Is a Bitcoin supply shock on the way? What BTC’s latest crash says

- We explore the possibility of a Bitcoin supply shock after recent market observations.

- Bitcoin velocity pivots, indicating that Bitcoin is well into a highly volatile phase.

When Bitcoin [BTC] underwent another halving earlier this year, there was speculation that a supply shock would soon follow. Today, the possibility of a Bitcoin supply shock is much higher, especially after the recent crash.

In Bitcoin’s case, a supply shock would occur if exchange reserves dropped to extreme lows. At the same time, demand might remain constant or soar higher.

Such a scenario would likely lead to an imbalance in favor of a rapid upside.

Bitcoin’s behavior during the latest crash offered some indication that a supply shock might be around the corner.

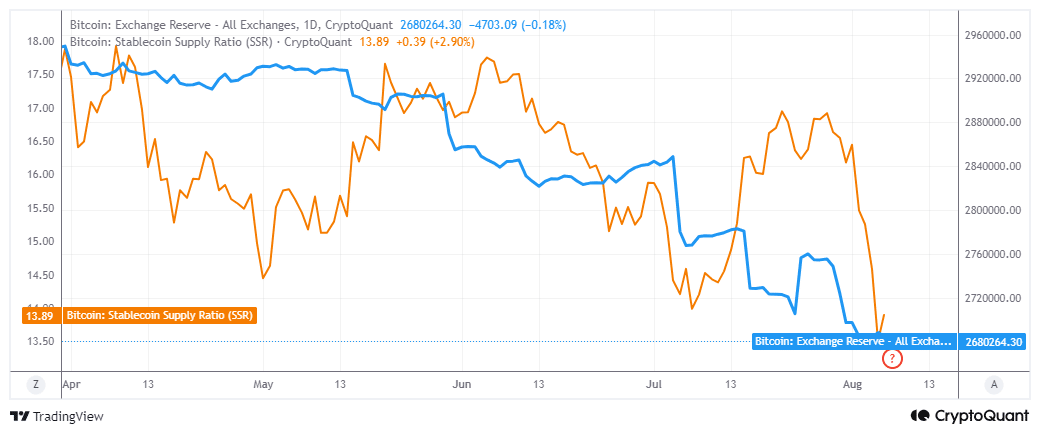

The first major sign supporting this expectation was the observation that the Bitcoin exchange reserves indicator is now lower than it was last week.

In fact, it only leveled out during the crash without a noteworthy uptick, despite the massive surge in sell side pressure.

AMBCrypto did, however, observe a spike in the Bitcoin stablecoin supply ratio in the last two days after its previous decline.

This was an important observation because every time this indicator went up in the past, it was accompanied by a BTC price rally. It may thus mark the star of another relief rally for the cryptocurrency.

Bitcoin velocity pivots

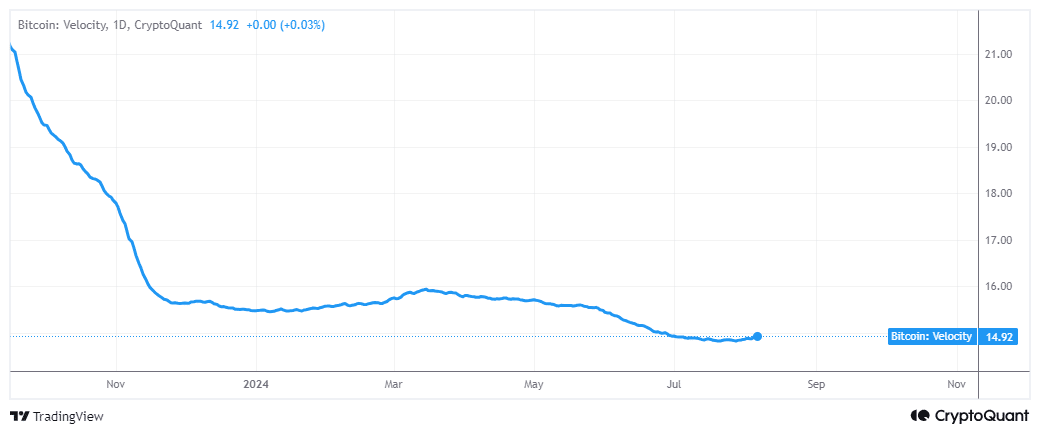

There are multiple reasons why Bitcoin velocity (the rate at which it exchanges hands) changes. A peak in excitement, whether negative or positive, may lead to more velocity.

When liquidity flows out of the market and BTC demand goes low, the velocity tends to dip.

The last major uptrend started in 2020 when excitement and liquidity started flooding into crypto. It peaked in August 2022 after the FTX crash and stablecoin depeggings that happened that year.

The latest surge in BTC velocity started in January and ended in March as liquidity tested the waters, leading to some uptrend.

Bitcoin’s velocity, at press time, signaled a pivot to the uptrend. If this uptrend is sustained, it may indicate that BTC is headed for another season of excitement and highly volatile price changes.

This will all depend on the level of liquidity in the market.

But what would happen in the market, there was a strong Bitcoin velocity surge?

Well, the fact that the BTC supply on exchanges keeps declining indicates that there is strong long term bullish optimism, largely because ETFs are now involved, and crazy high predictions are yet to be achieved.

Is your portfolio green? Check out the BTC Profit Calculator

Higher velocity combined with strong demand may play out in favor of the bulls. It would also likely be accompanied by large dips, just like the one that occurred recently.

Huge price movements would occur if a supply shock, likely pushing up Bitcoin’s velocity.