INJ’s reversal odds – Altcoin’s short-term forecast looks like THIS

- INJ traced a reversal pattern that could possibly mean a breakout

- Hike in buying pressure could be good news too

Injective (INJ), after falling by 11% in the last 7 days, was trading at $25 at press time. There seemed to be a corresponding fall in the altcoin’s trading volume too, with the same down by 22.38% to $192 million.

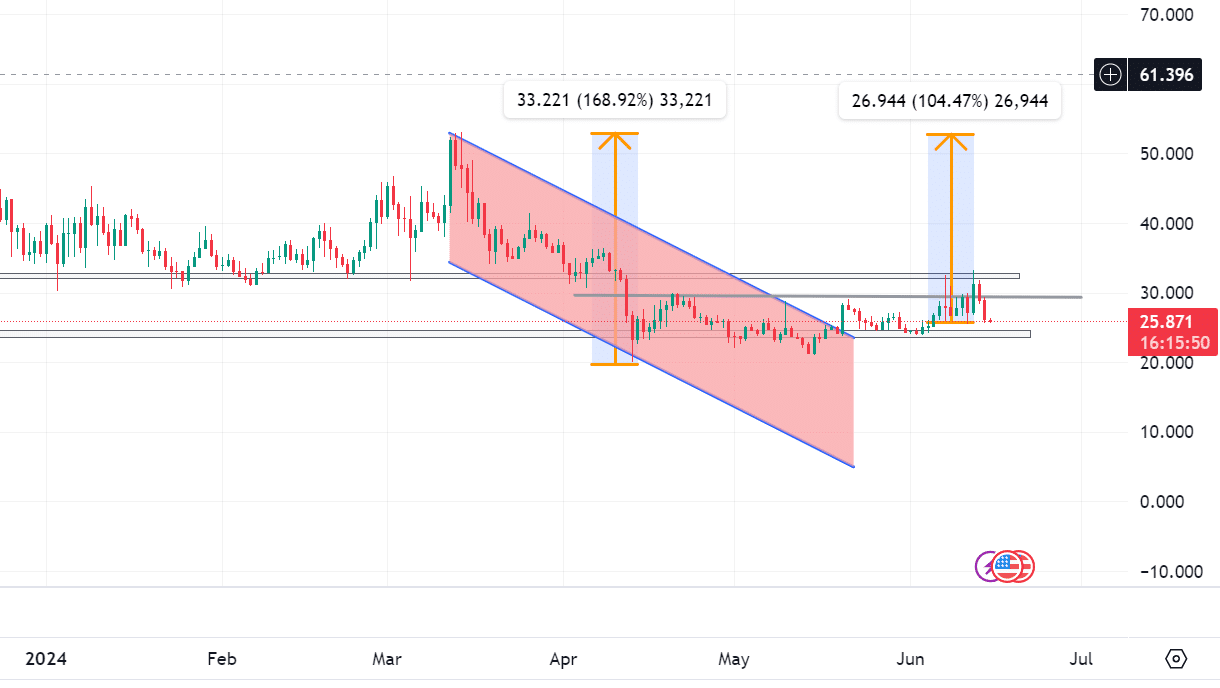

Over the last 2 months, INJ hit an ATH of $33 following a strong bullish trend. Equally, it has also flashed signs of a potential breakout on the charts.

The same was revealed by AMBCrypto’s latest analysis, with a breakout seen from the resistance level of $30. The sudden breakout could be a sign that the prevailing market trend will reverse itself to form an uptrend.

If INJ hikes by 104% from the aforementioned price range, the altcoin can be expected to climb as high as $53. In a broader market, the prevailing pattern is usually a sign of bullish price reversal.

What do metrics tell us?

While the patterns might say one thing, it’s important to know what the metrics are saying either. In this particular case, do metrics back the possibility of an uptrend on INJ’s charts?

According to Santiment, INJ recorded its highest social volume of 18 on 8 June, with the same followed by a fall in prices. In the following days, INJ saw lower social volumes, which resulted in the price hiking on the charts.

In totality, lower social volume means reduced public discussion on crypto, which leads to market shift as markets go opposite to public expectations. At press time, INJ’s social volume had a reading of 3, with the same falling consistently over the last 24 hrs.

Additionally, Supply on Exchanges data from Santiment revealed a peak point of $401K on 13 June. However, the peak was followed by a decline in exchange supply, dropping to $390K in the last 24 hours. What this implies is a hike in buyers across the market, a finding that is associated with a bullish trend. Hence, it can be argued that the reduced pressure could set the stage for a hike in the altcoin’s price.

How far will INJ go?

If the trend pans out as expected and the altcoin breaks out at the resistance level of around $30, bullish momentum will gather steam. If the resistance level is breached, INJ can be expected to climb to $53 on the back of a 104% price hike.