Is Bitcoin headed for a shake-up? THIS group holds the answer

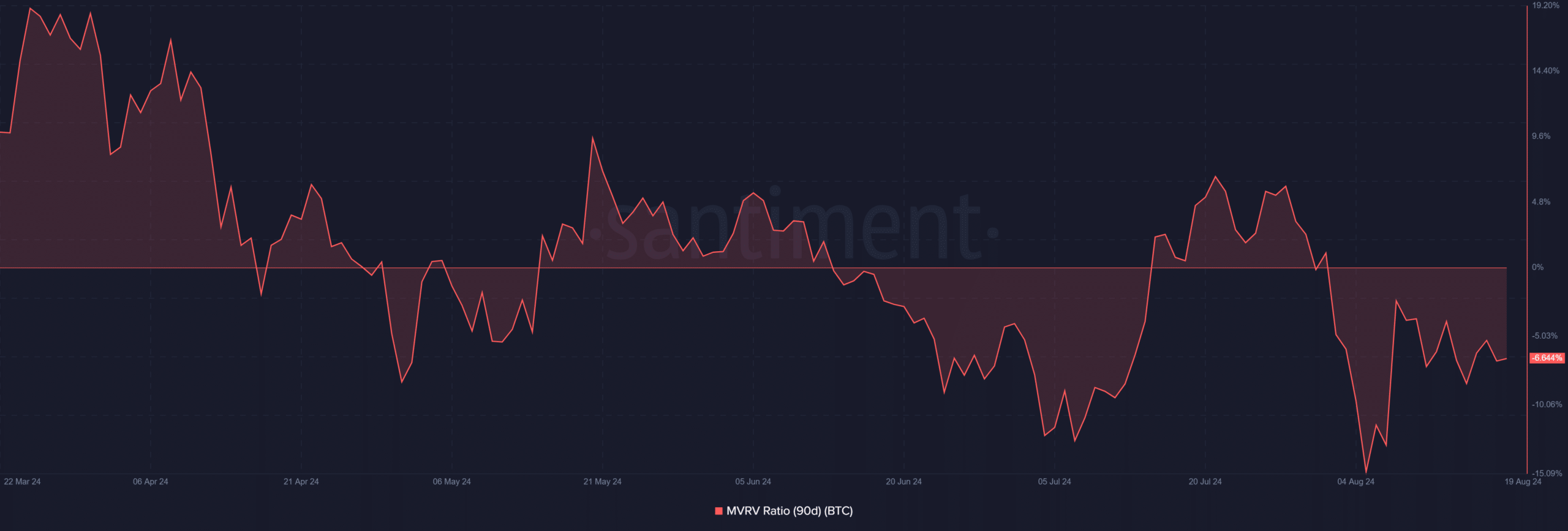

- BTC’s long-term MVRV was below 6% at press time.

- BTC might see capitulation or accumulation soon, based on the reaction of holders.

Despite Bitcoin’s [BTC] relatively stable price in recent months, key on-chain metrics suggested underlying challenges that could impact the market.

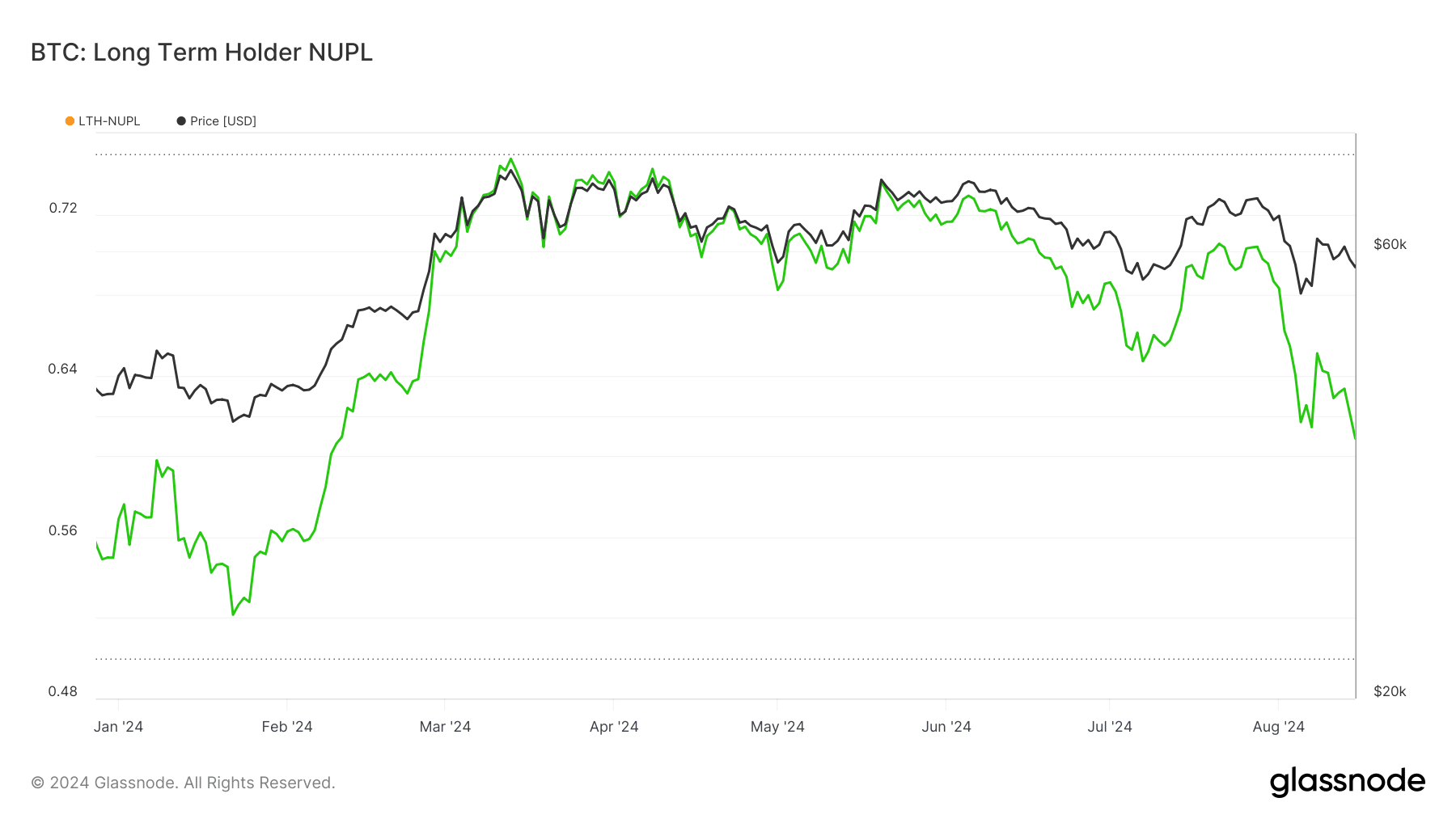

One concerning indicator is the Long Term Holder Net Unrealized Profit/Loss (LTH-NUPL).

Additionally, the long-term Market Value to Realized Value (MVRV) ratio has remained below zero for the past several weeks.

Declining Bitcoin profitability

An analysis of the Long-Term Holder Net Unrealized Profit/Loss (LTH-NUPL) on Glassnode revealed that long-term Bitcoin holders were experiencing a significant decline in profitability at press time.

This trend could be a critical indicator of the market’s future direction.

Around March 2024, Bitcoin’s price and the LTH-NUPL peaked, signaling that many long-term holders were sitting on substantial unrealized profits.

However, following this peak, both the price and LTH-NUPL began to decline, suggesting that the market may have seen considerable profit-taking.

From June to August 2024, the LTH-NUPL continued to decline, closely mirroring BTC’s downward price trend.

As of August 2024, the LTH-NUPL is positioned on the lower end of the spectrum, indicating that many long-term holders’ profits have significantly diminished.

What this could mean for Bitcoin

This situation could suggest that the market is approaching a critical juncture. It could be nearing a point of capitulation, where holders may start selling off their holdings to avoid further losses.

Also, it could be approaching a potential bottom, where new accumulation could occur as investors seek buying opportunities.

The LTH-NUPL specifically measures the unrealized profit or loss of long-term Bitcoin holders.

A high NUPL value indicates that the majority of the coins held by this group are in profit, potentially leading to profit-taking and a market correction.

Conversely, a low or negative NUPL value implies that more coins are held at a loss, which could lead to capitulation or present a buying opportunity for investors.

LTH’s profits sinks

AMBCrypto’s analysis of Bitcoin’s 90-day Market Value to Realized Value (MVRV) revealed that long-term holders were holding at a loss at the time of writing.

The trend reinforces the findings from the Long-Term Holder Net Unrealized Profit/Loss (LTH-NUPL) analysis.

Also, the 90-day MVRV has been below zero since 1st August, and as of this writing, it stood at approximately -6.6%.

This indicated that investors who bought Bitcoin during this period were holding an average loss of over 6%.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The persistent negative MVRV suggests that long-term holders were experiencing financial pressure, which could influence their decision-making in the near term.

This trend is crucial because how these holders react—whether by selling off their holdings to minimize losses or by holding on in anticipation of a market recovery—will significantly impact Bitcoin’s price direction.