Is Bitcoin’s price action at risk? Here’s why traders should watch out!

Bitcoin: Supply dynamics and market behavior

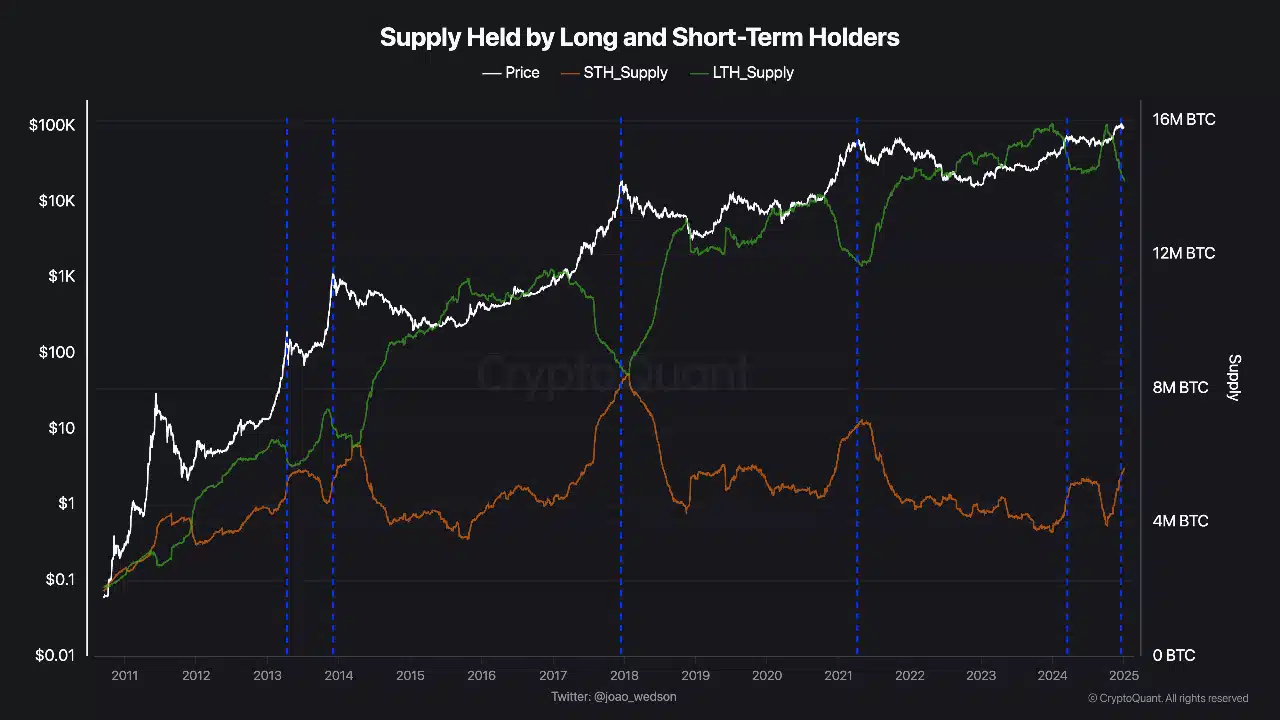

The dynamics between Long-Term and Short-Term Holders play a pivotal role in shaping Bitcoin’s price trends. Spikes in STH supply are often linked to market tops, contributing to heightened volatility.

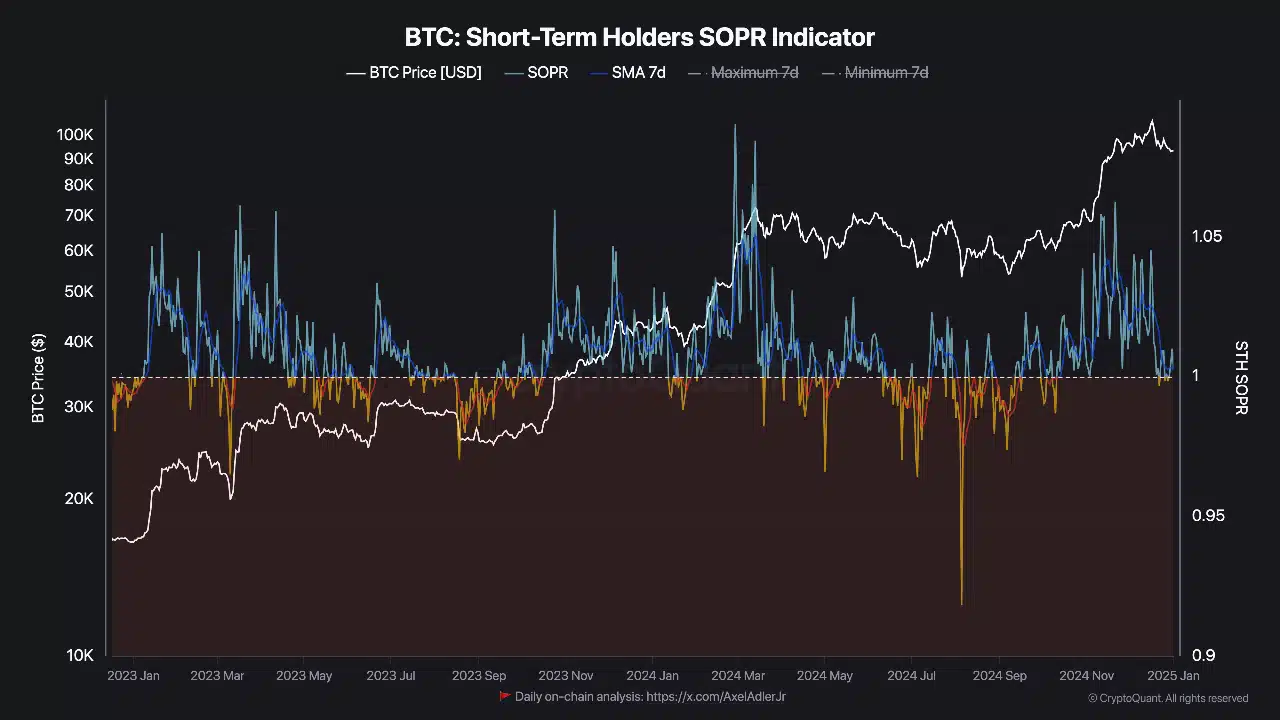

The recent neutral stance of the STH SOPR pointed to selling pressure at breakeven levels – Contributing to investor hesitancy. Resistance around the $85k–$99k range further suggested that consolidation or cautious accumulation may be likely, with potential for greater short-term volatility.

Read Bitcoin’s [BTC] Price Prediction 2025-26

The way forward

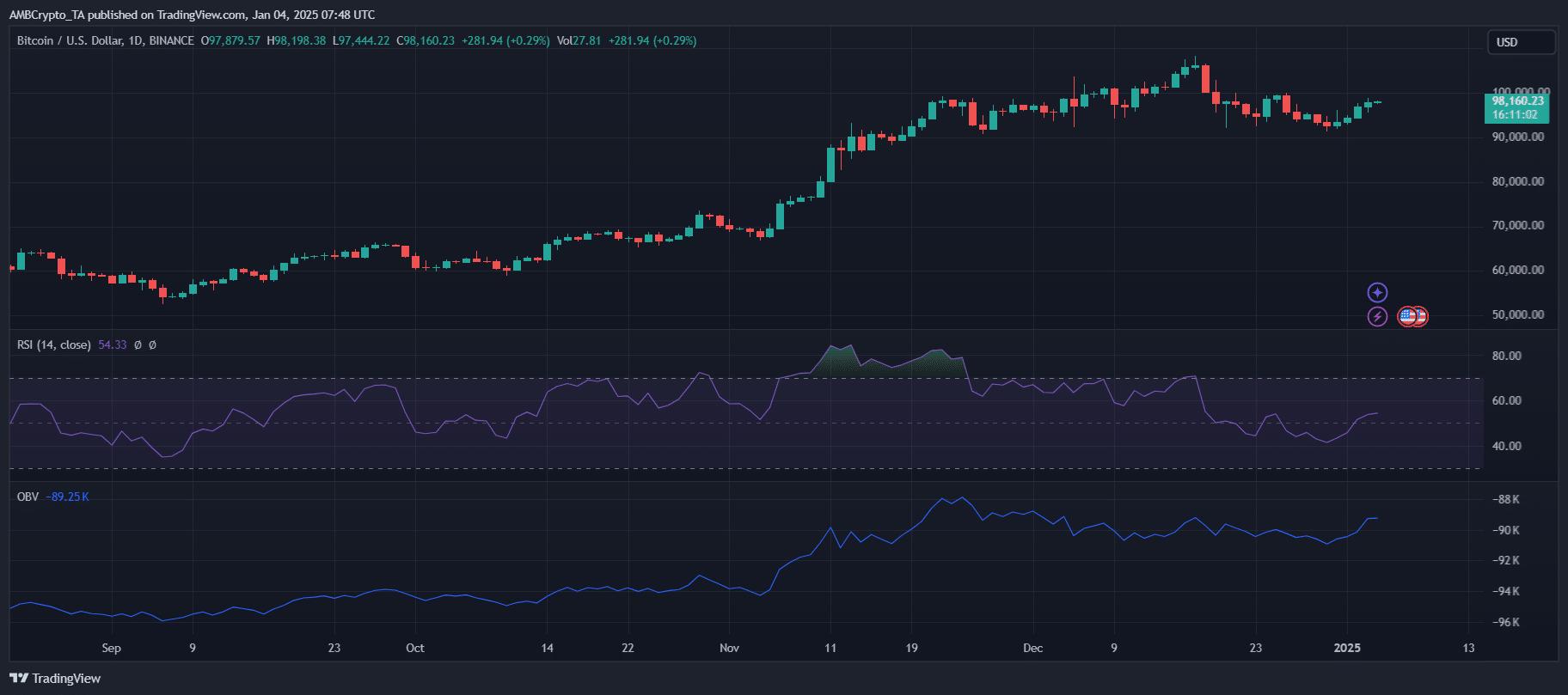

Bitcoin’s STH SOPR trends pointed to a critical juncture for market sentiment. Investors should monitor key support at $85k and resistance at $99k as signals for the next move.

A break below $85k could invite further selling pressure, while reclaiming $99k may trigger renewed bullish momentum. Given the ongoing consolidation phase, cautious accumulation could be viable, but traders should be prepared for potential volatility.