Is Bitcoin a good investment? Top 4 factors to consider

- Holders of Bitcoin might accumulate more, prompting suggestions of a price increase.

- A crucial indicator revealed that BTC might plunge again before it hits another all-time high.

Investing in crypto can be risky. But one thing that Bitcoin [BTC], the cryptocurrency with the largest market cap, has shown, is that choosing the coin can yield rewards that only a few assets can dream of.

But don’t take AMBCrypto’s word as advice.

Instead, a quick look at BTC’s all-time performance revealed that this is no fluke. According to data from CoinMarketCap, Bitcoin’s price has increased by a mind-blogging 103,942,579% since its inception.

However, one thing investors can assure you is that it is not just glitz and glamour on Bitcoin’s end.

For instance, the market crash of 2022 was proof that “up only” is only a myth, as any Bitcoin investment can go down once the market hits a bear phase.

Watch out! The direction is not always north

In 2021, Bitcoin hit an All-Time high (ATH) of $69,000. But a year back, triggered by certain events, the coin dropped below $16,000, confirming that the asset’s volatility could have an unpleasant impact on investors.

Fast-forward to 2024, the coin surpassed its all-time high, reaching $73,750 on the 14th of March. Despite the hike, the coin retraced. As of this writing, it changed hands at $64,298.

This value represented a 5.58% decrease in the last 30 days. But is Bitcoin a good investment for you? Well, certain factors influence the price of the coin.

For instance, the approval of spot Bitcoin ETFs earlier this year influenced the rally to its new all-time high. However, the amazing inflows of the first quarter are nowhere to be found.

As such, investors are left with the fundamentals and key indicators to depend on. For starters, AMBCrypto looked at Bitcoin’s potential to give good returns using on-chain metrics.

More gains may be coming

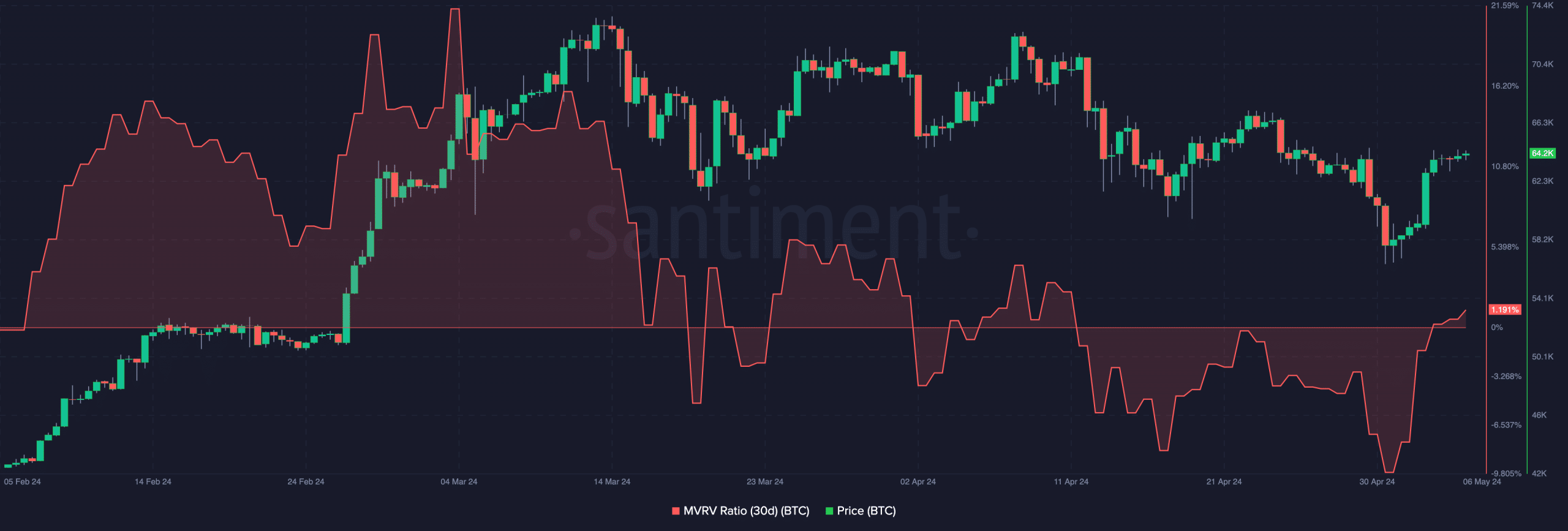

One of the metrics we looked at was the Market Value to Realized Value (MVRV) ratio. The MVRV ratio shows the profitability of BTC holders.

At press time, the 30-day MVRV ratio was 1.1.9%. This means that if holders of Bitcoin sell their assets, the average return would be around this percentage.

But this is unlikely to happen, as the unrealized gains do not seem enticing enough to trigger a widespread sell-off. Therefore, the reasonable action would be for investors to hold to their coins.

Also, when the MVRV ratio was 21.30%, Bitcoin’s price was over $71,000. With this data, more accumulation could take place, and this could lead BTC back to a more profitable region.

Will Bitcoin add an extra 40% increase?

Furthermore, there have been predictions that the coin might hit $100,000 this cycle. While some argue in favor of the forecast, others prefer to be on the conservative side.

For the bullish ones, the ETF and ATH before halving was evidence that Bitcoin might add another 40% to its price before it hit the top.

AMBCrypto spoke to Ben Cousens about the matter. Cousens is the Chief Strategy Officer at ZBD, a company using the Bitcoin lightning network to power payments.

While the ZBD chief did not give a specific price prediction, he displayed optimism in his comment, saying that,

“Within the Bitcoin ecosystem as a whole, historically, the halving has coincided with rising fiat prices due to the supply shock. his halving came at a time when ETFs were increasing institutional adoption, playing a bigger role with more of an impact. The additional excitement about the halving leads to a new cohort of users who learn how to use Bitcoin.”

Going by Cousens’s opinion, a new wave of new investors might come for Bitcoin. Should this be the case, rising demand could lead to higher prices, and most investments might be worth it.

A short-term outlook may not cut it

However, short-term investors might need to be wary. As much as BTC can be a good investment, the price might also undergo a correction.

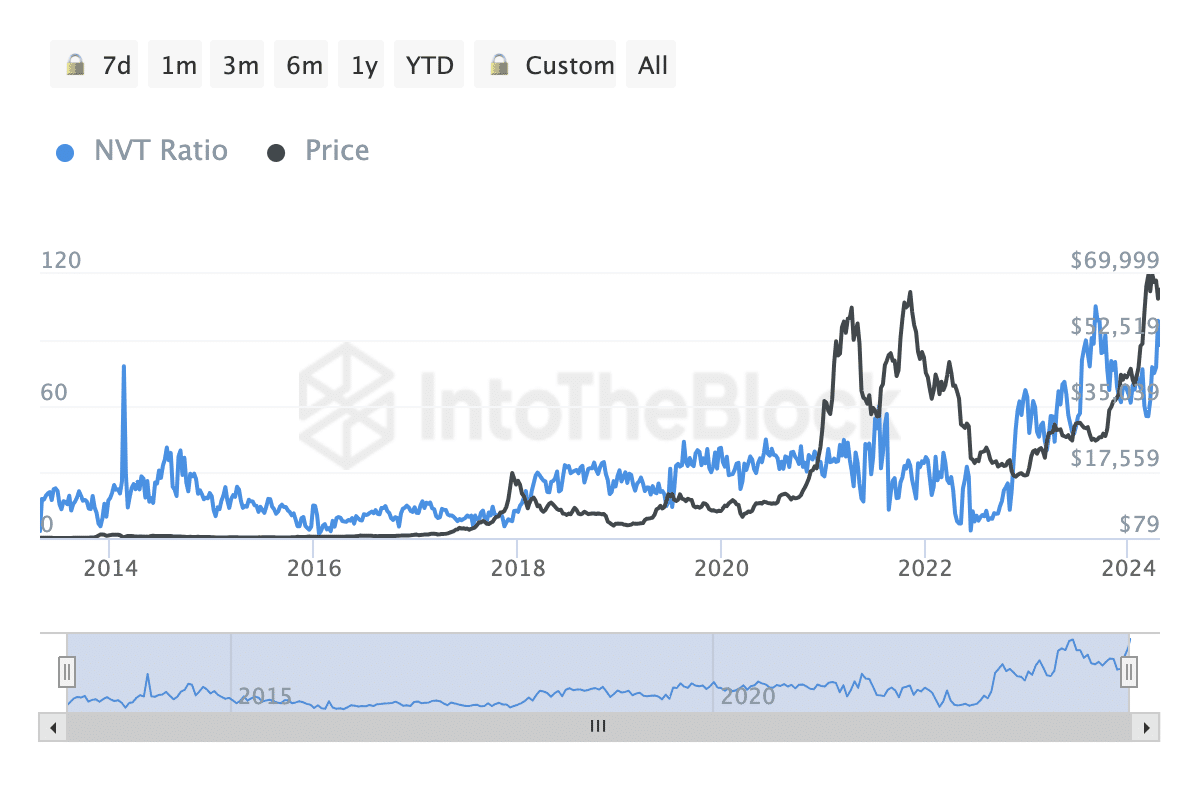

One of the reasons for this is the Network Value to Transaction (NVT) ratio. This metric looks at a coin’s market cap relative to its total trading volume.

If the NVT ratio increases, it means that the coin could be overvalued in the short term. However, a low NVT ratio suggests an undervaluation of the current asset value.

At the time of writing, IntoTheBlock data showed that Bitcoin’s NVT ratio had risen to 98.79, implying that a return below $64,000 could be imminent.

Should this be the case, the price of Bitcoin might collapse to $59,000 again. But in the long run, Bitcoin can be a good investment depending on the purchase price.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

For this cycle, the price of the coin is expected to hit between $87,000 and $92,000. Therefore, buying at press time price or waiting for another decline might be a good move.

Either way, investors should be on the lookout for happenings in the ecosystem, as an unfavorable event might invalidate this thesis.