temporary blip before the broader rally.

Will Bitcoin dip further?

The confluence of whale activity and higher-than-expected U.S. inflation paints uncertainty in the Bitcoin market.

While some analysts argue that whales are trying to trigger a fake dip before a major rally, others believe the selling pressure could lead to further price declines in the short term.