Injective: As bears step back, will THIS help bullish recovery?

- INJ’s demand made a comeback as the price showed signs of pivoting from its bearish performance in December.

- Spot flows and derivatives indicated a shift in favor of the bulls, in line with surging social sentiment.

Injective [INJ] could be on the verge of a bullish comeback. The cryptocurrency just ranked as one of the top AI coins in terms of social engagement, alongside other signs indicating renewed interest.

According to LunarCrush Analytics, INJ recently ranked second in the list of AI coins with the highest social engagement.

This means the cryptocurrency is receiving a lot of attention, an outcome that could influence its performance this month.

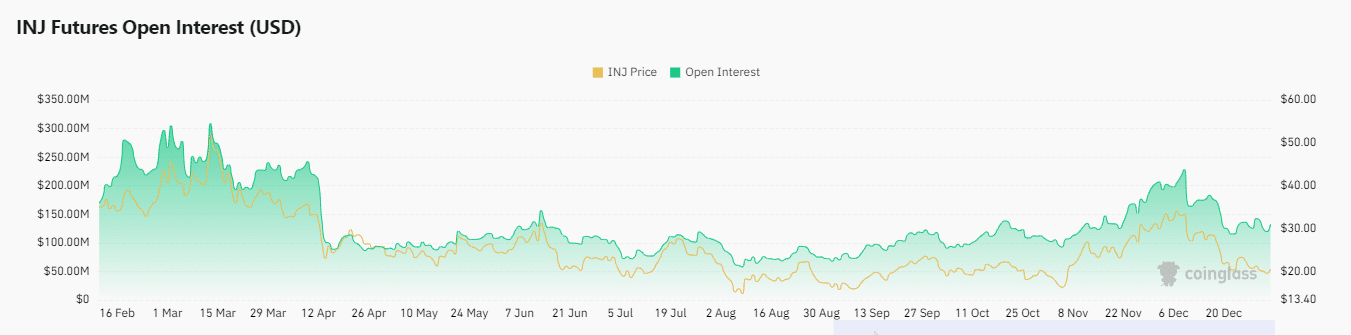

The social sentiment uptick aligned with a noteworthy spike in Open Interest in the last two days. INJ’s Open Interest was up by roughly $20.12 million during that period.

While this may not necessarily be much in the grand scheme of things, it demonstrated that open interest was making a recovery after the downside observed in the last three weeks of 2024.

Open Interest has been pushing higher after hitting a local low at $115.53 million on the 23rd of December. OI was up by 22.12% in the last 24 hours, accompanied by a 9.45% volume surge during the same period.

This confirmed a resurgence of accumulation and bullish demand.

INJ price action reflects social sentiment

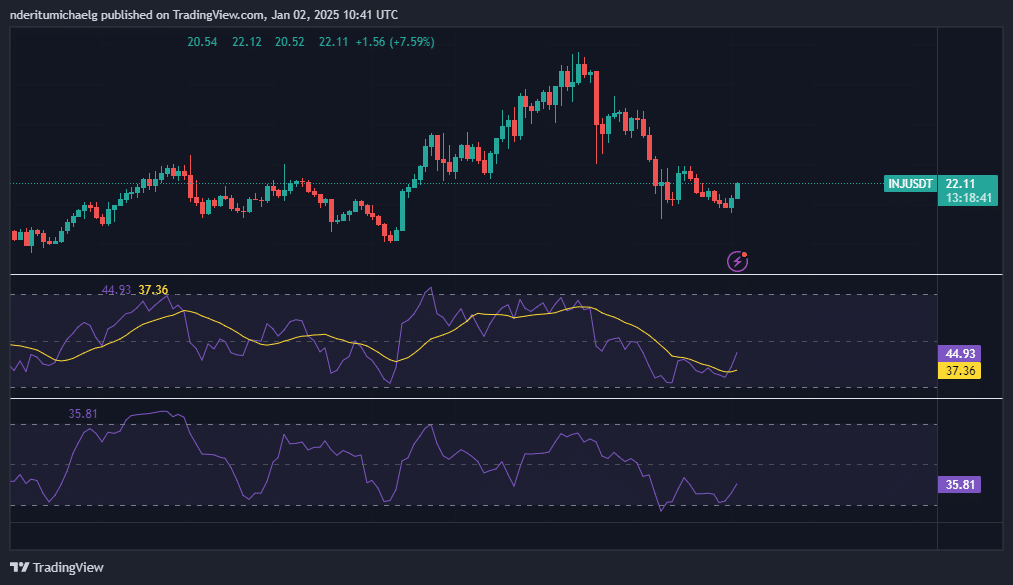

INJ bears appeared to have given up their dominance as 2024 wrapped up. The cryptocurrency exchanged hands at $21.91 at press time, and was up by 14.80% in the first two days of 2025.

INJ’s money flow index confirmed that the cryptocurrency was once again receiving liquidity injection. Strong demand could help INJ push back up to December highs. If that happens, the coin will rally by almost 60%.

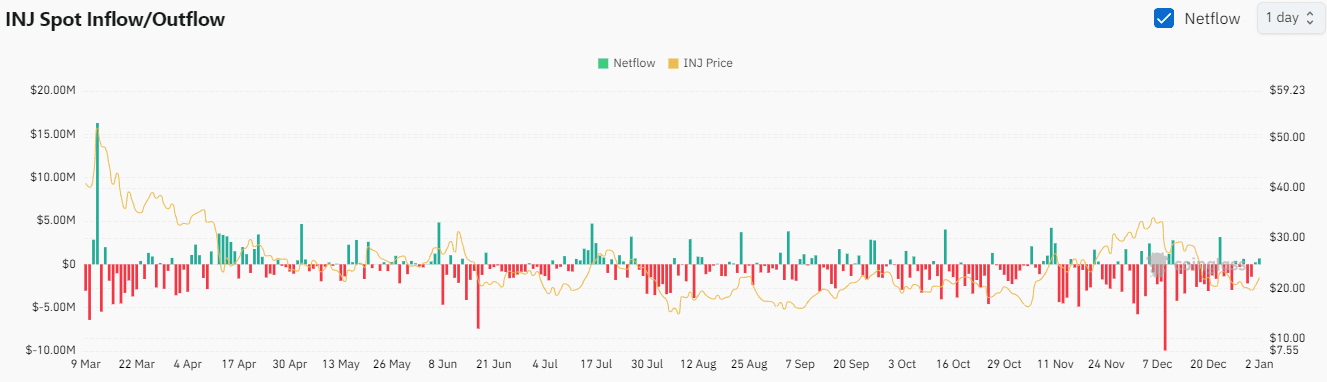

Spot flows reveal that INJ could be ready for another robust bullish run. Spot outflows were dominant in December, which contributed to its sizable pullback.

However, outflows have been cooling down, paving the way for inflows to make a comeback.

Spot flows switched to positive in the first two days of January, with almost $1 million in inflows. In other words, inflows were still relatively low but could potentially build up in the coming days.

Read Injective’s [INJ] Price Prediction 2025–2026

INJ performed better in the first half of 2024 than it did in the second half. The underperformance in the second half of the year suggests that it is still heavily discounted.

This may make INJ a more attractive coin in 2025 courtesy of its potential upside, especially if the AI coin narrative prevails.