Why INJ faltered above $17.50 despite Injective’s breakthroughs

- BlackRock’s BUIDL Fund allows institutional investors to gain exposure to U.S. dollar yields.

- Both retail and institutional investors can trade the perpetual index market that tracks the BUIDL Fund’s supply changes.

Injective Labs, the research and development company behind Injective [INJ], has introduced a groundbreaking tokenized index for the BlackRock USD Institutional Digital Liquidity Fund.

The BUIDL Index tracks the supply changes of the BUIDL tokens constituting the BUIDL fund.

This supply of BUIDL tokens directly relates to the price of the index perpetual, i.e., when the supply increases or decreases, the index price rises or falls, respectively.

Injective Labs CEO Eric Chen said in the announcement blog,

“The BUIDL Index showcases the sheer potential of Injective’s infrastructure in being able to truly bring traditional finance onto fully decentralized rails.”

Launched on Ethereum [ETH], the BUIDL fund became closely tracked after surpassing a similar offering managed by Franklin Templeton within the first six weeks of its March debut.

First tokenized index for BlackRock’s BUIDL fund

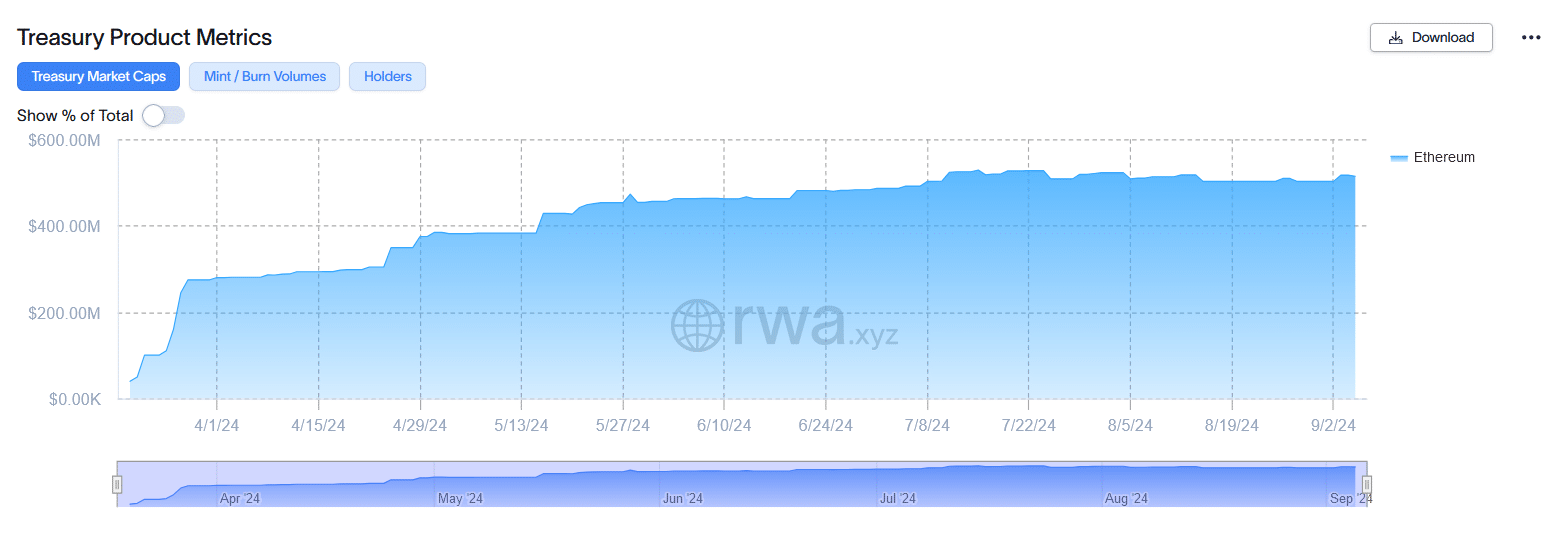

The BUIDL Fund is the largest treasury fund tokenized on a blockchain with assets worth $514 million under management according to data from rwa.xyz.

Traditionally, the fund requires an investment of at least $5 million limiting its access to deep-pocketed investors – only 20 holders as of writing.

Injective’s BUIDL Index addresses this entry barrier by opening up the gateway for investors of all sizes to access U.S. dollar yields on-chain.

Traders can make long or short bets on the fund’s supply changes based on their speculation on the direction of the market. In addition, the index will only be accessible via native Injective DEXs where speculators can use leverage.

Injective’s growing presence in asset tokenization

As a Web3 finance-focused interoperable L1 blockchain, Injective has been at the forefront of powering DeFi applications.

The introduction of the BUIDL Index, which is powered by open data marketplace Stork, marks a pivotal moment in the evolution of on-chain finance.

Last month, Injective rolled out Altaris – the first major ecosystem upgrade after Volan which was unveiled in January.

The Altaris mainnet release featured several additions, including the first RWA oracle module, which unlocks Injective’s potential to avail novel tokenized asset offerings.

In a separate update this week, Chainlink integrated Injective’s data streams to empower blockchain enthusiasts and builders to shape the future of global markets on-chain.

Injective [INJ] price action

The BUIDL Index has the potential to attract both institutional and retail participants, which could increase demand for Injective’s native token, INJ.

Increased use of Injective’s dApps and financial instruments could further drive more liquidity and engagement, positively impacting INJ’s price.

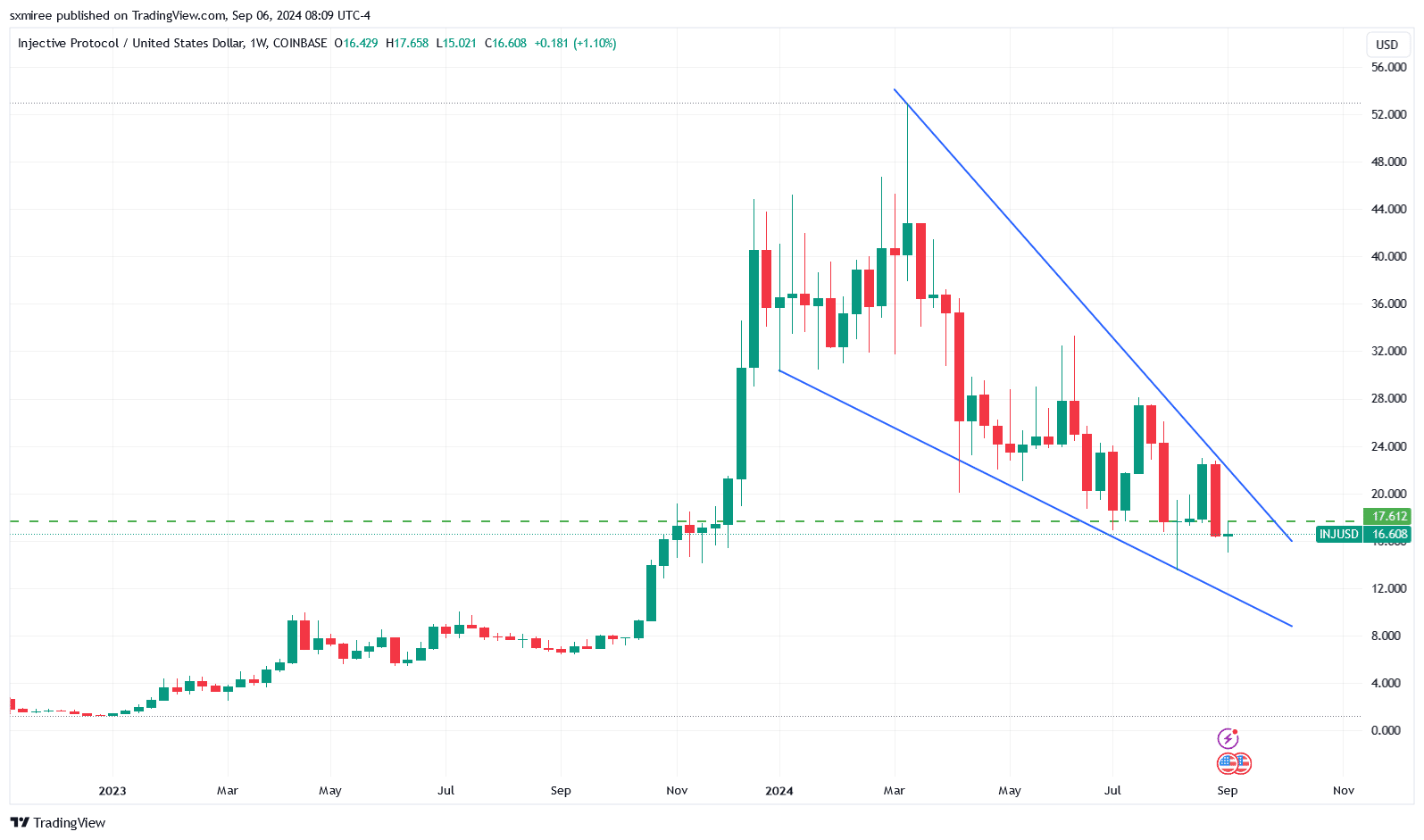

INJ token price rose briefly on September 4 in reaction to the launch of the BUIDL index, retesting its monthly close near $17.60 but saw rejection at the level.

Read Injective’s [INJ] Price Prediction 2024–2025

TradingView data shows the INJ/USDT pair has been trending inside a falling wedge on the weekly chart.

INJ was trading at $16.68 at press time, down 6.12% in the last seven days. Year-to-date, INJ has shed 53% and lags behind Bitcoin [BTC] and other major alts, which have registered gains during this period.