Is Bitcoin set for a rally? Insights from key levels

- Bitcoin’s Taker Buy Sell Ratio has risen over one.

- BTC remained in the $66,000 price range.

In the past few days, the price of Bitcoin [BTC] has fallen, hitting new lows each day. Despite the apparent decline, one metric suggests that the price might pick up soon.

Bitcoin takers and sellers

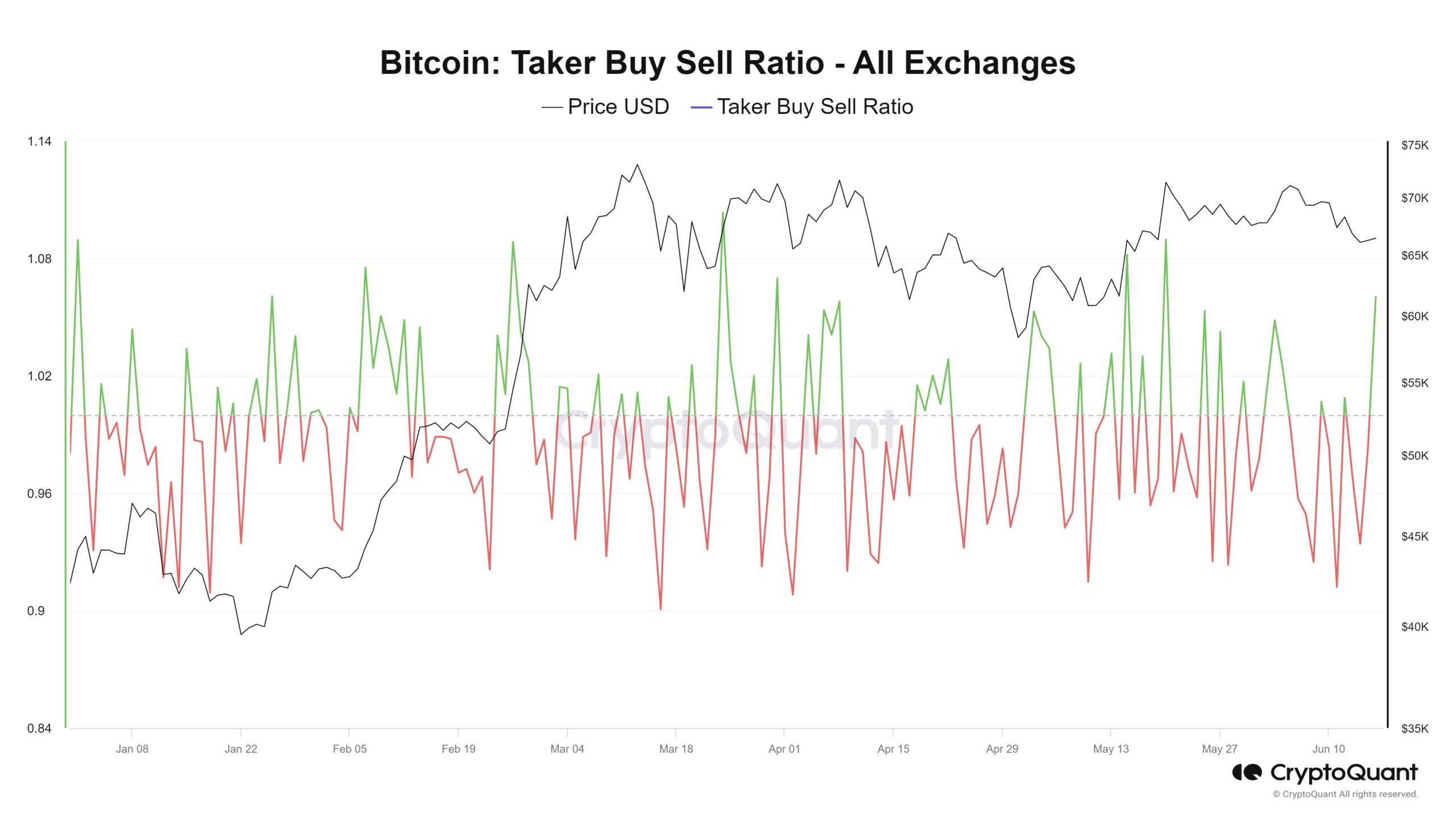

AMBCrypto’s analysis of the Bitcoin Taker Buy Sell Ratio on CryptoQuant showed a recent positive trend.

The chart indicated that at the end of trading on the 15th of June, the ratio was trending below one, signaling a bearish sentiment.

However, the metric has been rising as of the previous trading session.

Further analysis revealed that it had spiked above one on some exchanges, indicating a shift towards a bullish sentiment as more buy orders are being executed compared to sell orders.

As of this writing, the BTC Taker Buy Sell Ratio has broken above one. This indicated that buying pressure was exceeding selling pressure across most of the exchanges.

This shift suggested that the market sentiment is becoming more positive, and it could lead to a potential price increase for BTC soon.

Inflows dominate, but there’s a catch

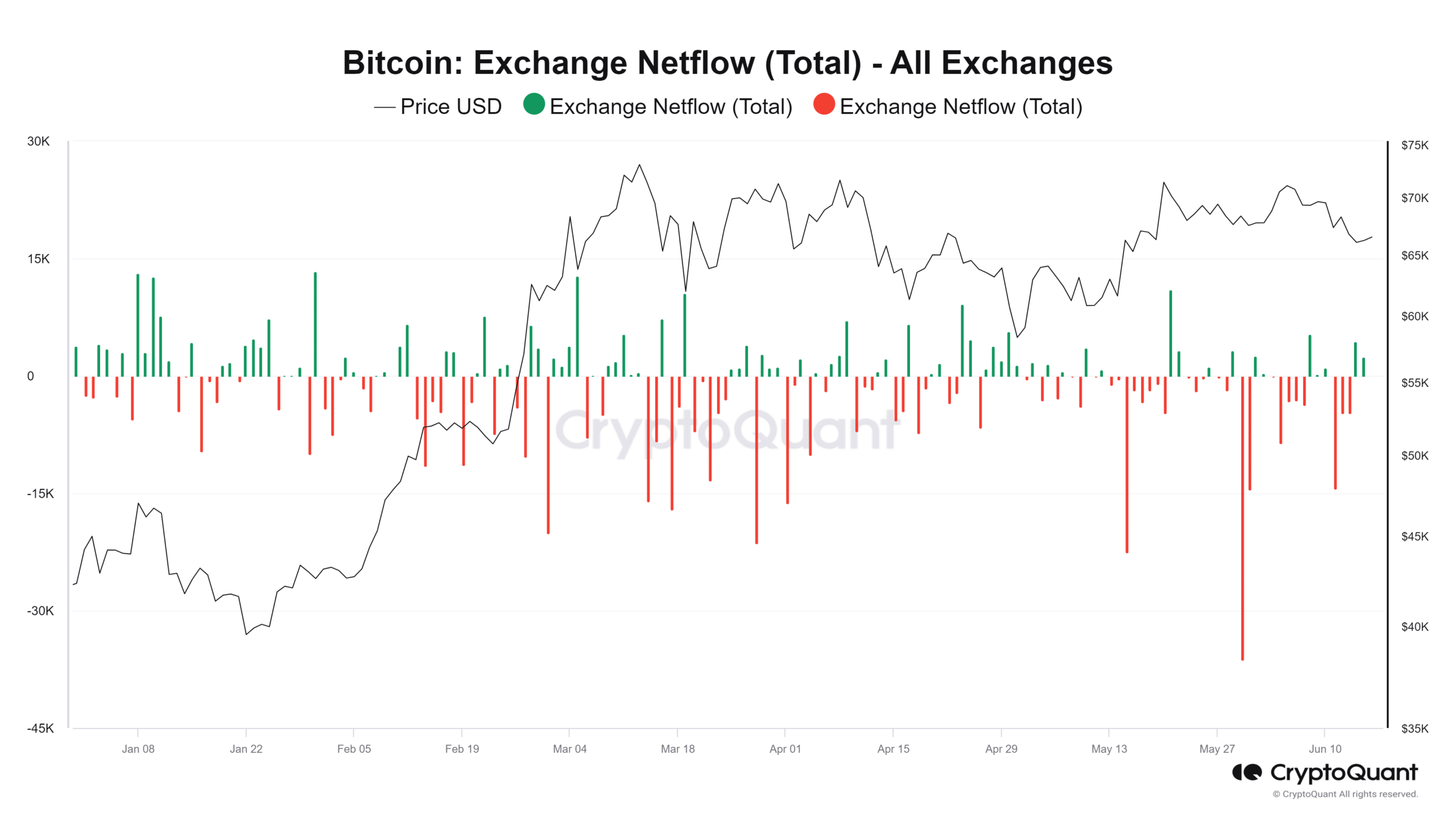

Bitcoin’s Exchange Netflow showed that it has been positive for the past few days. This indicated that more BTC is being sent to exchanges than withdrawn from them.

While this might initially appear to be a bearish signal, further analysis revealed that the inflow is still relatively low compared to the outflow in the last few weeks.

Despite the recent increase in BTC being sent to exchanges, the overall trend of accumulation and withdrawal to private wallets remains strong, which could still support a bullish outlook for BTC.

Bitcoin remains bearish

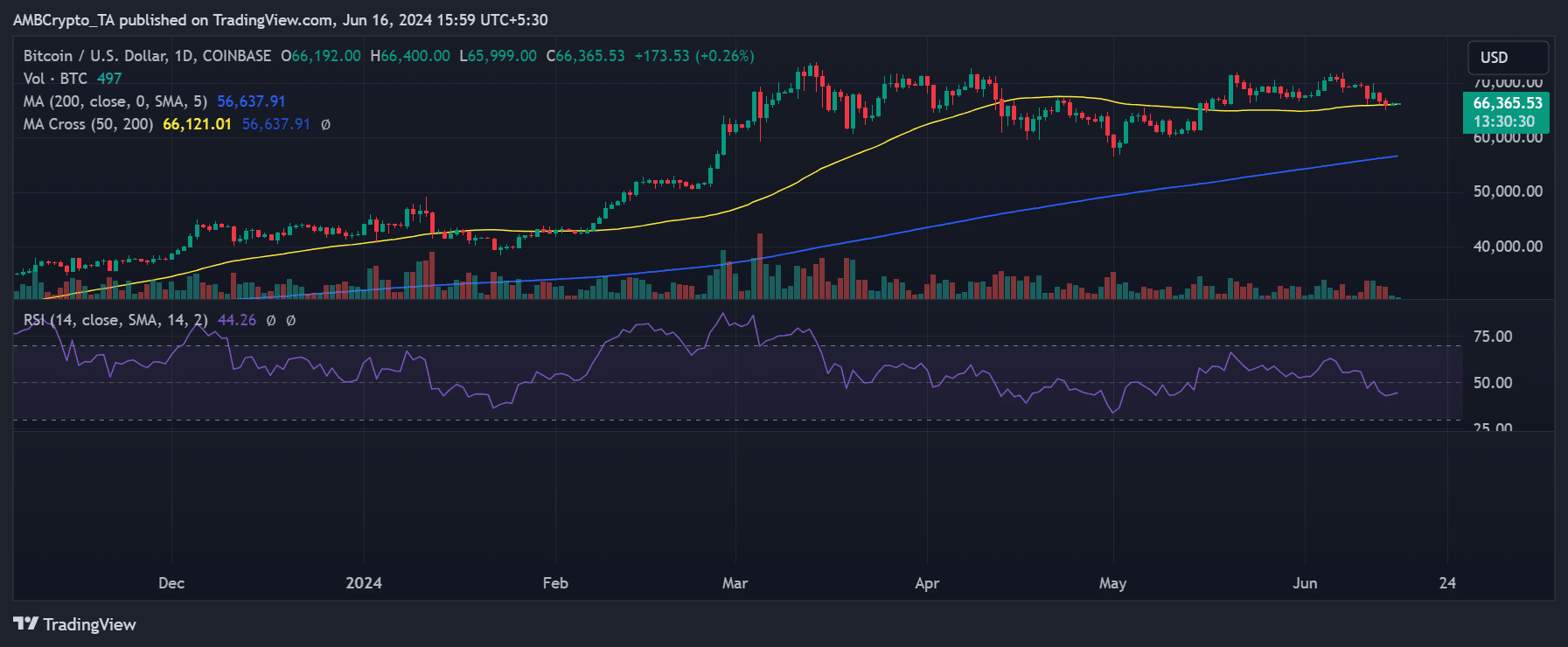

AMBCrypto’s analysis of Bitcoin on a daily timeframe showed an overall decline in the past few days, with minor uptrends not being sufficient to stabilize it.

As of this writing, BTC was trading at around $66,360 despite a minor uptrend.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Additionally, BTC’s support was now strained, as the price was resting heavily on it. The last support range is around $65,000, and Bitcoin is still trading above this level for now.

Furthermore, the Relative Strength Index (RSI) remained below the neutral line. As of this writing, the RSI is around 45, indicating that BTC is in a bear trend.