Altcoin

Identifying the why and how of Arbitrum flipping Ethereum on this front

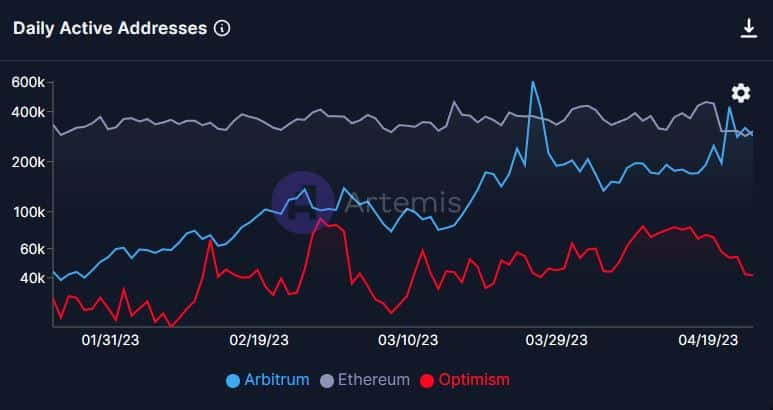

Arbitrum outperformed Ethereum in terms of daily active addresses for the second time. As far as the TVL is concerned…

- Arbitrum noted a massive surge in terms of daily activity and flipped Ethereum

- Development activity on the protocol fell too as ARB took a hit

Arbitrum was on the receiving end of a lot of attention once as its much-awaited token airdrop was set to be announced. In fact, owing to the same, the protocol managed to surpass even Ethereum in terms of daily active addresses.

However, as time passed, the hype around the Arbitrum network started to decline.

Is your portfolio green? Check out the Arbitrum Profit Calculator

As a consequence, the transactions on Arbitrum and activity on the network began to fall. Arbitrum surpassing Ethereum in terms of daily activity was written off as a one-off incident.

However, at the time of writing, the same was happening for the second time. Arbitrum exceeded Ethereum in terms of daily activity, suggesting that Arbitrum’s elevated level of activity could be indicative of a trend rather than an isolated incident.

This level of high activity can be attributed to the performance of Arbitrum One, which is a mainnet of the Arbitrum protocol. At press time, the protocol had managed to surpass 200 million in terms of transactions.

? Arbitrum One has reached the 200m transaction milestone!

We appreciate all the builders and communities that have made this possible in such a short time.

Let’s keep building Arbitrum, together.?? pic.twitter.com/GDEJc68ysM

— Arbitrum (?,?) (@arbitrum) April 20, 2023

The heightened use of the Arbitrum protocol has resulted in a commensurate increase in the total value locked in its smart contracts. Additionally, Artemis’ data indicated that except for Ethereum, the project had exceeded most protocols in this aspect, with its TVL recorded to be $2.2 billion at press time.

Developers take a back seat

Although high activity was seen on Arbitrum’s protocol, the same couldn’t be said about its GitHub. For instance – According to Token Terminal’s data, the number of active developers on the network declined significantly over the past few months. Coupled with that, the number of code commits being made to Arbitrum’s GitHub over the last 90 days fell by 51.4% too.

If this trend continues, Arbitrum may take more time than other protocols to introduce new features and upgrades. This would result in Arbitrum losing its prevailing dominance.

Despite the larger positive performance of the protocol, the sentiment around ARB has remained negative.

Consider this – Santiment’s data indicated that weighted sentiment had massively turned negative over the last few days. Coupled with that, the overall velocity of the ARB token also fell, implying that the frequency with which the token was being traded had fallen.

Realistic or not, here’s ARB’s market cap in BTC’s terms

Due to the aforementioned factors, the price of ARB started to plummet on the charts.