India: The full scope of what’s actually in store for exchanges after 1%TDS

The 30% crypto income tax policy came into effect in India in February 2022. The country’s finance minister Nirmala Sitharaman described the tax law as another step toward positive crypto regulations. However, local investors didn’t see eye-to-eye nor showed the same enthusiasm. Many investors/traders censured this move.

Incredible India!!

Indian crypto traders/investors face a hefty fee structure on their crypto acquisitions. Keeping in mind the 30% income tax regime, cryptocurrency exchanges at the moment have come under added pressure from the additional 1% tax that went into effect on 1 July. These developments have directly affected the trading volumes on Indian cryptocurrency exchanges.

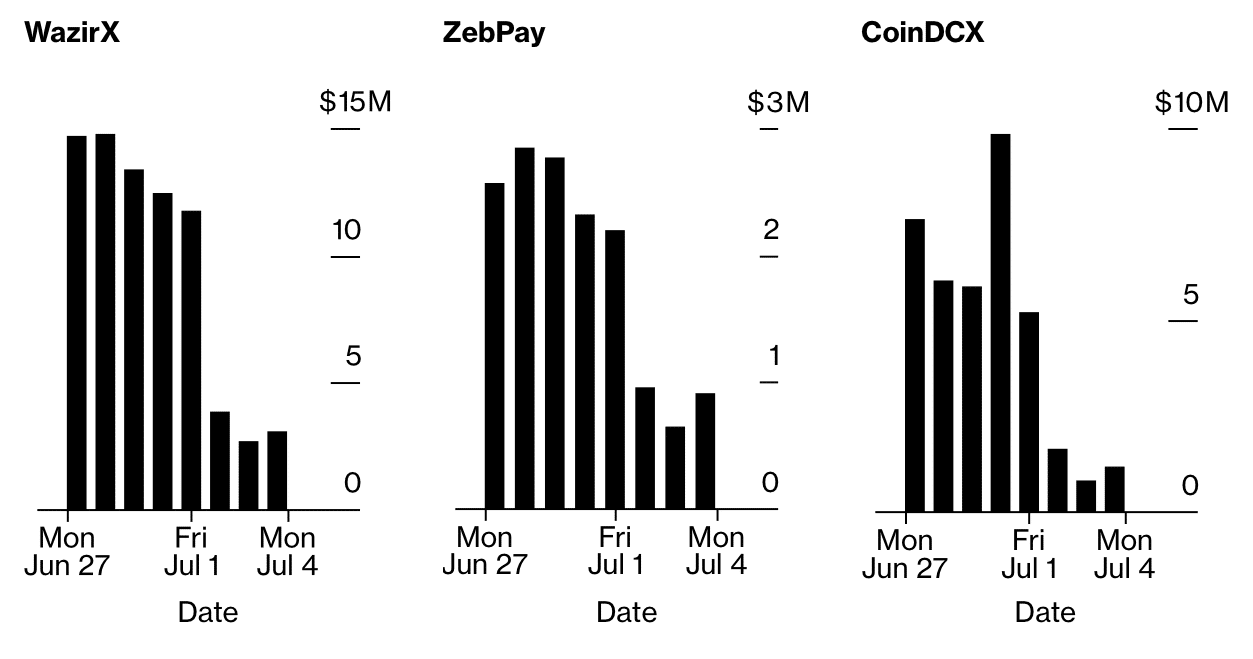

Three Indian exchanges suffered declines of 60% and 87% in the value of daily trading immediately after the 1% tax deductible at source became effective from 1 July. Organizations including ZebPay, WazirX, and CoinDCX have suffered the consequences. A fourth, Giottus, witnessed a trading sink of 70% as per the 5 July Bloomberg report.

Here’s the graphical representation:

Source: Bloomberg

The report further added:

“Those steep declines came from already depressed trading levels, as a combination of plunging prices, unfavorable tax treatment and difficulty getting cash onto exchanges combined to depress the once-hot market.”

In addition, WazirX Vice President Rajagopal Menon shed more light on situation. Long-term crypto holders buying and selling, but ‘market makers and high-frequency traders gone. Traders are also doing more peer-to-peer trading and migrating to so-called decentralized exchanges,’ he stated.

Different leaders from exchanges too raised similar concerns in a 4 July AMBCrypto article. Furthermore, the respective government also banned offsetting losses on such assets, treating them differently from stocks and bonds. Ergo, the exodus doesn’t come as a total surprise. It is in fact a way to curb further reductions.

What’s the ‘hullabaloo’

That’s exactly what Sumit Gupta, CEO of CoinDCX had asked about in a series of tweets discussing the ongoing development. Here, Gupta asked the government to ‘rethink this decision’.

In fact, by implementing 1% TDS on every trade, the Indian government would lose out on a massive profit margin.

3/5 With 1% TDS, trading frequency is likely to drop in just 7 months! And volumes are expected to go down in 10 months.

Whereas with 0.01%, we see consistent growth in trading volumes and frequency even after 18 months! ?

— Sumit Gupta (CoinDCX) (@smtgpt) July 4, 2022

Lastly, he also questioned the main motive behind the implementation of the said TDS. He said:

“Tracking transactions can be done in other ways too. Is TDS really the right solution? Or will it create more problems? Something to think about?”

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)