Is Bitcoin the key to solving U.S. national debt? Senator Lummis thinks so!

- Senator Cynthia Lummis reveals BTC as a strategic reserve asset.

- Bitcoin will boost USD, and eliminate national debt.

Bitcoin and Crypto have taken center stage as the United States prepares for the upcoming presidential elections. Over the past months, Donald Trump has become a pro-crypto presidential candidate, as reported earlier by AMBCrypto.

The rise of political discourse about BTC and Crypto is shaping the future trajectory. During the Bitcoin conference, Senator Cynthia Lummis announced a bill proposing that BTC be a U.S. strategic reserve asset.

Senator Cynthia announces BTC strategic reserve Bill.

During the Bitcoin 2024 conference, U.S. Senator Cynthia Lummis announced a proposal to bolster the USD.

The senator proposed the establishment of a strategic Bitcoin reserve to support the dollar against rising inflation and cement the U.S. position in a changing financial system.

Through her proposal, she noted that,

“Establishing a strategic Bitcoin reserve would firmly secure the dollar’s position as the world’s reserve currency into the 21st century and ensure we remain the world leader in financial innovation,”

She argued that the current economic conditions are difficult with rising inflation rates. Therefore, with the rising inflation, it’s necessary to diversify into BTC and protect America’s economic future.

She added that the legislation will ask the U.S. government to purchase 1 million Bitcoins over five years. Through her statement, she added that,

“Implement a 1-million-unit Bitcoin purchase program over a set period to acquire a total stake of approximately 5% of total Bitcoin supply, mirroring the size and scope of gold reserves held by the United States.”

BTC holding for U.S. debt management

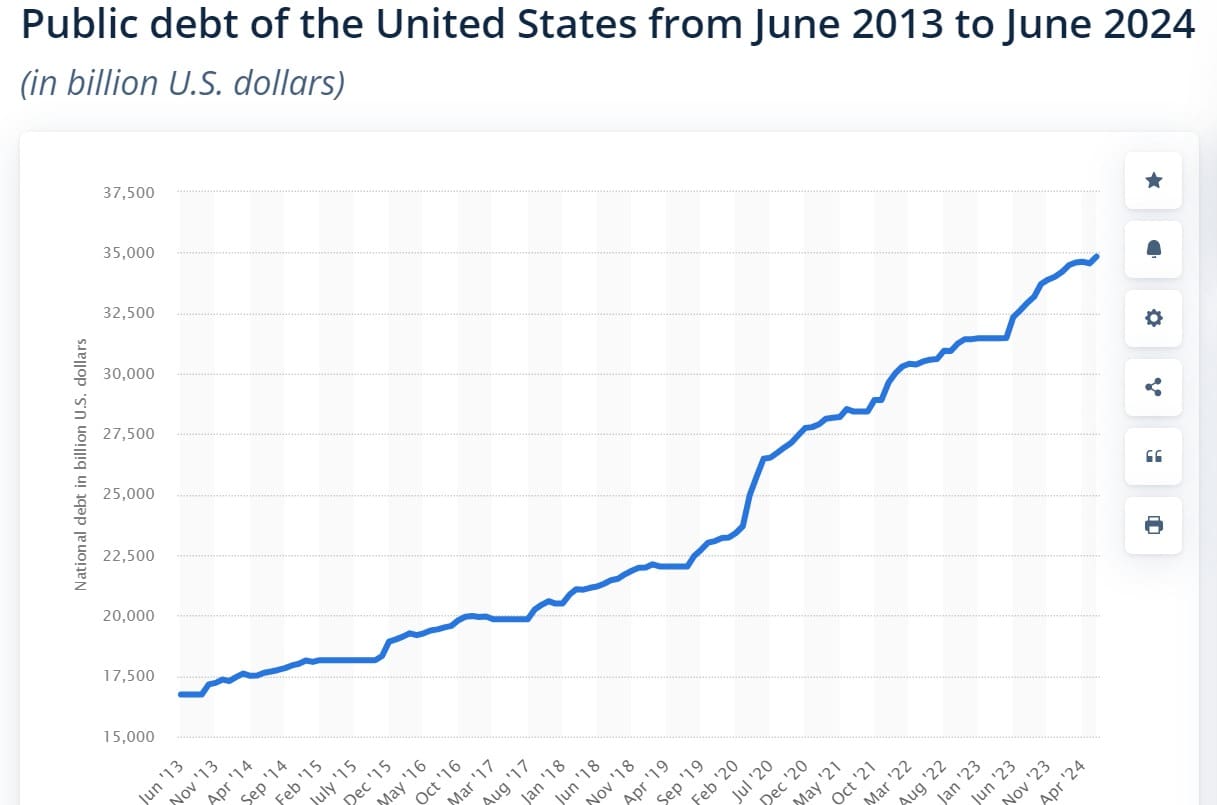

The U.S. debt has skyrocketed to a record high of $35 trillion in the last decade. In her speech, Senator Cynthia argued that if the government invests $3.3 million in BTC reserve, the government will eliminate the debt.

According to the Senator, the government can use BTC to eliminate debt since the value of BTC will rise over time. Therefore, BTC was created to anticipate the looming fiscal and monetary crisis in the United States and globally.

BTC aimed to address the constant devaluation of the fiat currency through government spending and borrowing, facing the U.S. today.

Thus, through BTC reserve assets, the government can reduce borrowing while individual holders avoid fiat devaluation.

What would the BTC reserve mean for the USD?

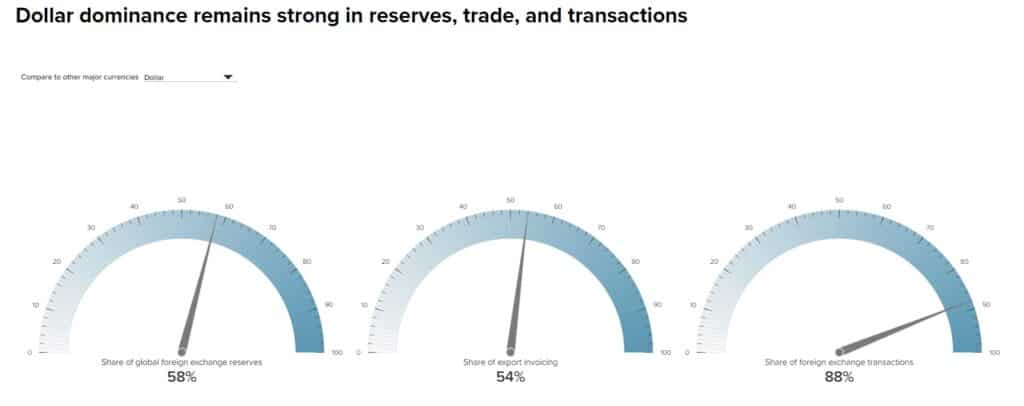

Source: Atlantic Council

For years, USD has defied the prediction of its collapse as it remains the most dominant currency. Almost 60% of global foreign exchange reserves are in dollars.

However, the share has gradually declined over recent years. The decline arises from the financial market evolution, especially through the rise of cryptocurrencies and changing geopolitics.

With cryptocurrencies taking center stage in the digital financial revolution, having a BTC reserve asset will boost the dollar.

Although BTC prices experience volatility, their value rises annually, unlike USD, which loses value through devaluation.