IOTA’s +750% hike in 2021 – Why this alt is only for certain traders

It’s been a difficult few years for IOTA. Back in 2017, on the back of a raging bull market and the ICO boom, the crypto had caught the imagination of many with the promise of decentralized solutions for the Internet of Things. In fact, once upon a time, the altcoin was ranked as high as 4th on CoinMarketCap’s charts.

At the time of writing, however, IOTA was long out of the top-10, with the cryptocurrency now the 24th-largest cryptocurrency with a market cap of $6.02 billion. In fact, according to CoinGecko, the altcoin was still over 55% away from its ATH of $5.25 from 19 December 2017.

All doom and gloom, right? Well, not quite.

Consider this – On the eve of the 1st of January this year, the crypto was valued at just over $0.28. On the 17th of April, right before market-wide corrections set in, IOTA was trading at a price level of $2.18. Put simply, the crypto hiked dramatically to the tune of over 775% in less than four months. That is an extraordinary figure, especially for an altcoin with a market cap of billions.

Source: IOTA/USD on TradingView

For IOTA, the reasons behind the price appreciation are very clear, with both correlation stats and ecosystem-centric developments coming to the fore over the past few months. For the purpose of this article, let’s focus on the latter.

21 April will see IOTA begin the token migration onto its new network, Chrysalis, with the same expected to go live next week on the 28th. Following the same, the current mainnet will become the IOTA legacy mainnet. According to the IOTA Foundation,

“Chrysalis marks a true rebirth for the IOTA protocol, as it is the launch of an entirely new network. This relaunch will bring IOTA up to the level of an enterprise-ready product that is fully equipped for use in outside organizations and businesses that wish to leverage the power of the Tangle.”

The project has also claimed that Chrysalis “improves the efficiency, security, scalability, and stability of the IOTA protocol,” while making the latter “enterprise-ready.”

The aforementioned development has been preceded by other announcements over the past few months. A few weeks ago, for instance, IOTA co-founder Dominik Schiener issued the tentative roll-out date for IOTA Coordicide during an AMA session. Before that, the Foundation announced the release of a newer version of the Pollen testnet with Coordicide modules. What’s more, IOTA has also partnered with Cartesi to strengthen the use cases of DeFi.

With the release of Chrysalis, according to Schiener, IOTA has also sought to correct a few concerns associated with previous versions of the network. The removal of the Coordinator node that helps in the validations of transactions on the network is one such step.

Thanks to updates like these, there is a lot of optimism around IOTA at this moment, with the same underlined by the sporadic hikes in social sentiment and social volume since the start of the year.

What does this mean for the altcoin’s price? Well, corresponding to the bullish crypto-market and its ecosystem-centric development, the alt recently climbed to a 3-year high on the charts. At press time, while it was certainly well away from its ATH, it was heading in the right direction.

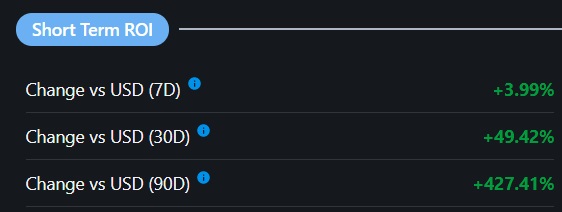

Ergo, IOTA could emerge as an altcoin worth looking at, especially if you’re a short-term trader. In fact, according to Messari, the alt’s 30-day and 90-day RoIs were as high as 49.42% and 427.41%, respectively.

Source: Messari

On the contrary, even if you’re in it for the long-term, the lack of a dynamic trade volume over the past few months on exchanges might suggest that most are HODLing IOTA, instead of trading IOTA. Either way, what these observations mean is that traders are recognizing the bullish prospects of the altcoin, especially in light of the aforementioned developments.

![Why Chainlink [LINK] and Polygon [MATIC] are more similar than you realise](https://ambcrypto.com/wp-content/uploads/2024/04/Chainlink_and_Polygon-1-400x240.webp)