Is Bitcoin ‘losing’ to Gold right now? Here’s what Peter Schiff thinks…

- Bitcoin’s price dropped while gold spiked

- Peter Schiff’s advocacy diminished by BTC’s investment surge

Bitcoin [BTC] has once again dropped on the charts, with its price falling from over $70,000 to just over $67,000 at press time. In fact, BTC lost over 5% of its value in just 24 hours.

On the other hand, Gold – One of the market’s more traditional assets – surged to a new ATH on the back of global financial markets’ uncertainty. Where does that leave Bitcoin?

What’s behind the surge in gold prices?

The aforementioned disparity in price actions led to various Bitcoin skeptics coming forward and sharing their viewpoints. Peter Schiff, among many others, highlighted in his recent podcast that some media stories attribute the rise in gold prices to geopolitical tensions, such as those in Ukraine or Israel.

However, he believes that this explanation misses the true reason behind the appreciating in gold prices. He said,

“People are just buying gold as a hedge, right? I mean in a way they’re right it is a hedge, but it’s not a hedge against geopolitical uncertainty it’s a hedge against inflation.”

Schiff further noted that even though the US Dollar appears strong, compared to other currencies, it’s actually weakening, with the same evidenced by Gold’s rise against all currencies.

Taking to X (Formerly Twitter), he noted,

“It’s a rejection of fiat currencies and a harbinger of the end of the U.S. dollar’s role as the world’s reserve currency.”

This is a sign that the U.S Dollar’s reserve status is uncertain, and its apparent strength is only temporary.

Bitcoin stands strong against gold

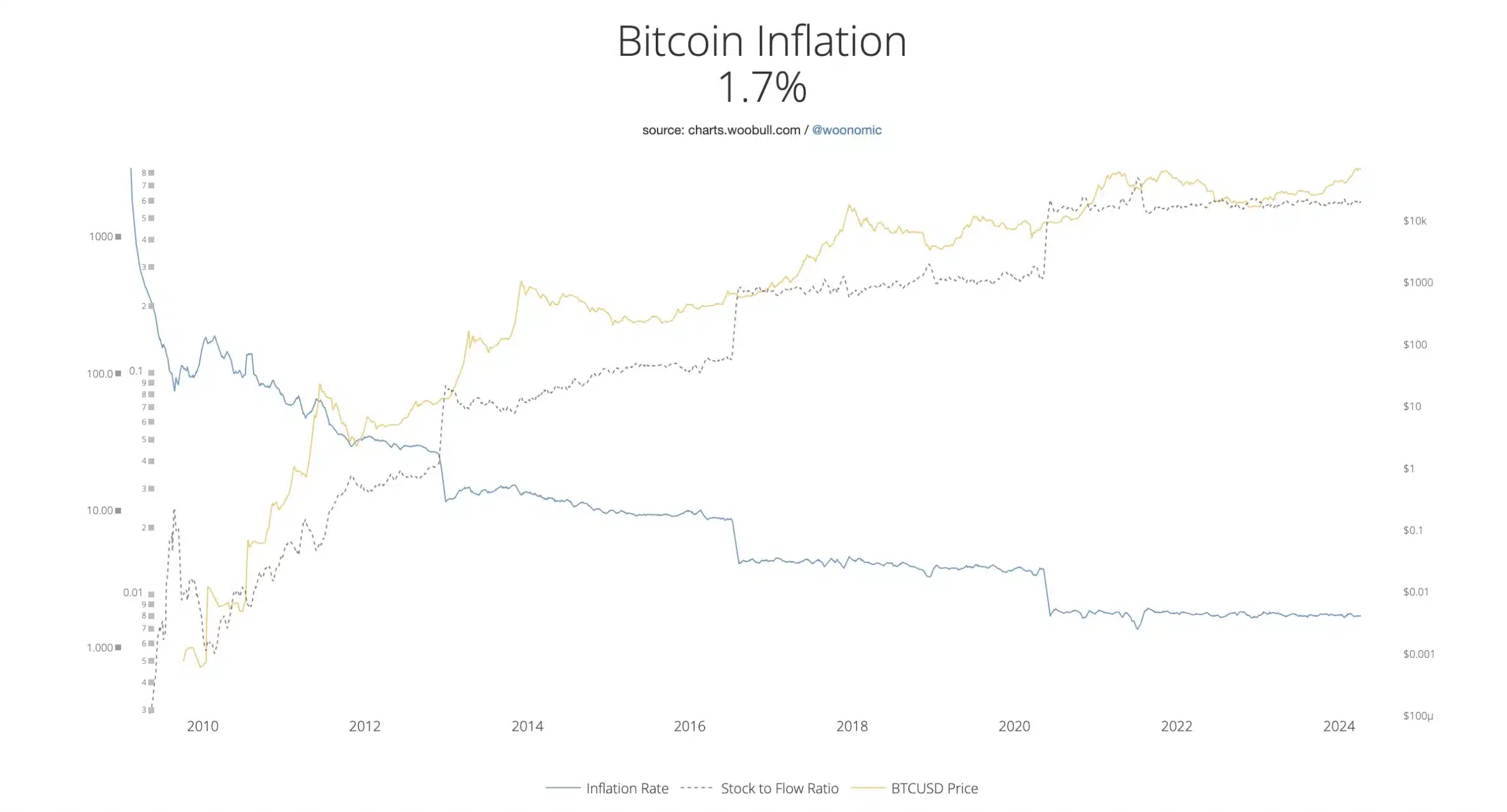

Despite Bitcoin’s recent price volatility, however, Woodbull Charts highlighted a fall in its inflation over the past four years, dropping from 3.72% in 2020 to 1.7% in 2024. This can be implied as a sign that short-term declines in BTC’s price are unlikely to prompt widespread selling of the cryptocurrency.

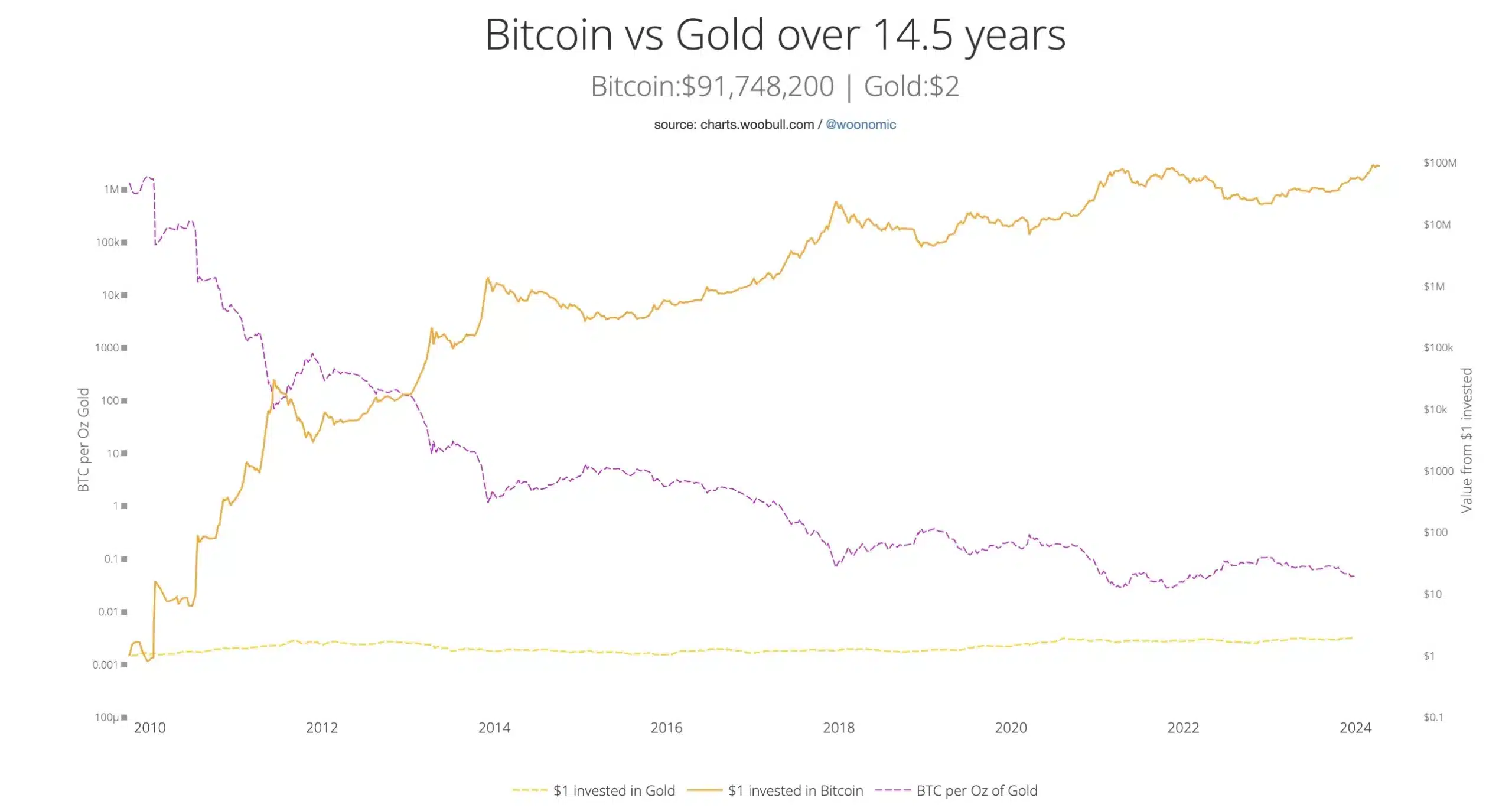

In line with these observations, Woodbull charts also recently compared the performance of Bitcoin to gold over a period of 14.5 years. As of April 2024, Bitcoin’s investment value stood at $19.83, while gold was struggling at $1.97.

Here, it’s worth noting that Woodbull Charts had a point to make to Peter Schiff and his followers too,

Bitcoin continues to win hearts

Ergo, despite its erratic fluctuations in value, Bitcoin has established itself as a desirable investment opportunity for many. In fact, many institutions like MicroStrategy has also started including BTC in their portfolios owing to its performances over the last few years.

Needless to say, sentiment around BTC remains as positive as ever, with one commentator claiming,

“Repeat after me. They won’t shake me out. 100k, BTC to the moon!”