Is Bitcoin price bottom in? aSOPR suggests BTC is about to…

Bitcoin [BTC] may be on the brink of a critical turning point, with recent market signals suggesting a potential shift in momentum.

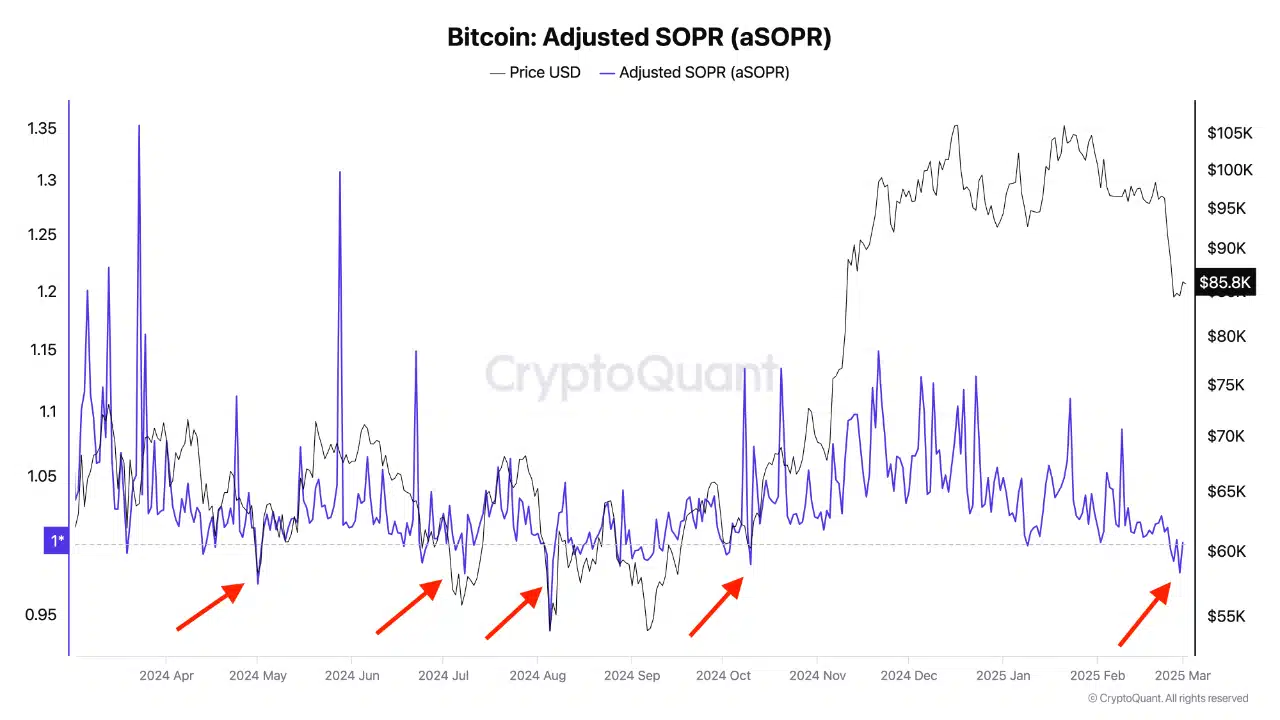

The Adjusted Spent Output Profit Ratio (aSOPR) has remained persistently below 1, signaling that many investors are selling at a loss — an indicator often linked to market capitulation.

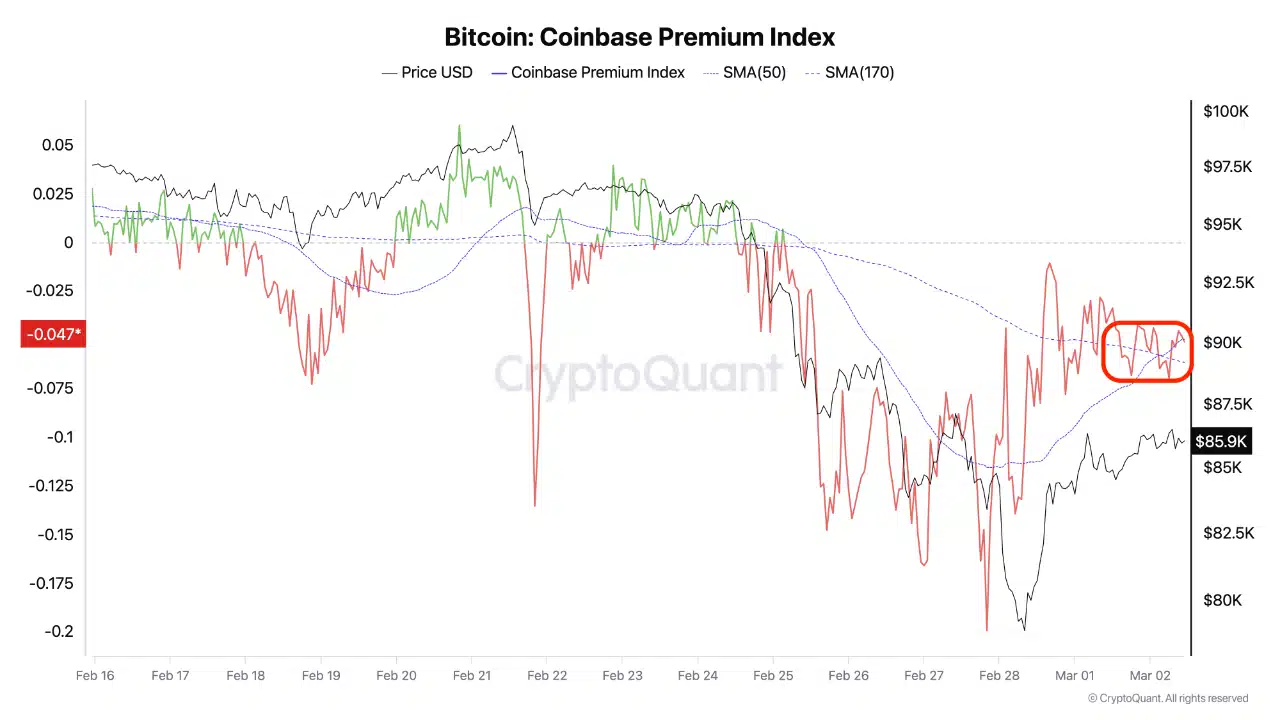

At the same time, the Coinbase Premium Index is showing signs of recovery, pointing to a potential easing of selling pressure despite recent outflows and typical weekend slowdowns.

Is Bitcoin nearing a market bottom, or is there more volatility ahead?

aSOPR and market bottom signals

aSOPR measures whether Bitcoin investors are selling at a profit or a loss. A reading below 1 indicates that the average seller is exiting at a loss, often aligning with capitulation phases and market bottoms.

Historically, when aSOPR dips below 1 for an extended period and then recovers, it has signaled a shift in trend.

In the chart, red arrows highlight previous instances where aSOPR fell below 1, aligning with local price bottoms before Bitcoin rebounded.

The most recent drop in early 2025 suggests a similar pattern, raising the question whether Bitcoin is nearing another turning point.

If selling pressure eases and demand strengthens, history may repeat with another recovery.