Is Bitcoin’s bottom near? These wallets hold the clue

- Bitcoin’s accumulation was strong among custodial wallets.

- The largest crypto exchange, Binance, has added to its reserves, just like in early 2024.

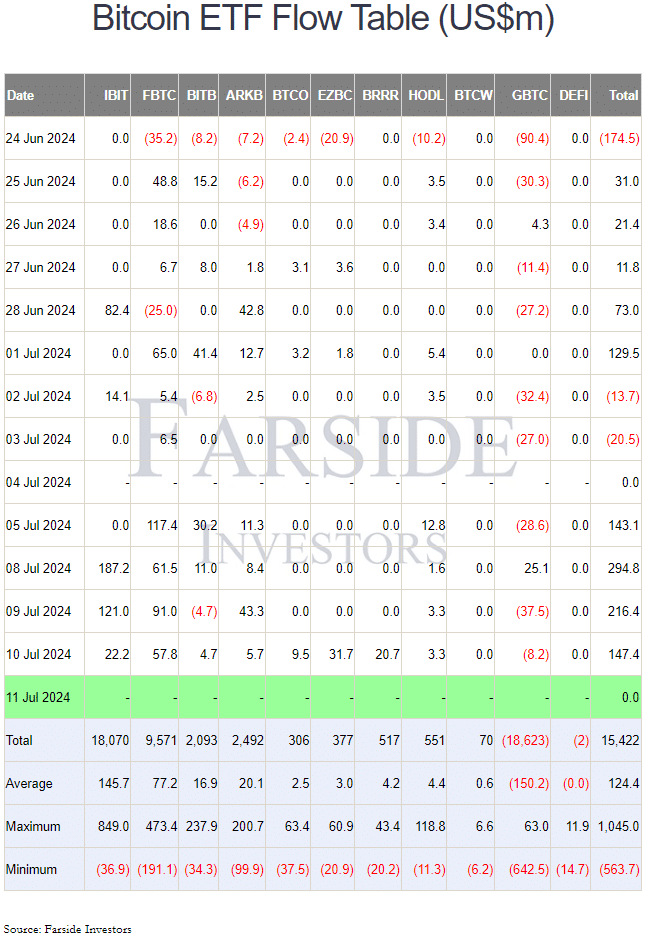

Bitcoin [BTC] showed signs of accumulation despite its price drop below the $60k zone. Its ETF inflows have been positive over the past few days, which was an encouraging sign about its market sentiment.

Source: Farside Investors

There was huge buying pressure behind the king coin, but is it enough to overcome the correction of the past month? Should traders prepare for a quick recovery or hunker down for a consolidation phase?

Bitcoin permanent holders add to their positions

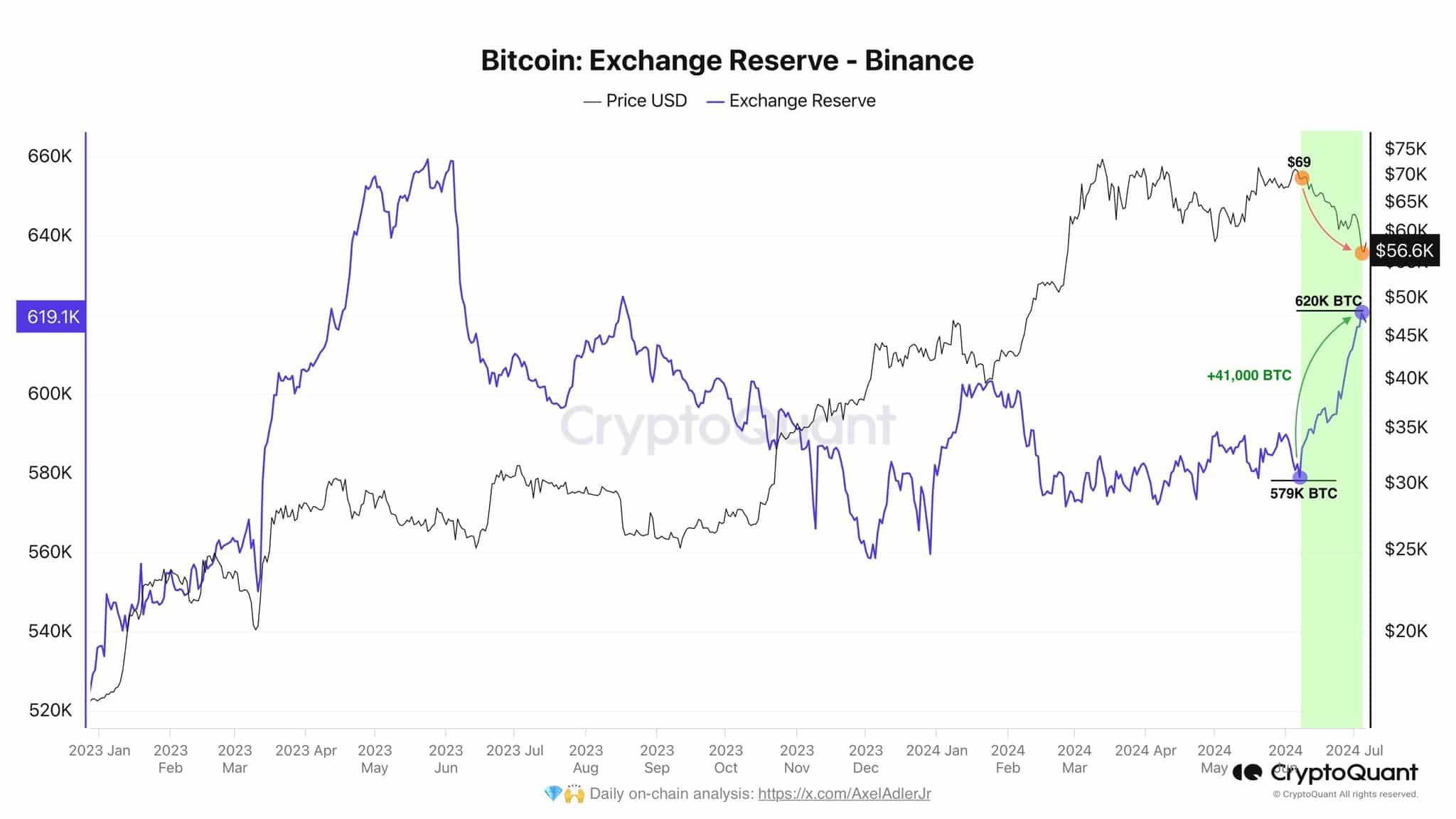

Source: Axel Adler on X

Crypto analyst Axel Adler observed in a post on X (formerly Twitter) that since the Bitcoin correction began just over a month ago, 41k BTC were added to the Binance reserves.

The exchange accumulates BTC for its reserves and liquidity purposes. January 2024’s additions were followed by a strong rally beyond $40k.

It might not be surprising if they, with their experience and expertise, have been buying the dip for a month now. Traders might not want to take this as actionable information, but more as food for thought.

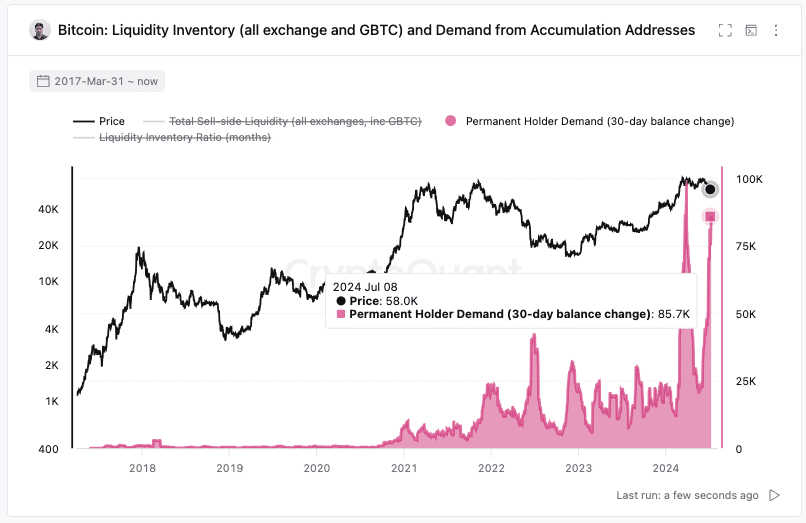

Source: Ki Young Ju on X

Ki Young Ju, the founder and CEO of CryptoQuant noted that custodial wallets with no outflows have been adding during the price dip. They accumulated 85k BTC over the past month, while 16k BTC flowed out of ETF reserves.

This meant that the market-savvy long-term holders were adding to their bags while the more retail-oriented ETFs were responding to their clients’ pressure, revealing a possible divide between smart money and retail sentiment.

Examining whale behavior

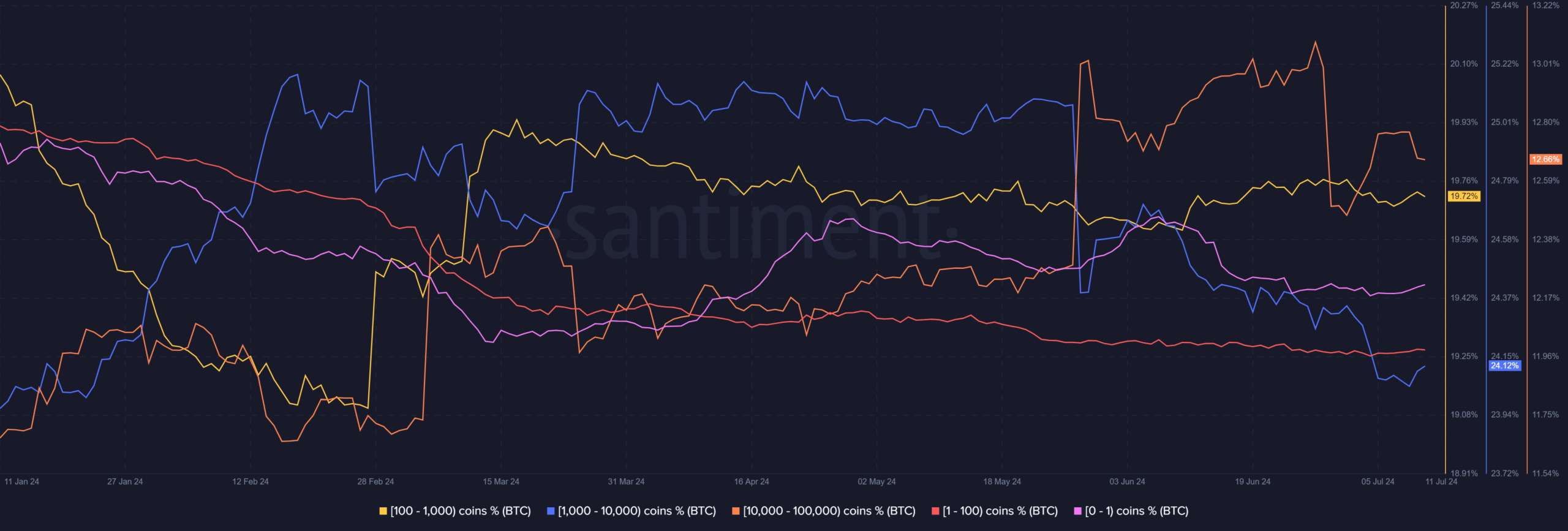

Source: Santiment

The whale cohort with 1k-10k BTC holdings has been selling since mid-May, which was not encouraging. However, the 10k-100k holders had aggressively added in late May but sold a good portion toward the end of June.

Meanwhile, the smaller wallets with 100-1k Bitcoin also accumulated.

Source: Axel Adler on X

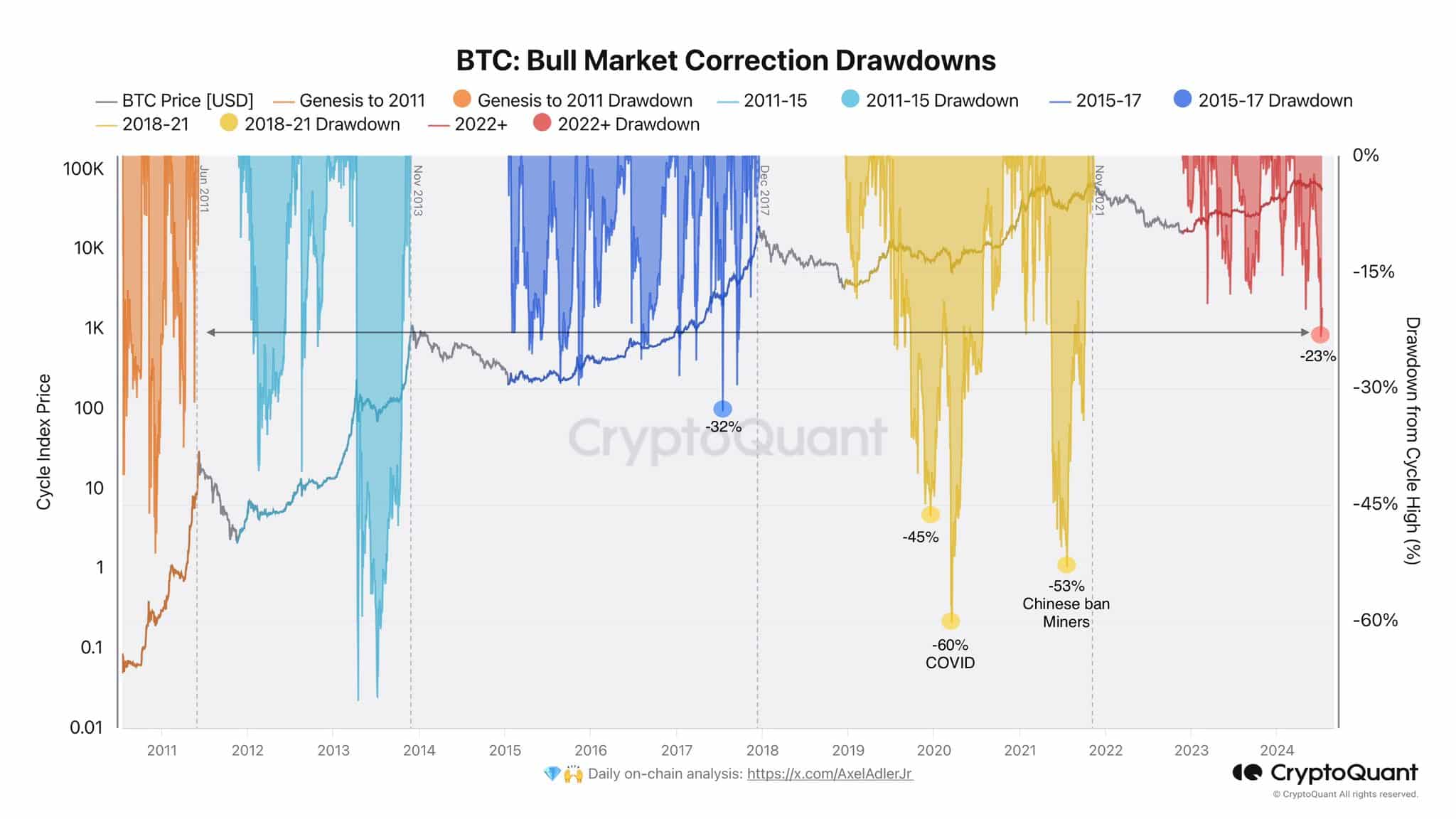

The chart from Axel Adler underlined the need for investors to not lose their heads. The previous cycles saw many sharp price downturns.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The current one might not be at an end, and $52k and $46k are the next levels to watch.

Based on the data at hand, the price bottom might be near, but it’s unclear just how near, and traders would want to be prepared for a scenario where the $52k support might temporarily be lost.