Are Bitcoin’s 7 months of ‘Euphoria’ over? All about BTC’s market shift

- Despite recent price troubles, the BTC market remained euphoric.

- Readings from the coin’s MVRV ratio and Realized Loss metrics suggested that a local bottom may soon be discovered.

Bitcoin’s [BTC] Net Unrealized Profit & Loss (NUPL) metric has shown that the coin’s market remains within the euphoria phase with significant unrealized gains among investors, Glassnode found in a new report.

The BTC market is said to be euphoric when there is widespread optimism and belief that the coin’s price will continue to rise indefinitely.

During this period, the market witnesses rapid price growth and increased trading activity fueled by the excitement.

According to Glassnode, although this phase has cooled off since the market correction began, the value of the coin’s NUPL above 0.5 showed that euphoric elements remained within the BTC market.

Santiment said,

“By this metric, the Euphoria phase (NUPL>0.5) of this bull market has been in effect for (the) last seven months. Even the mightiest up-trends experience corrections, however, and these events offer valuable information about investor positioning and sentiment.”

Is the local bottom in?

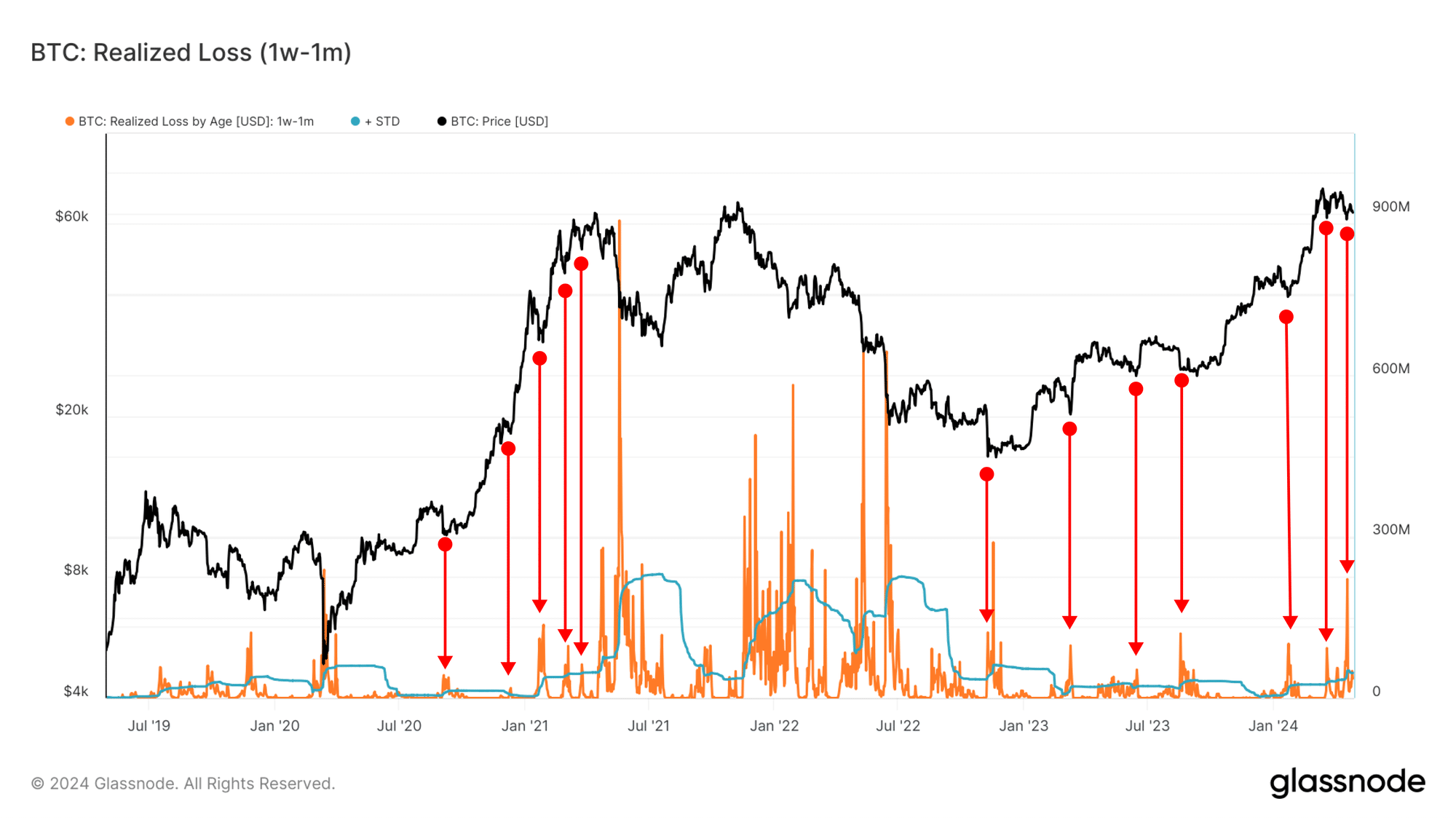

According to Glassnode, the recent correction in BTC’s price has caused its short-term holders (STHs), particularly those who have held their coins for periods between one week and one month, to intensify distribution.

Their distribution activity during periods of market correction such as this becomes noteworthy as it can help identify potential buying opportunities (local lows).

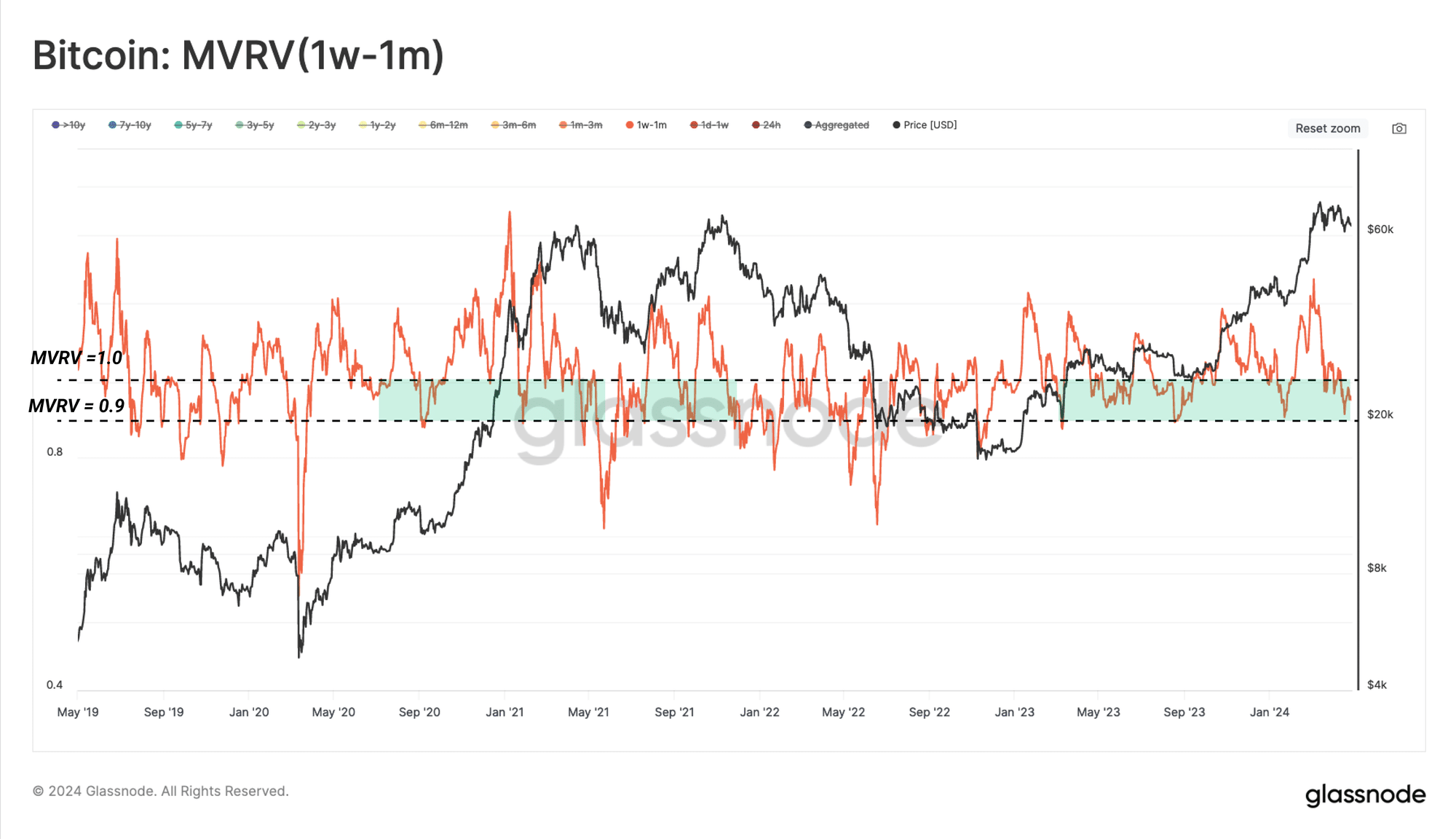

Glassnode assessed the historical pattern of the MVRV ratio of coins held between one week and one month and found that during bull market corrections like this, the value of the ratio “drops into the 0.9-1 range.”

Read Bitcoin’s [BTC] Price Prediction 2024-2025

This means that investors who have held their coins for periods between one week and one month would usually witness around 0% to 10% decline in their assets, causing them to sell.

The on-chain data provider also considered the Realized Loss by one-week to one-month-old entities.

Historical precedents show that when this metric goes above 1, it suggests that STHs are panic selling at a loss.

Glassnode combined its readings from both metrics and concluded:

“Since the price resides within the $60k to $66.7k range, the MVRV condition is met, and it could be argued that the market is hammering out a local bottom formation. That said, a sustained break below that MVRV level could create a cascade of panic and force a new equilibrium to be found and established.”