Indian retail group begins accepting CBDC payments

- A leading Indian retail chain, Reliance Retail, has begun accepting the national CBDC, the digital rupee (e₹).

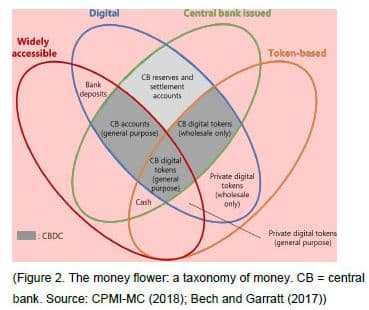

- In India, the central bank is testing digital currency across wholesale and retail segments.

Reliance Retail, a leading Indian retail chain, has begun accepting the national CBDC, the digital rupee (e₹), at one of its store lines and intends to expand the payment process to all of its businesses. The details were shared by its fintech partner, Innoviti Technologies, via a press release.

India’s central bank, the Reserve Bank of India (RBI) outlined plans for the CBDC in India in a concept note in October last year. The central bank defined a number of factors, including the potential positive and negative effects of a digital rupee in the country.

Source: RBI

As per the Indian central bank, one of the main reasons for introducing a CBDC in the country is to reduce the operational costs of managing cash.

CBDC tests water in the Indian retail segment

CBDC support is already available at Reliance Retail’s gourmet store line, according to the company. Furthermore, the company stated that it will be expanding support for the digital rupee to all of its establishments, which could potentially accelerate CBDC adoption in the country.

Reliance Retail has partnered with the banking institutions, ICICI Bank and Kotak Mahindra Bank, along with the fintech Innoviti Technologies for the CBDC payment system. Customers who choose to pay in the CBDC will be given a QR code at the center to execute their transaction.

“This historic initiative of pioneering the digital currency acceptance at our stores is in line with the company’s strategic vision of offering the power of choice to Indian consumers,” said V. Subramaniam, Director, Reliance Retail Limited.

In November last year, the central bank launched a wholesale pilot of the digital rupee for institutions and merchants. A month after testing the wholesale CBDC, the central bank launched a digital rupee pilot for retail with four banks in four metropolitan cities on 1 December 2022.

The digital currency will be issued in the same denominations and distributed through financial intermediaries as part of the pilot, and users should be able to transact through a digital wallet provided by the said banks.