Is Bitcoin’s recent slump over? BTC ‘golden cross’ suggests…

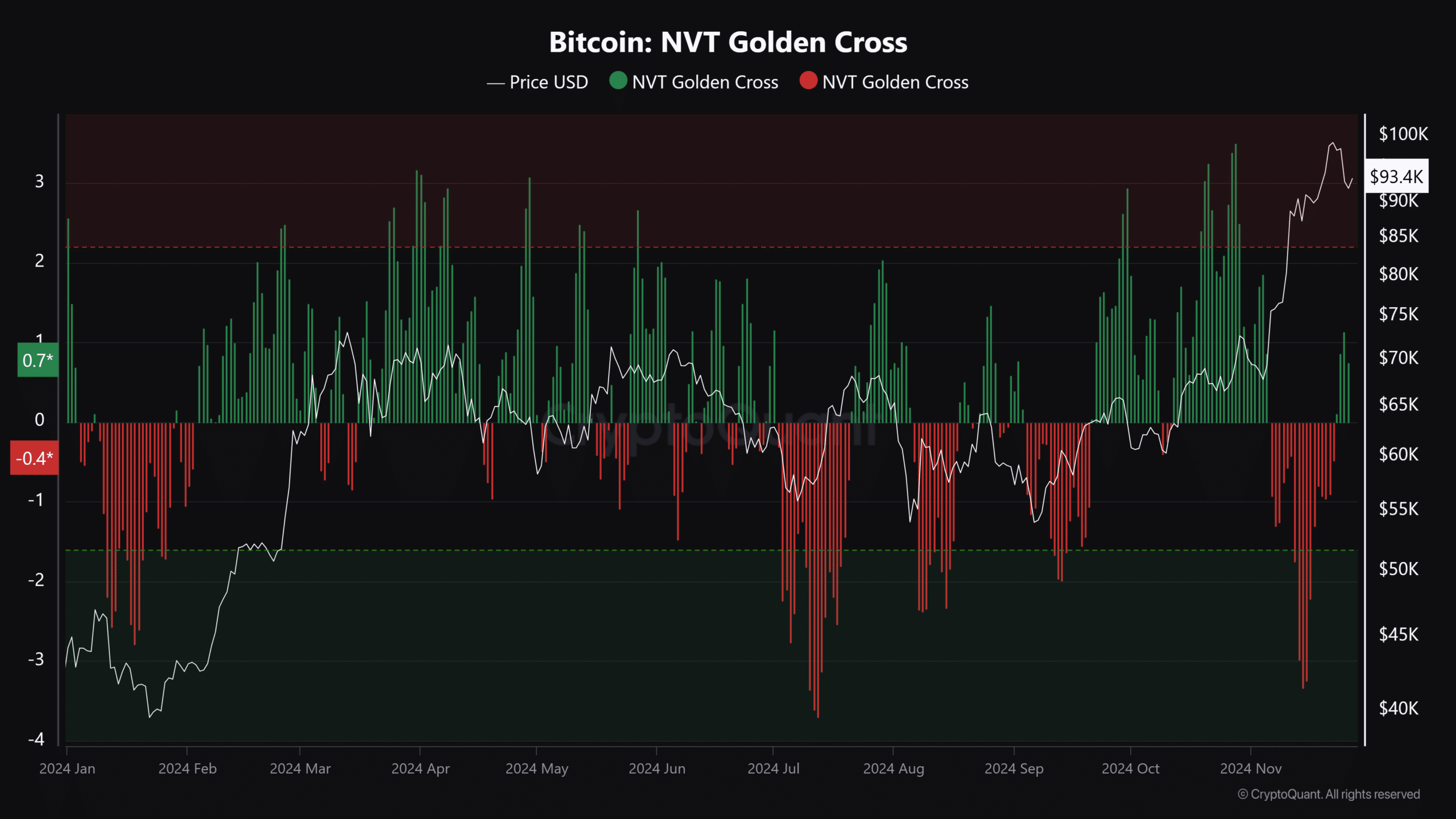

- The latest price decline didn’t reset the local top risk signal, according to Bitcoin’s NVT Golden Cross.

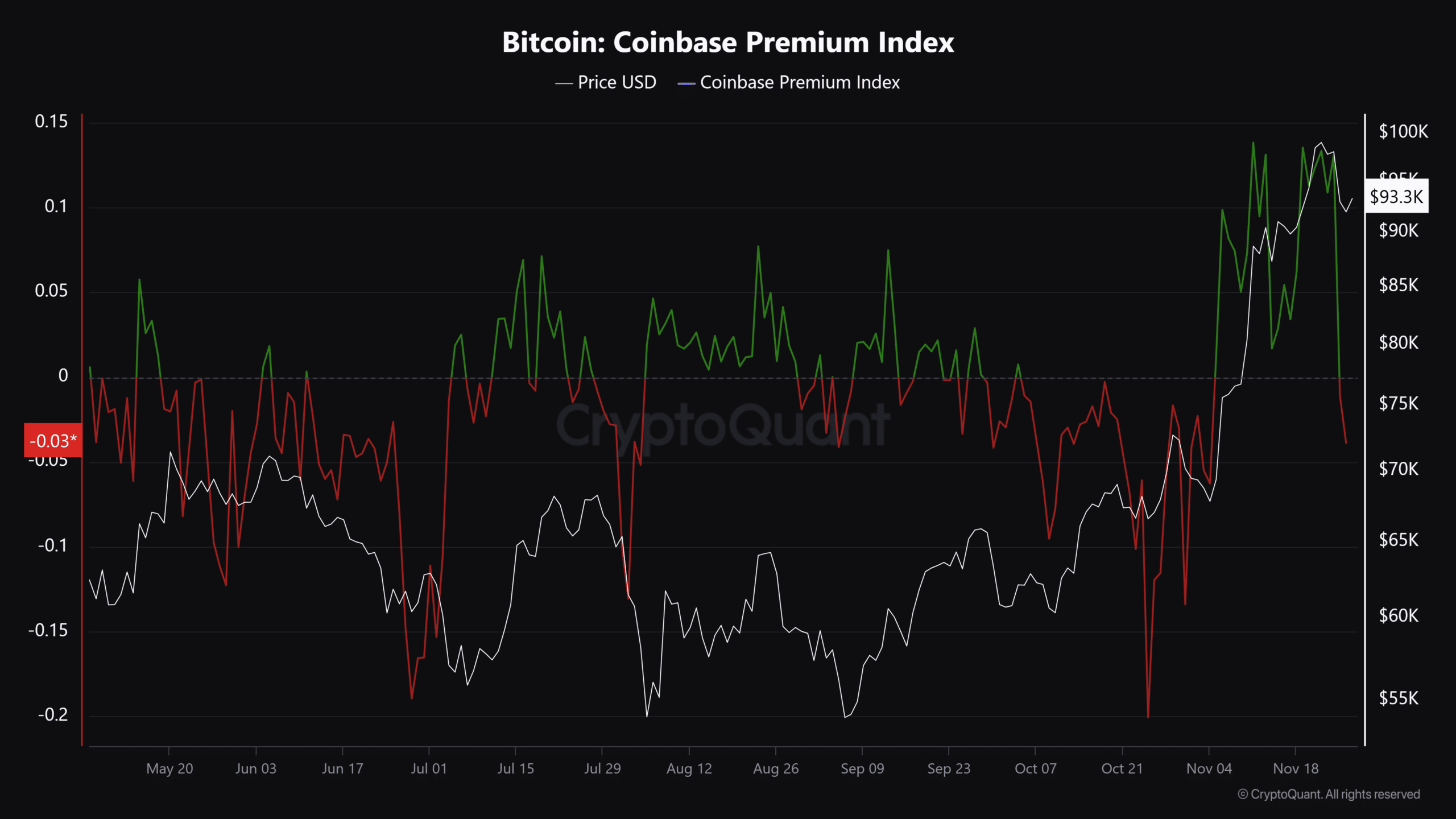

- U.S. investor demand turned negative for the first time since the elections.

Bitcoin’s [BTC] decline from around $100K to $90K wasn’t surprising, as AMBCrypto had earlier pointed out key overheated market signals just before the flash crash.

The recent shakeout was expected to normalize market conditions for a solid recovery. But a key local top/bottom metric signal, Bitcoin NVT Golden Cross, remained sticky and elevated.

Bitcoin’s NVT Golden Cross warning

For context, the indicator is a modified version of the valuation metric Network Value to Transaction (NVT).

It correctly picked previously past local BTC tops and bottoms whenever it turned positive or negative. A reading above 2.2 (overbuying) could suggest a likely top, while a low reading of -1.6 points to a possible local bottom.

CryptoQuant analyst DarkFost flagged it a few days ago when it turned positive, warning of a potential top if it remained elevated. As of press time, the metric was still high but below the risky 2.2 level despite the 9% BTC decline.

If historical trends continue, the BTC NVT Golden Cross reading (1.73, green bars) at press time suggested that BTC could still be due for an extra correction.

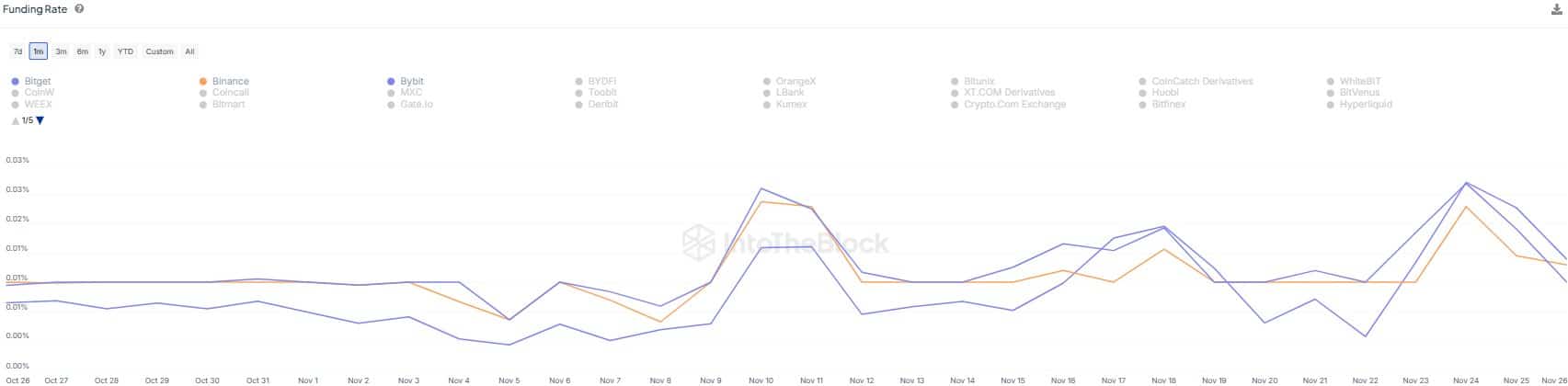

That being said, other overheated market signals, like funding rates, had normalized after the drop to $90K.

According to IntoTheBlock, the shakeout was a leverage flush, which could have run its course after clearing the high-leveraged positions and normalized funding rates.

That said, the BTC weakening stressed U.S. investors as demand turned negative for the first time since the U.S. elections. This was illustrated by the Coinbase Premium Index, which tracks U.S. investor appetite for the king coin.

Read Bitcoin [BTC] Price Prediction 2024-2025

Will the trend change? Most market pundits believed that the bottom was in and that a recovery attempt after the U.S. Thanksgiving holiday was likely.