Is Altcoin season near? Bitcoin dominance tests key resistance

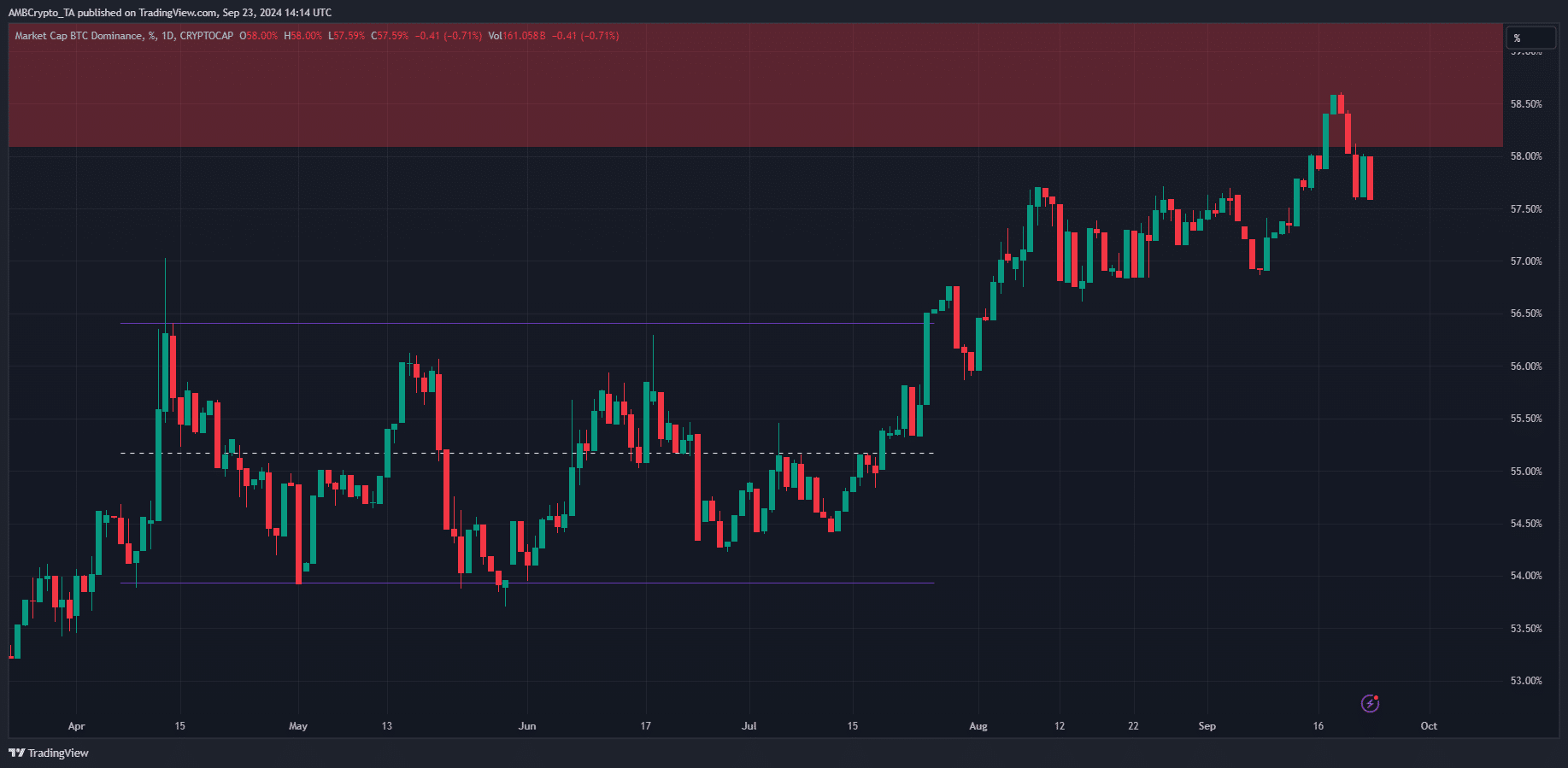

- The Bitcoin Dominance chart has reached a resistance zone.

- The falling SSR metric agreed with the rising hopes of an altcoin season.

Since Friday, the 6th of September, the crypto market capitalization has increased by 20.33%, going from $1.814 trillion to $2.182 trillion. The $368 billion increase was largely fueled by Bitcoin [BTC].

This was seen in the Bitcoin dominance chart. The metric rose from 56.87% on the 8th of September, to 58.59% on the 18th of September before pulling back. It also reached a resistance zone beneath the 60% mark.

The significance of this resistance

The Bitcoin Dominance chart measures the market capitalization of BTC as a measure of the total crypto space, which includes the top altcoins. A rise in the BTC.D means the king outperforms the rest of the market.

In a post on X, crypto analyst Ali Martinez noted that the dominance chart had formed a rising wedge pattern and could have topped out under the resistance at 60%. A drop in BTC dominance would indicate capital flowing into the altcoins.

This could lead to an alt season, a period of bountiful gains for long-term holders of altcoin projects.

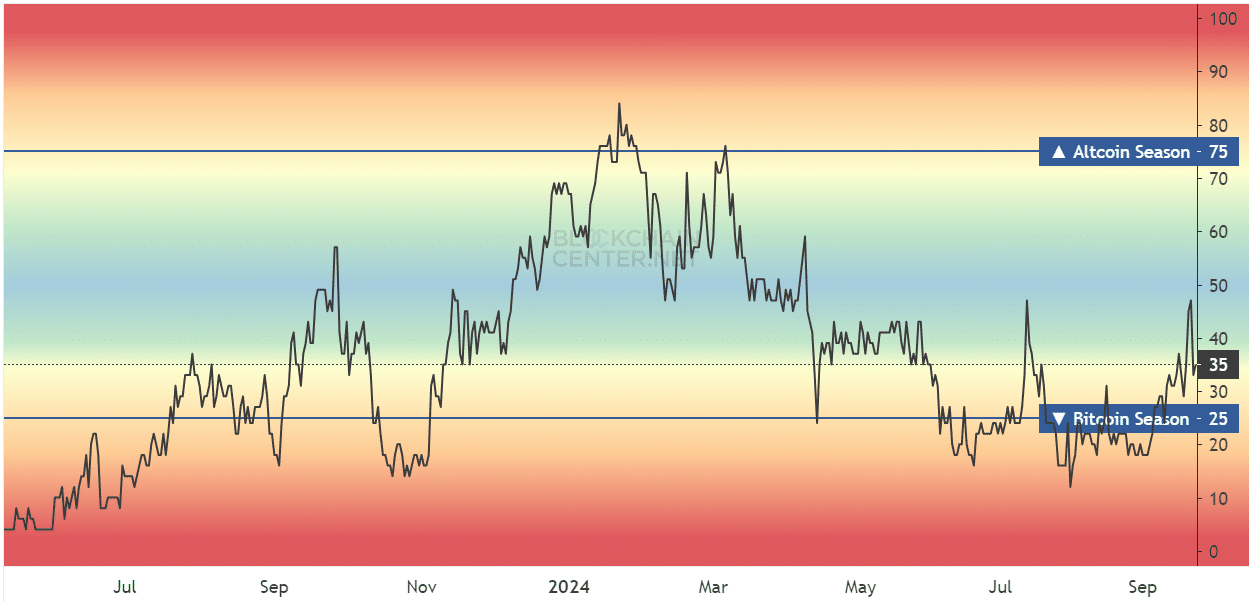

Source: BlockchainCenter

The altcoin season index showed a reading of 35, and a 75 reading is necessary for the alt season. The rising score can be encouraging for long-term crypto market participants.

Stablecoin clue that the market is ready for an altcoin season

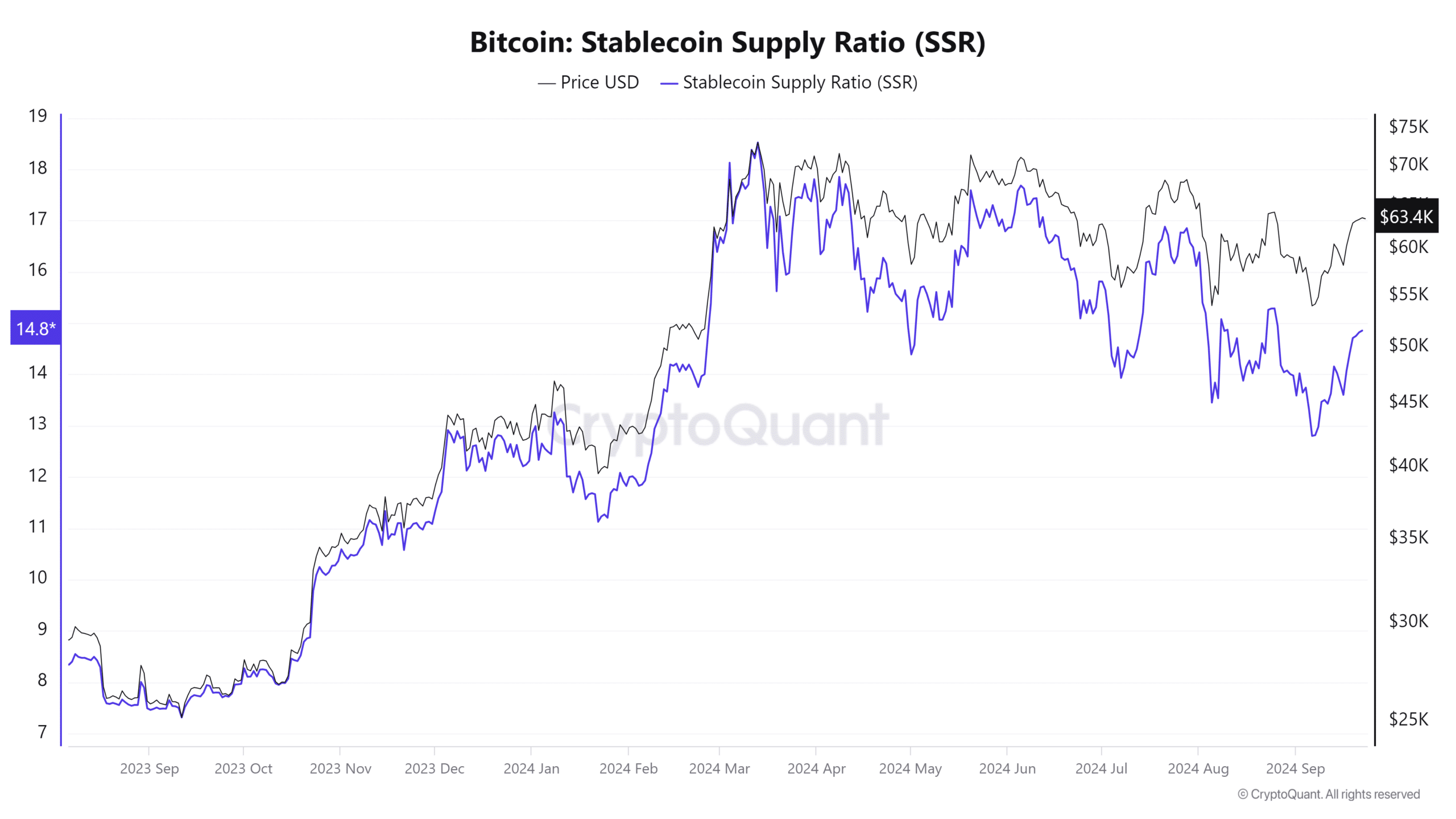

Source: CryptoQuant

The stablecoin supply ratio metric also suggested that the market is readying for an alt season. The metric’s downtrend implied that the aggregated market cap of all stablecoins was rising relative to Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In turn, this implied an increase in buying power in the market. Therefore, a price rise across the altcoin market is possible.

However, the metric’s readings are nowhere close to the 2023 October lows which brought the previous rally.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)