Institutional players’ love for Bitcoin continues – The why of it all

- Bitcoin registered another week of institutional inflows

- OI in BTC Futures on global derivatives exchange CME soared to a two-year high

Bitcoin [BTC] attracted institutional funds worth $20 million last week, taking the total inflows since the start of the year to $1.7 billion. This, according to the latest report by crypto-asset management firm CoinShares. Influential investors have been pouring significant chunks of their capital into Bitcoin in recent weeks.

Bitcoin on the radar

The king of the cryptos has been riding high on the euphoria surrounding the potential green lighting of a dozen odd spot exchange traded-fund (ETF) applications. Investors hope that the approvals would pave way for the mainstreaming of the digital asset and offer a convenient way for TradFi participants to gain exposure to the crypto-market.

In fact, Bitcoin has spearheaded the ongoing bull run, surging by 60% since the rally commenced in mid-October. During the journey, it reclaimed crucial levels which were last visited before the bear market began in May 2022. Worth pointing out, however, that at press time, BTC had fallen below $42K on the charts.

When BTC was appreciating, it was not just the bullish traders who were investing in Bitcoin. Short-Bitcoin positions saw a $8.6 million influx last week, indicating that some investors saw some downside potential.

The Open Interest (OI) in BTC Futures on global derivatives exchange CME soared to a two-year high of $5.28 billion, AMBCrypto discovered using Coinglass data. Since the start of the rally, the OI has more than doubled.

For the curious, CME’s standard Futures contract is worth five BTC and is seen as a barometer of institutional interest in cryptocurrencies.

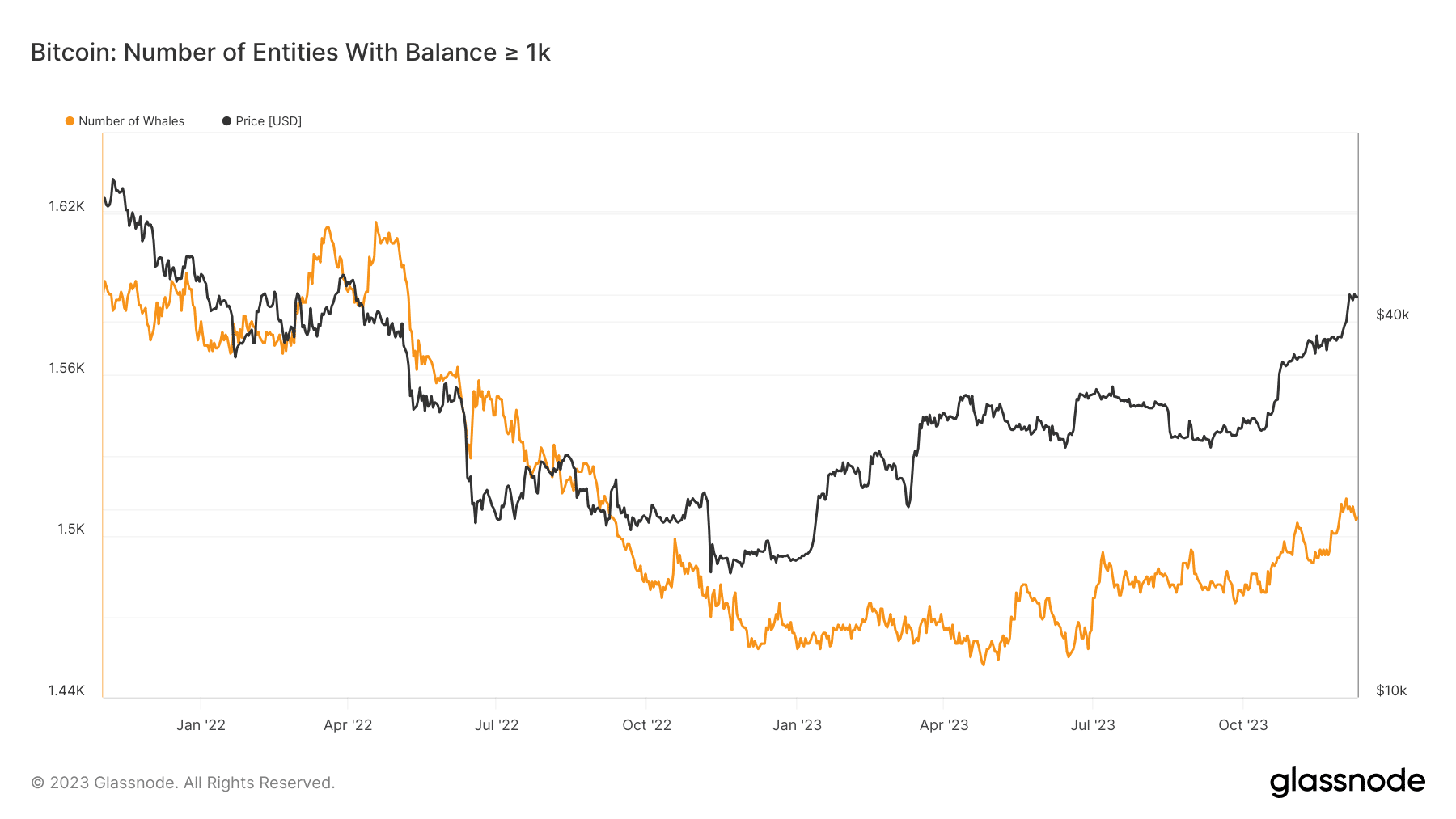

Whales increase BTC appetite

Whale investors, a proxy for influential investors who hold large stashes of cryptos, have been seen increasing their exposure to Bitcoin. The number of entities holding at least 1,000 coins has been on an uptrend in H2 2022, as per AMBCrypto’s analysis of Santiment data.

This is additional evidence that Bitcoin was experiencing net buying from the institutional side.

How much are 1,10,100 BTCs worth today?

Overall, the digital assets market registered their 11th straight week of inflows totaling $43 million. The upbeat sentiment linked to spot ETFs trickled down to Ethereum [ETH] and the broader altcoin market as well.