Is Binance founder CZ’s sentence the boost BNB needed all along?

- BNB tumbled over 6% in the 24-hour period owing to broader market bloodbath.

- The positive commentary around the coin increased dramatically in the last 24–48 hours.

Binance Coin [BNB] suffered substantial losses in the last 24 hours, as the broader market downturn took its toll on the native token of the Binance ecosystem.

The fourth-largest cryptocurrency by market cap tumbled over 6% in the 24-hour period, data from CoinMarketCap showed.

However, on a monthly time frame, the coin performed comparatively better against other leading coins, nursing losses of just 6%.

That being said, BNB could be in for healthy gains in the short to medium term, as a major chapter, which fueled considerable FUD for the coin in the recent past, reached a conclusion.

A short-term bullish catalyst?

Binance’s ex-boss, Changpeng Zhao, popularly known as CZ, was sentenced to four months in prison, for the charges brought against him by the U.S. government.

The charges were severe, including violation of anti-money-laundering rules that allowed illicit transactions on the exchange.

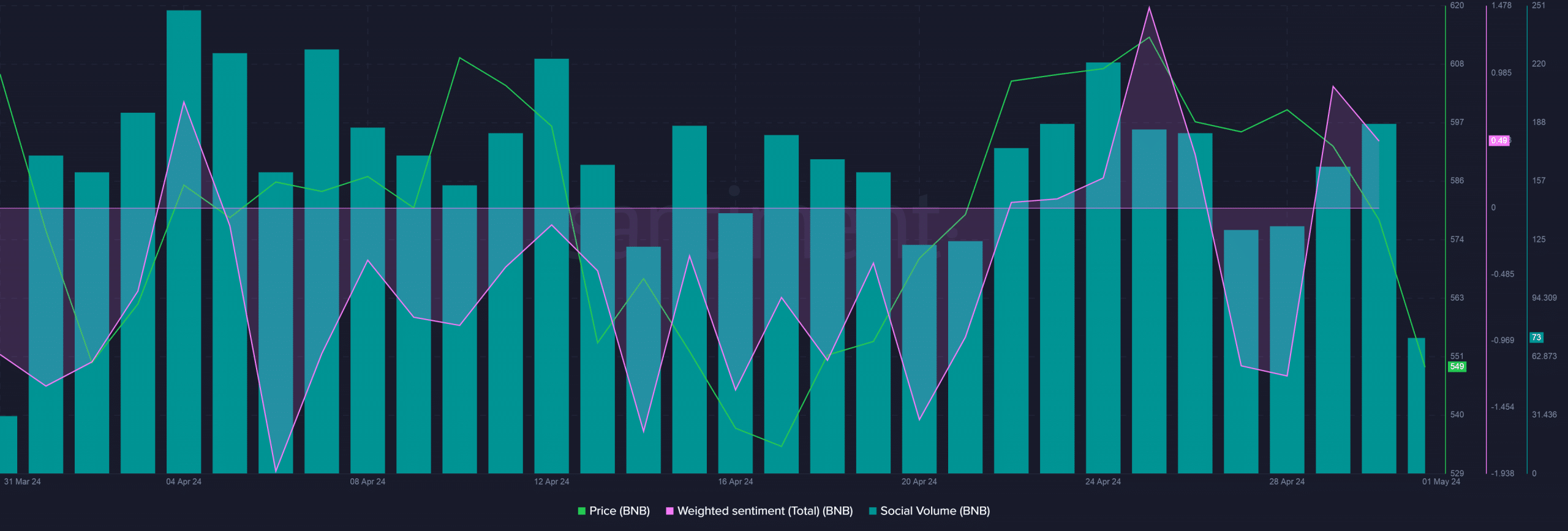

The news of the announcement set the social circles buzzing. According to AMBCrypto’s analysis of Santiment’s data, the mention of BNB on top crypto-focused social channels surged dramatically.

Interestingly, positive commentary around the coin exceeded bearish takes, as weighted sentiment entered the positive territory. This suggested a more favorable view of BNB’s next moves by the market.

Futures traders not hopeful of quick rebound

BNB’s sentiment in the derivatives market continued to be bearish.

The number of traders shorting the crypto increased considerably in the last 24 hours, AMBCrypto spotted using Coinglass’ Long/Shorts Ratio indicator.

Read Binance Coin’s [BNB]Price Prediction 2024-25

The Open Interest (OI), or the money invested in active futures contracts of BNB, dropped 1.27% in the last 24 hours to $564 million.

While this might be due to the broader market downturn, BNB could see investments trickling in once the sentiment improves.