Investors and NFTs, the odds of Polygon losing both are…

In the consolidating market, most assets have been finding balance slightly above the level where they began their rally. Not Polygon [MATIC], however, as the cryptocurrency has already invalidated all of March’s growth. In fact, while the spot market has been suffering, the DeFi front of the asset isn’t acing either.

Polygon, unlike expectations…

Has not been faring well over the past two months. It has been consistently testing the $1.36 line as support even after two separate hikes, which were both equally lacklustre.

The first one, seen towards the end of February, led to a hike of 16.35%. The most-recent mid-March to April rally was worth less than 25%.

Polygon price action | Source: TradingView – AMBCrypto

Consequently, investors began losing patience, and their dejection was visible in their behavior. While towards the beginning of the month, on average, more than 7k investors conducted transactions on-chain, at press time, the figure was below 3k.

Polygon active addresses | Source: Intotheblock – AMBCrypto

Consequently, on-chain transactions took a hit as well. Although a slight improvement was noted towards the beginning of the month, over a 24-hour period, unique transactions slipped by 74%.

Polygon monthly unique addresses | Source: Dune – AMBCrypto

Not a happy NFT market?

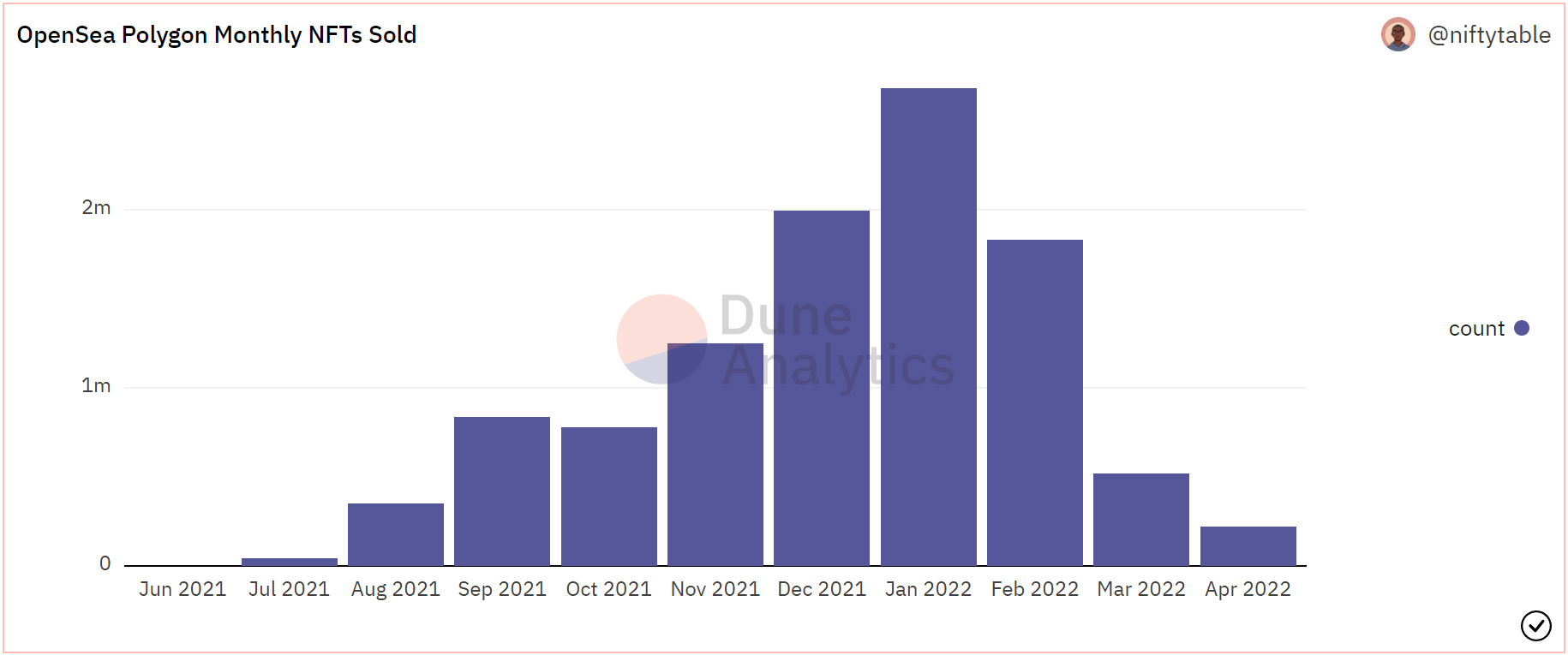

Interestingly, at the same time, out of no correlation, this disappointment seems to have extended to Polygon NFTs as well. Opensea has always had domination of Ethereum-based NFTs, but Polygon NFT collections too had their demand. This, however, has now severely subsided.

At the beginning of this year, sales crossed 2.68 million NFTs in a month. Last month, just a little over 500k NFTs were sold.

Polygon NFTs monthly selling volume | Source: Dune – AMBCrypto

Thus, as demand fell, the overall monthly volume of these NFTs fell as well. From $80 million in January to $49 million in March, the decrease marks a 38% decline in sales.

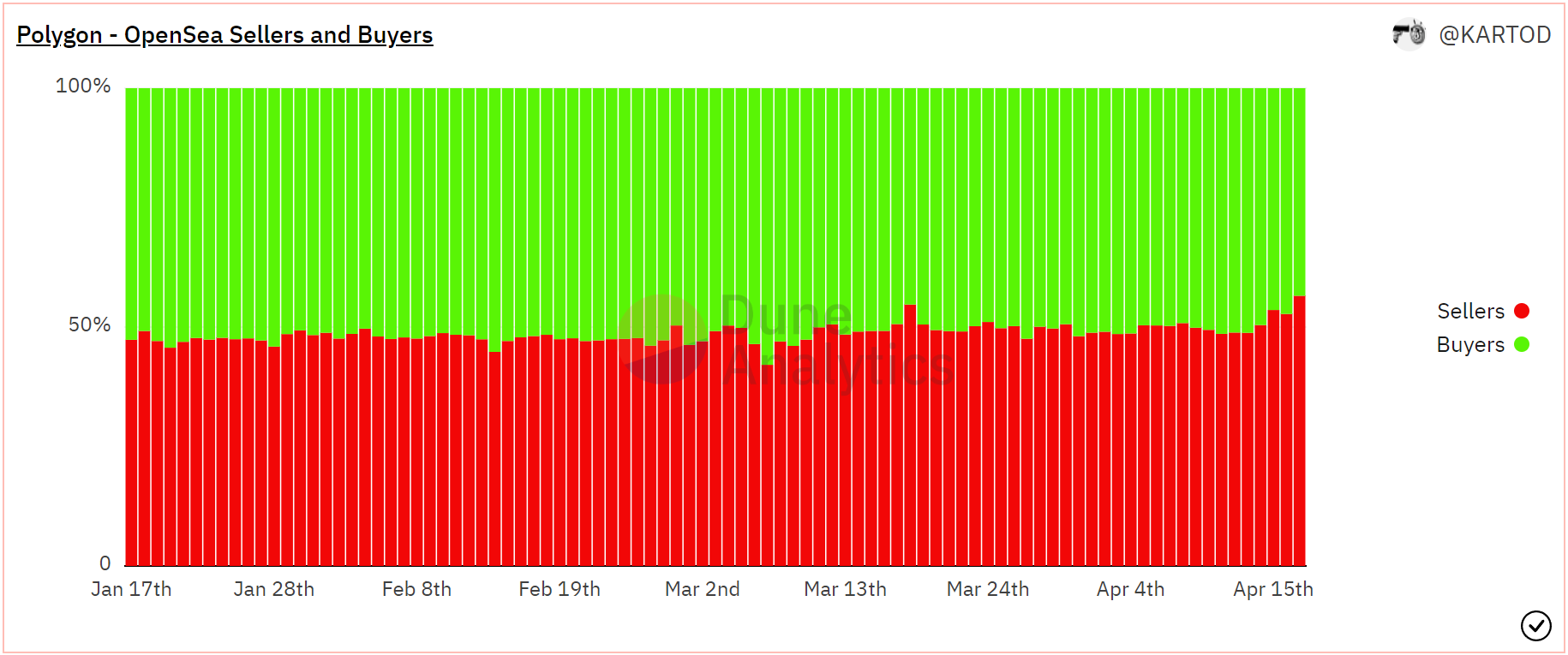

However, despite the lack of motivation from investors and traders, buying and selling is maintaining a balance as demand on both ends seems to be consistent. Now, over the last week, sellers’ domination has slightly increased. But, it is not a matter of concern since as soon as the market recovers, demand in the market will rise as well.

Polygon NFTs buyers and sellers | Source: Dune – AMBCrypto

Plus, given the increasing adoption of NFTs and Metaverse by brands, companies, and celebrities, they are bound to see higher trades soon.