Altcoin

INJ’s volume soars to 8-month-high – Here’s what it REALLY means!

INJ demonstrated signs of profit-taking, despite rising Open Interest and the recent volume surge.

- Injective’s volume spike mirrored the surge in the protocol’s elevated social activity

- INJ pulled back at key resistance following a surge in spot outflows

Is Injective’s native token INJ about to pull off a major breakout? Well, recent on-chain data revealed some interesting findings which could indicate that the token could be about to record a major move.

Injective could be on the cross-hairs of liquidity flows as crypto liquidity rotation continues to intensify amid declining BTC dominance. In fact, investors have been looking for cryptocurrencies and tokens with a lot of upside potential, especially those that have underperformed recently.

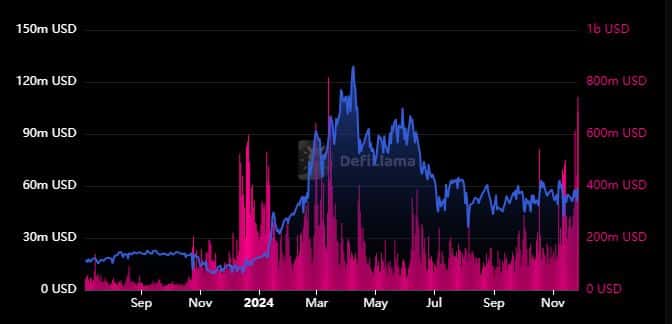

INJ, the native token on Injective protocol, recently noted a surge in token volume. The volume figure surged as high as $741.29 million in the last 24 hours, at the time of observation. This was its highest surge in the last 8 months and its second highest in 2024.

Here, it’s worth noting that Injective’s TVL has struggled to post significant gains in the last few months.

The volume surge suggested that a lot of trading involving the INJ token has been taking place so far this week. However, this was not surprising considering the fact that the Injective network ranked high among the crypto projects

with the highest social activity.A spike in Injective social activity suggests that the network and its native token gained popularity and visibility this week. However, does this necessarily translate to bullish momentum?

INJ retests noteworthy resistance level

The aforementioned volume surge might have been related to its recent bullish momentum.

In fact, INJ surged by 14.35% during Tuesday’s trading session. This price uptick pushed into its previous support and resistance zone near the $31 price range.

Will INJ’s price push for a resistance breakout? It had already pulled back by 6.07% to its $28.89 press time price tag.

Well, the bearish outcome seemed to be consistent with negative INJ spot flows observed over the last few days – Indicating that investors have been taking profits.

The surge in spot outflows confirmed the short term profit-taking, watering down hopes of a major breakout. Injective could still be considered undervalued even at recent highs. Here, It is worth noting that its Open Interest in the derivatives segment was still low, which could explain why it still struggled to break through the recent resistance.

Injective’s Open Interest peaked at $176.32 million in the last 24 hours. This was considerably lower than its peak Open Interest at $308.25 million on 13 March.

The lack of a strong TVL comeback might be a sign that investors have not been quite as optimistic, despite the volume surge.