Institutional giants dive into Bitcoin ETFs – Who’s buying and who’s selling?

- U.S. spot Bitcoin ETF inflows, Millennium Management’s holdings demonstrate growing institutional involvement

- Galaxy Digital’s income surge and increased ETF investments propelled Bitcoin’s latest hike too

As Bitcoin hiked past $66,000 on the price charts, U.S. spot Bitcoin [BTC] ETFs registered a notable hike. In doing so, it recorded two-week high inflows of $303 million.

In fact, according to data published by Farside Investors, all spot Bitcoin ETFs except for BlackRock’s iShares Bitcoin Trust (IBIT) saw inflows on 15 May.

Interesting data sets

Surprisingly, IBIT remained stagnant for the third consecutive day, neither seeing significant inflows nor outflows. Fidelity’s FBTC was the one leading the charge with a substantial influx of $131.3 million. Additionally, Grayscale’s GBTC marked its first day of inflows in a week, attracting $27 million.

Seeing this performance, Sunnydecree, a Bitcoin investor/analyst noted,

“$303’000’000 Bitcoin ETF inflows yesterday. We are so back!”

Adding to the excitement, another X user, ‘Bitcoin for Freedom’ said,

“That’s a Bull Market Multiple of 276! No one is ready for this bullrun. We’ve seen nothing yet!”

Millennium Management’s big move

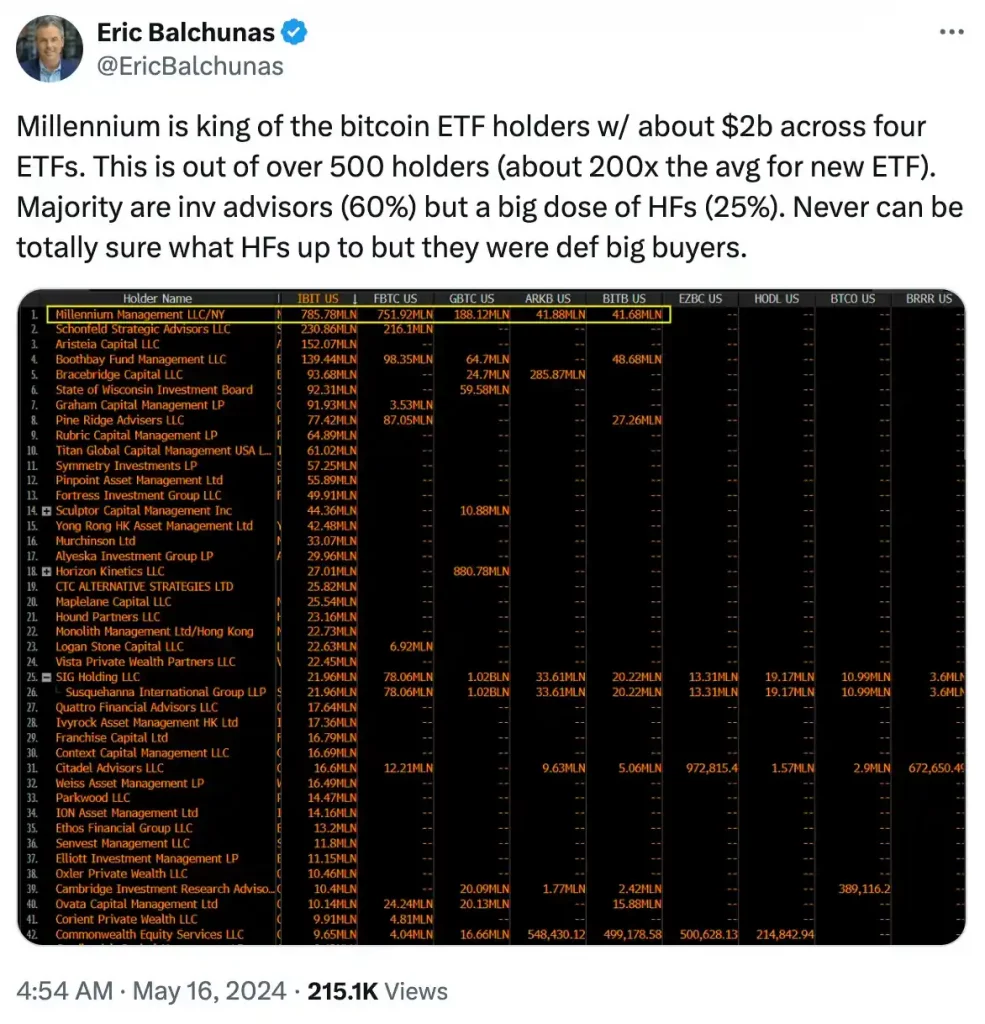

Well, the story doesn’t end here! According to 13F filings, international hedge fund Millennium Management has reported holding nearly $2 billion in spot Bitcoin ETF shares. As of 31 March, Millennium had a total of $1.94 billion invested across five spot Bitcoin ETFs. These ETFs include ARK 21Shares, Bitwise, Grayscale, iShares, and Fidelity’s offerings.

Notably, BlackRock’s Bitcoin fund represents the hedge fund’s largest allocation, with over $844 million invested, followed closely by Fidelity’s fund with just over $806 million in shares held.

Providing further insights on the same, Bloomberg ETF analyst Eric Balchunas noted,

In response to this James Seyffart added,

“It’s only retail traders buying the #bitcoin ETFs”

Joining the critics of ETFs, Salim Ramji, the newly appointed CEO of Vanguard in a recent conversation with ‘Barron’s’, stood firm on the company’s decision not to pursue a spot Bitcoin ETF launch.

These remarks underline the unique nature of these investments and suggest a nuanced and complex market perspective.

Increase in institutional investors

Despite criticism, institutional investors and banking giants are flocking towards Bitcoin investments. According to the latest SEC filings, Bracebridge Capital disclosed a $363 million investment in spot Bitcoin ETFs, while J.P. Morgan’s clients contributed $731,246 to the same.

Moreover, on 15 May, Galaxy Digital Holdings Ltd. made waves with a remarkable 40% hike in net income to $422 million, attributed to the influence of spot Bitcoin ETFs.

Hence, these recent resurgences in spot Bitcoin ETF investments might have been the biggest factors behind Bitcoin’s hike this week.