Altcoin

Injective price analysis – Why INJ can rally 36% by December-end

As December begins, Injective surges over 82% year-to-date, hitting new ATHs with bullish momentum continuing.

- INJ has surpassed the $30 resistance mark, and a weekly close above a certain level will confirm a bullish outlook.

- Injective is just 36% away from its all-time high.

As December 2024 begins, Injective [INJ] has surged over 82% year-to-date, hitting a new all-time high of $52.72. A recent breakout above $30 shows potential for a further 36% rally.

Injective stands out in the DeFi space with its zero-gas decentralized derivatives and cross-chain trading capabilities. Unlike competitors such as DYDX, its focus on efficiency and deflationary tokenomics sets it apart.

Is ATH next after the $30 breach?

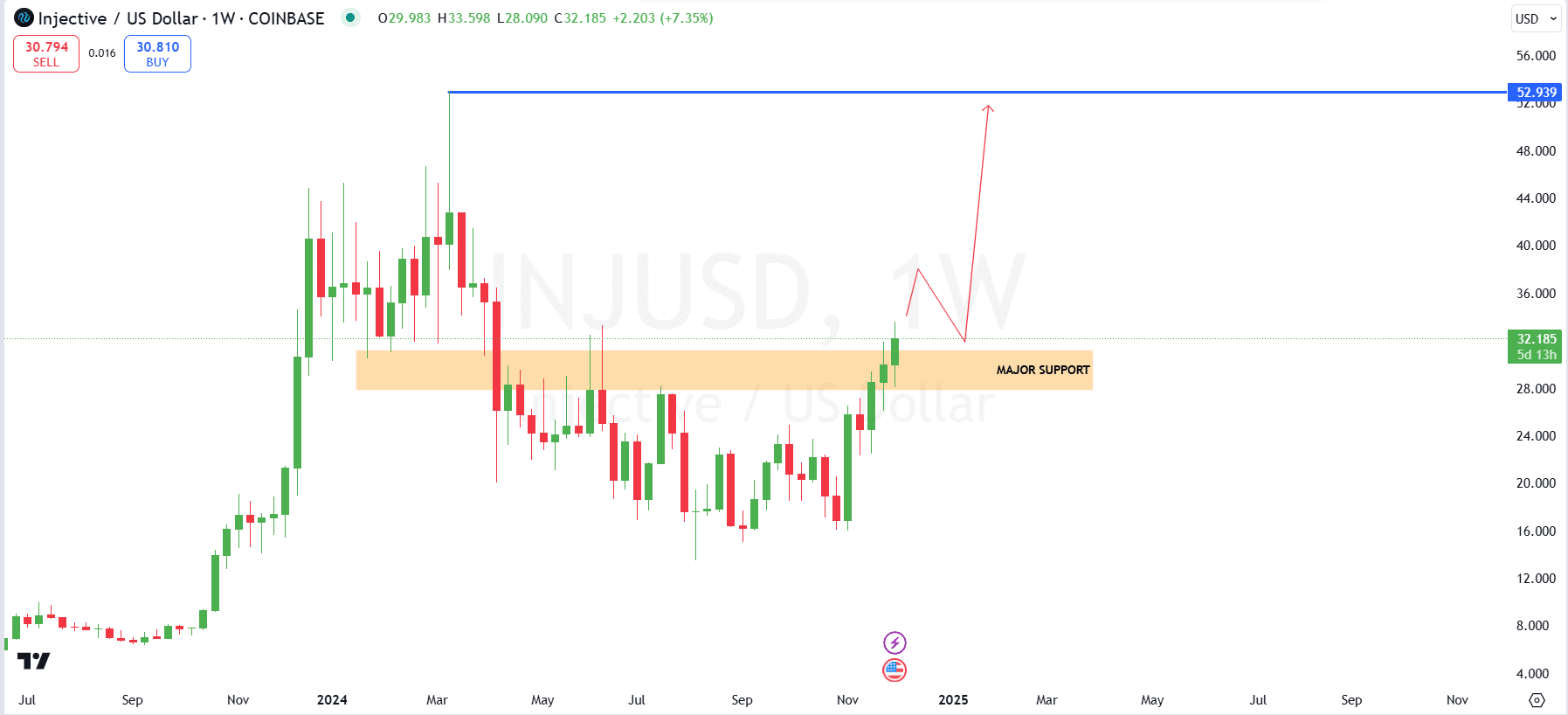

The weekly chart for Injective reflects strong upward momentum. At press time, INJ was trading at $32.33, marking a 7.86% weekly increase.

The $28.00–$30.00 zone has proven to be a critical support area, successfully reclaimed after earlier consolidation in 2024.

The strong demand zone has fueled the recent rally, indicating a bullish phase with higher highs and higher lows since mid-2024.

If the price holds above this support, the next key target for bulls is the all-time high of $52.77. The 4-hour chart showed that Injective was maintaining a steady upward trend within a rising channel.

After breaking above the $22.96 support level, INJ has surged by 41.72% in recent sessions.

The breakout suggests further potential, with resistance at $42.00, marking a 28.02% upside from current levels.

As long as the channel’s lower boundary continues to support the price, the bullish trend is likely to persist.

Does INJ need more user activity for a boost?

The number of large transactions began at around ten per day in early September. On the 21st of September, large transactions surged to approximately sixty per day, coinciding with an increase in INJ’s price from $22.96 to $32.00.

This sharp rise in transaction volume indicates a strong uptick in market interest and larger investors entering the market.

Following this peak, large transactions decreased, averaging around five to ten per day in October. This aligned with a consolidation phase in the price, holding steady between $28.00 and $32.00.

However, in November, the number of large transactions began to rise again, peaking at fourteen transactions on the 26th of November, as the price broke above $30.00.

Profitability peaks below $29.62, losses begin above $33.80

According to data from IntoTheBlock, 57.55% of INJ wallet addresses (24.9k) are “In the Money,” meaning they hold INJ purchased below the current price of $32.19, making them profitable.

Meanwhile, 33.32% (14.42k addresses) are “Out of the Money,” having acquired INJ above the current price, indicating unrealized losses.

Additionally, 9.13% (3.95k addresses) are “At the Money,” holding INJ purchased near the current price, breaking even.

The profitable range extends up to $29.62, while losses start above $33.80, illustrating a detailed distribution of holder profitability.

The uptrend on LTF confirmed

The Ichimoku Cloud indicated a bullish trend, with the price above the cloud and the leading span green area widening, signaling strong upward momentum.

Read Injective’s [INJ] Price Prediction 2024–2025

Additionally, the TSI indicator showed a bullish crossover, highlighting increasing buying pressure as the short-term momentum line crosses above the long-term line.

Additionally, the CMF value of 0.04 suggested mild positive money flow, indicating that buying interest is gaining strength in the market.