Inside Chainlink’s [LINK] quest to fit into place amid market resurgence

![Inside Chainlink's [LINK] quest to fit into place amid market resurgence](https://ambcrypto.com/wp-content/uploads/2023/03/po-2023-03-17T174336.351.png)

As the crypto market maintains revival, tokens like Chainlink [LINK] have found it challenging to grab a share of the widespread positive sentiment.

According to on-chain data, several projects have enjoyed an array of investors’ participation since the ecosystem stabilized at the detriment of the bears.

How many are 1,10,100 LINKs worth today?

Despite being ranked #21 in terms of market capitalization and staying on the watchlist of over 1 million prospective investors, LINK’s contest for adoption was a scuffle.

The LINK grounds are far below dominion

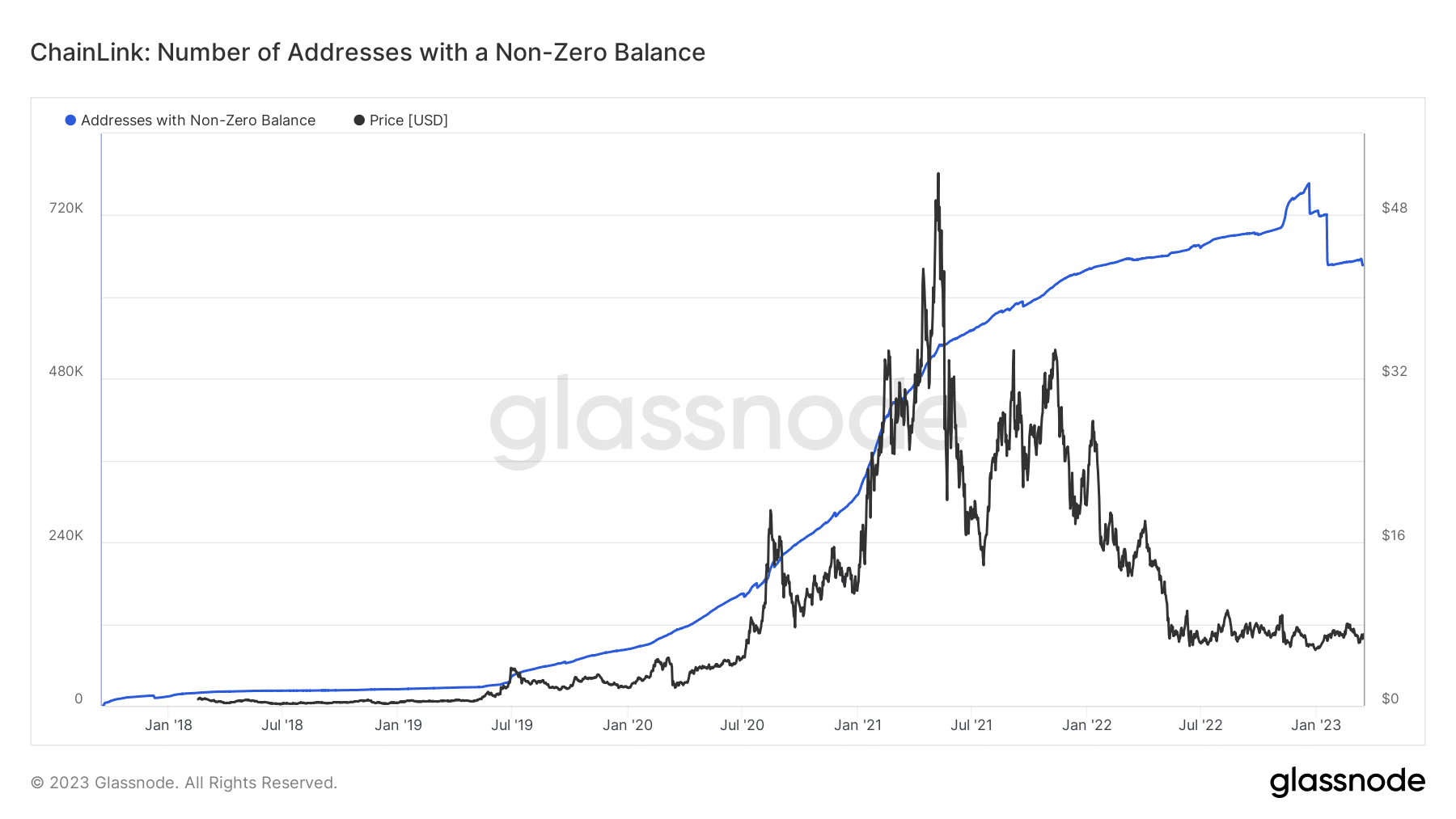

According to Glassnode, the non-zero LINK addresses have decreased to 665,850. As inferred from its name, the metric measures the number of addresses holding a positive number of cryptocurrencies.

So, the drop depicts sell-offs from existing holders or investors looking into other projects.

But a thorough look at the data above shows that the decline has been there since January. This puts the option of slow traction above the selling pressure effect.

LINK, 87.36% down from its All-Time High (ATH), has only managed a 1.44% value increase in the last 30 days. This was mainly in contrast to the trend displayed by Bitcoin [BTC], Ethereum [EHT], and several others in the same bracket.

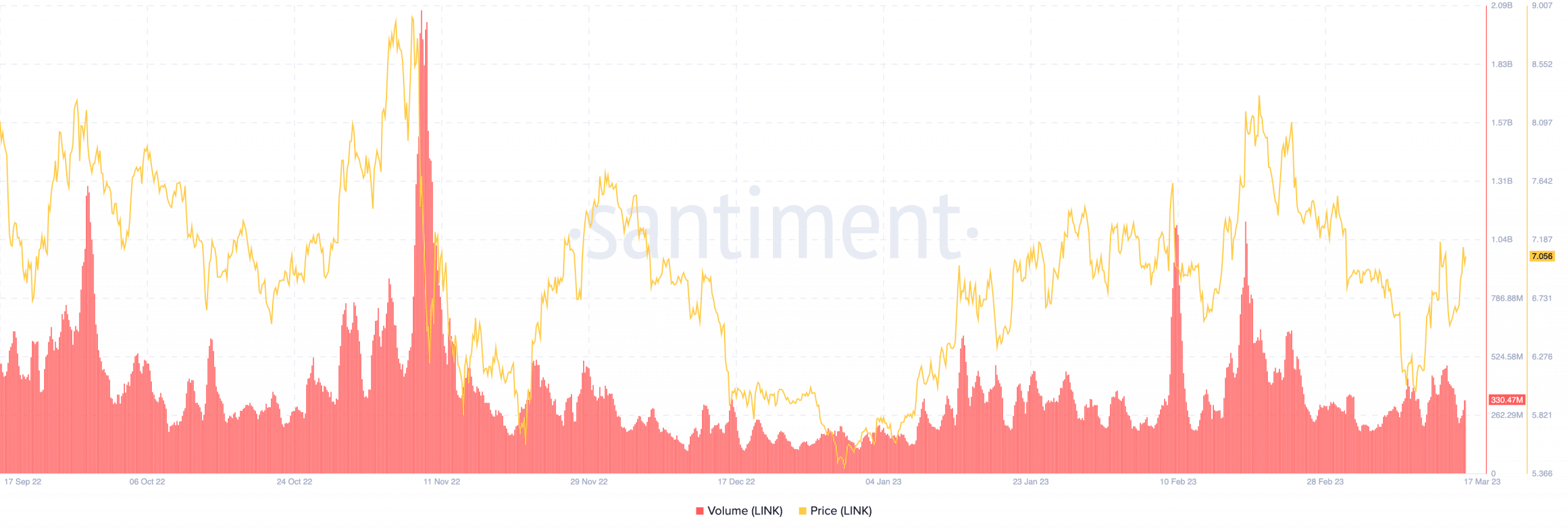

However, the token seemed to have made up for lost detachment as it built up an 8.13% uptick in the last seven days. Although LINK improved per its price, its volume had been drawn in the ebb and flow over the last few days.

The volume serves as an indicator of market strengths. Rising volume signals an increase in transactions on a network and is typically viewed as a sign of a healthy network.

At press time, the LINK’s volume was at 328.21 million. Although it was an increase from the value on 18 March, it was minimal when compared with several other tokens.

Is your portfolio green? Check out the Chainlink Profit Calculator

Longs have control

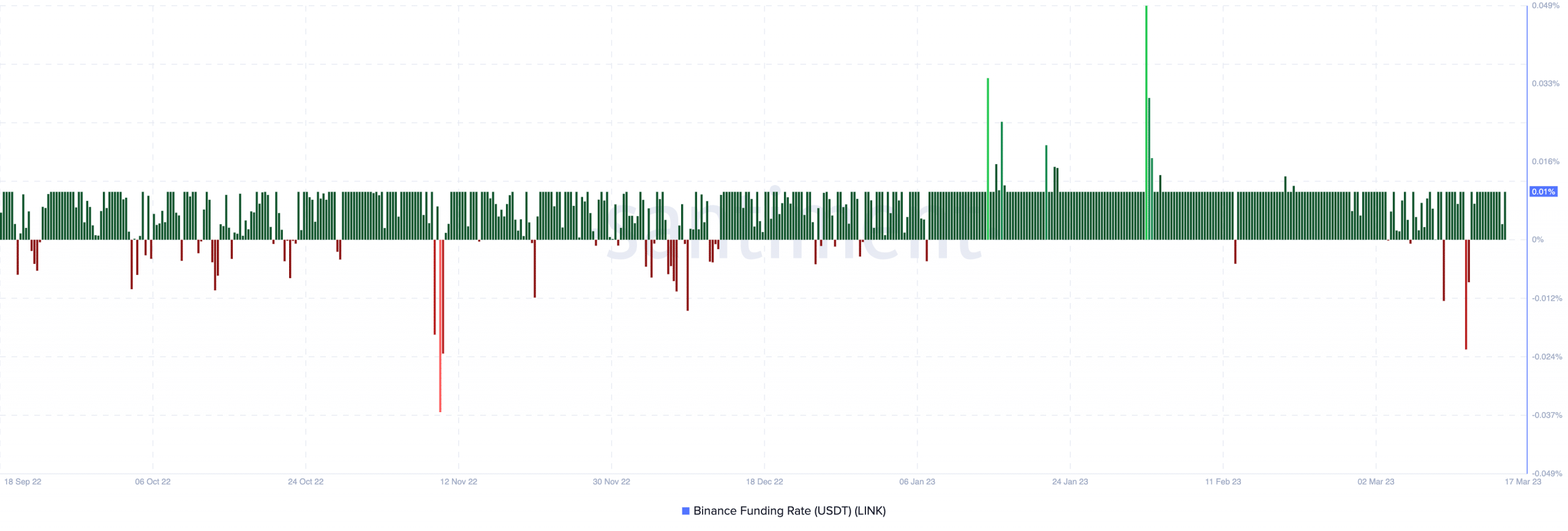

Nonetheless, the LINK funding rate at press time was positive at 0.01%. The metric reveals the rate of periodic payments based on long and short positions held by traders.

When the metric is positive, it means short positions are paying the longs. On the other hand, longs pay shorts when the funding rate is negative.

So, the current state implied that LINK longs made the most profits at the expense of short positions. However, the LINK sentiment in the future could depend on which direction BTC moves.

Lastly, events like the banking sector turmoil could also impact the token.