Is Bitcoin’s bottom close by? The next buy opportunity may be…

- Bitcoin could bottom soon amid rising Bitfinex long positions

- According to the Mayer Multiple, BTC’s press time price may be undervalued and a relative bargain

Since early August’s massive sell-off, Bitcoin [BTC] hasn’t fronted a sustainable solid recovery. In fact, after the aforementioned dump, a relief rally to $65k was sharply reversed – Illustrating the risk-off mode from investors and traders.

However, despite the latest dip to $52.5k, a local bottom for BTC could be likely. According to market analyst Marty Party, BTC could bottom out amid rising Bitfinex long positions. He said,

“Bitfinex Longs continue to grow – historically, this predicts the bottom of #Bitcoin more than any other indicator.”

Should you grab the dip?

According to the analyst, Bitfinex’s BTC longs were triggered on 28 August and suggested that the asset could rebound soon.

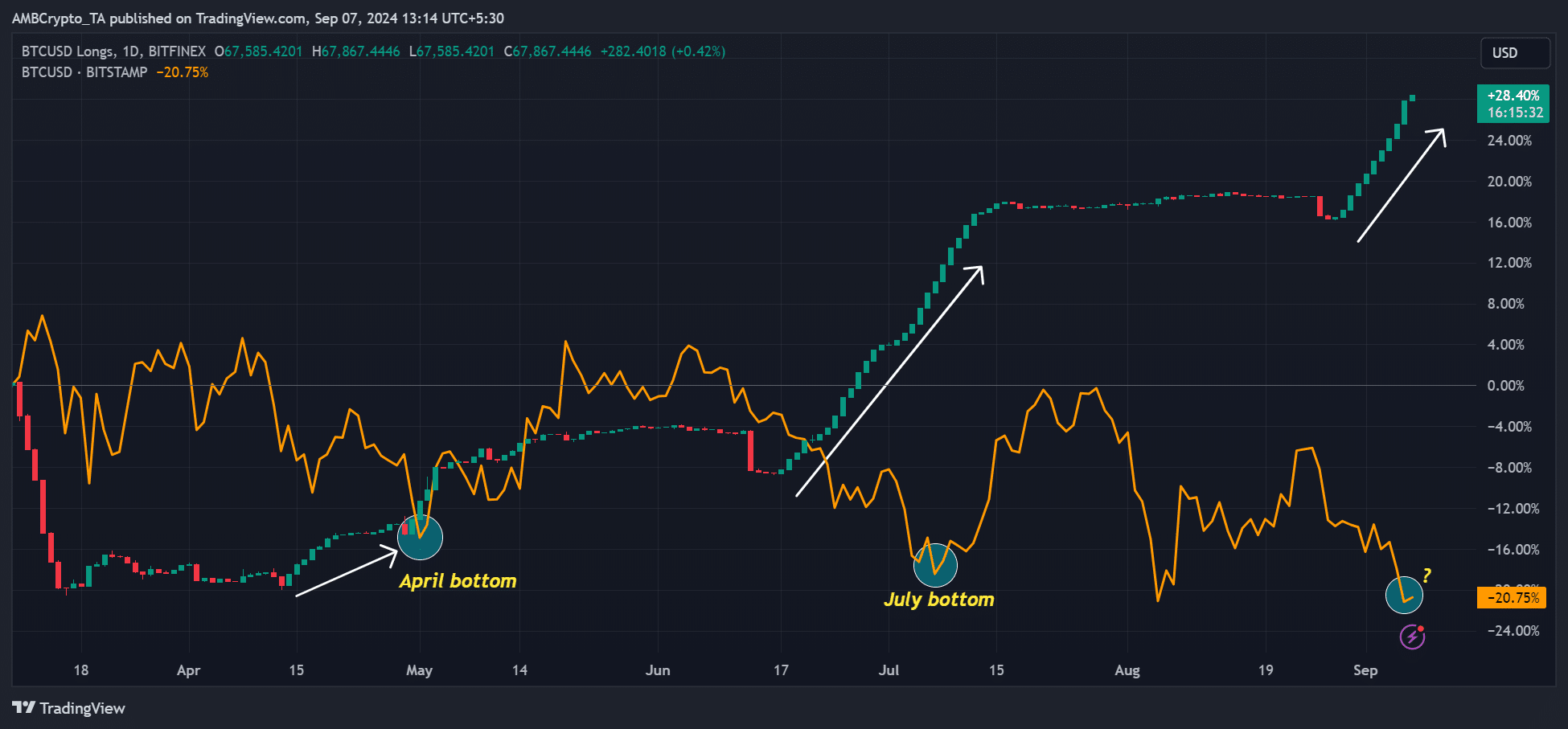

AMBCrypto’s evaluation of Bitfinex’s BTC long positions and price revealed some positive correlations to recent bottoms too.

As per the attached chart, BTC’s bottom in April and July coincided with a sharp rise in long positions on Bitfinex exchange. On average, BTC hit a bottom after 15 days amid rising long positions. Whether September will follow a similar trend remains to be seen.

Here, it’s worth pointing out though that correlations don’t equal causation. And, BTC’s rebound could be triggered by other factors, including macro or crypto-centric updates.

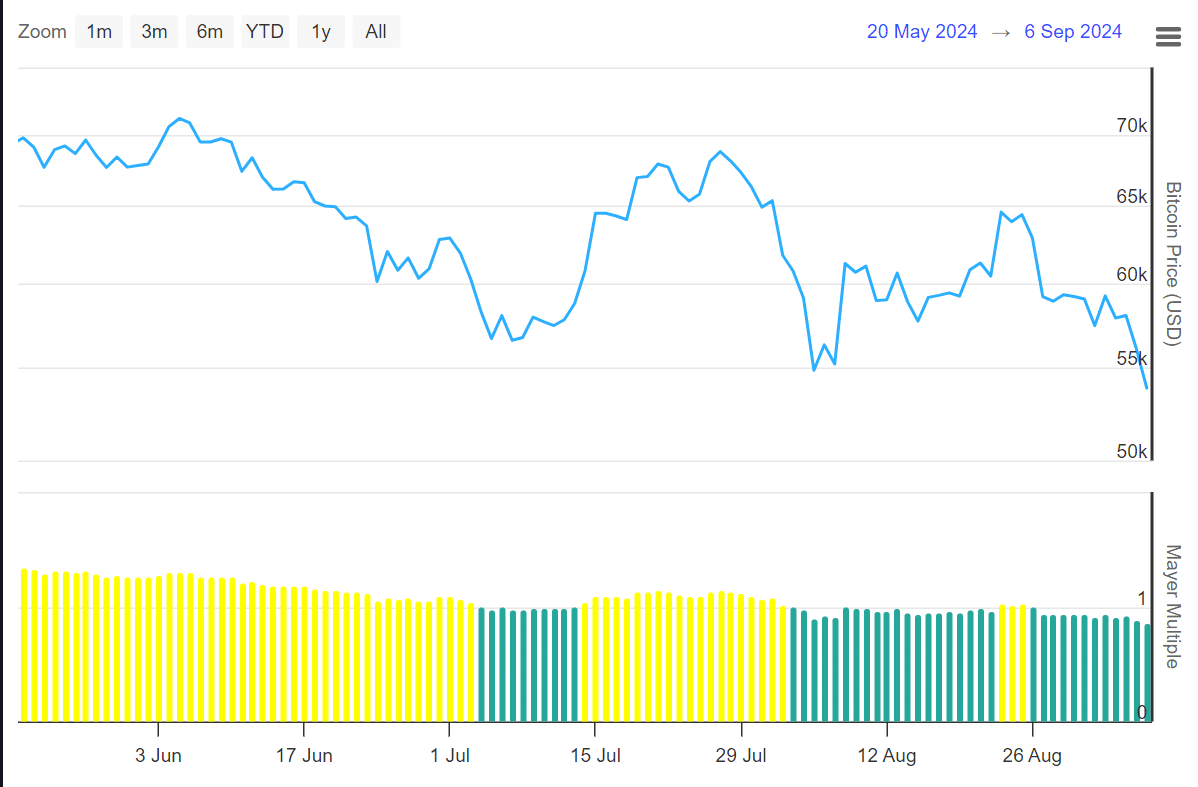

Nevertheless, according to the Mayer Multiple, BTC’s press time price levels may be undervalued. By extension, this would present traders a healthy buying opportunity.

For those unfamiliar, the Mayer Multiple gauges BTC’s price relative to the 200-day Moving Average. In doing so, it also captures its relative valuation.

Historically, a value below 2.4 means undervalued conditions and great buying opportunities. Anything above 2.4 is a warning sign of an overheated market.

Meanwhile, values below 1 (green) coincided with local bottoms in July and early August. The same signal was flashed in late August, similar to when Bitfinex longs were triggered. This suggested that BTC may be massively undervalued at its current prices.

The extreme fear across markets, as illustrated by a reading of 23 on the Crypto Greed and Fear Index, is another buy signal to grab discounted BTC.