Is Bitcoin’s recovery here? Key factors that can help BTC rise again

- The STH-SOPR and one other indicator revealed that Bitcoin’s respite is coming.

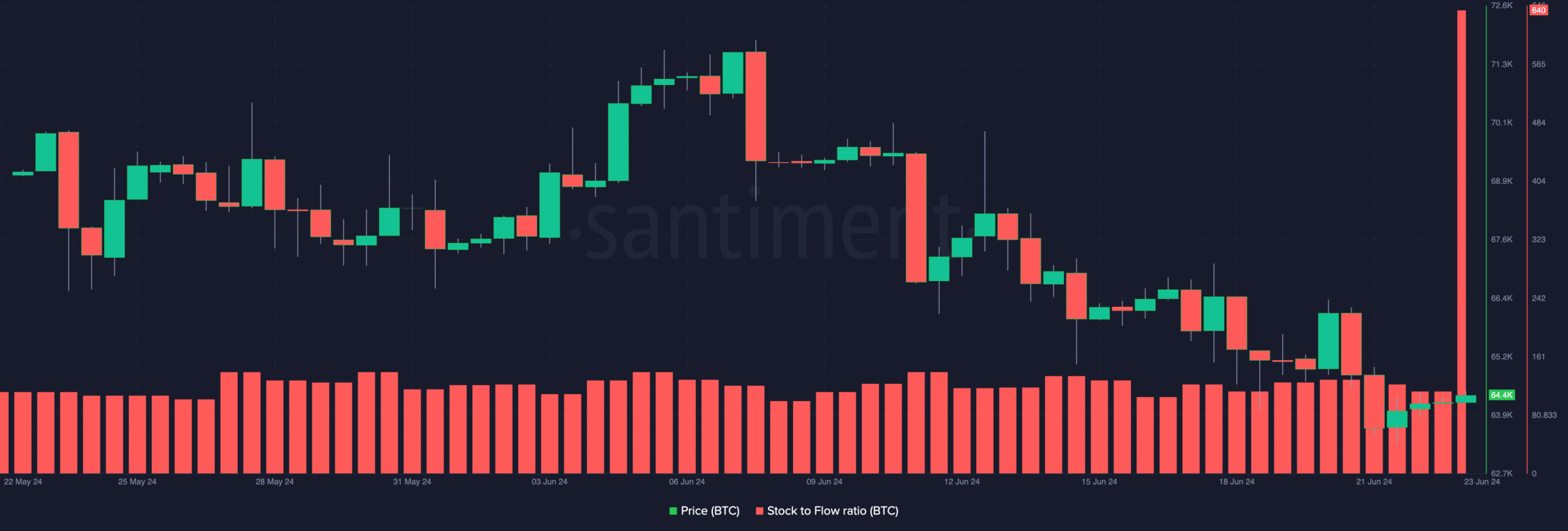

- The spike in the Stock to Flow ratio backed the potential price increase.

History might not repeat itself in the crypto market, but patterns often rhyme. This is why the price of Bitcoin [BTC] could be gearing up for a significant turnaround from its correction.

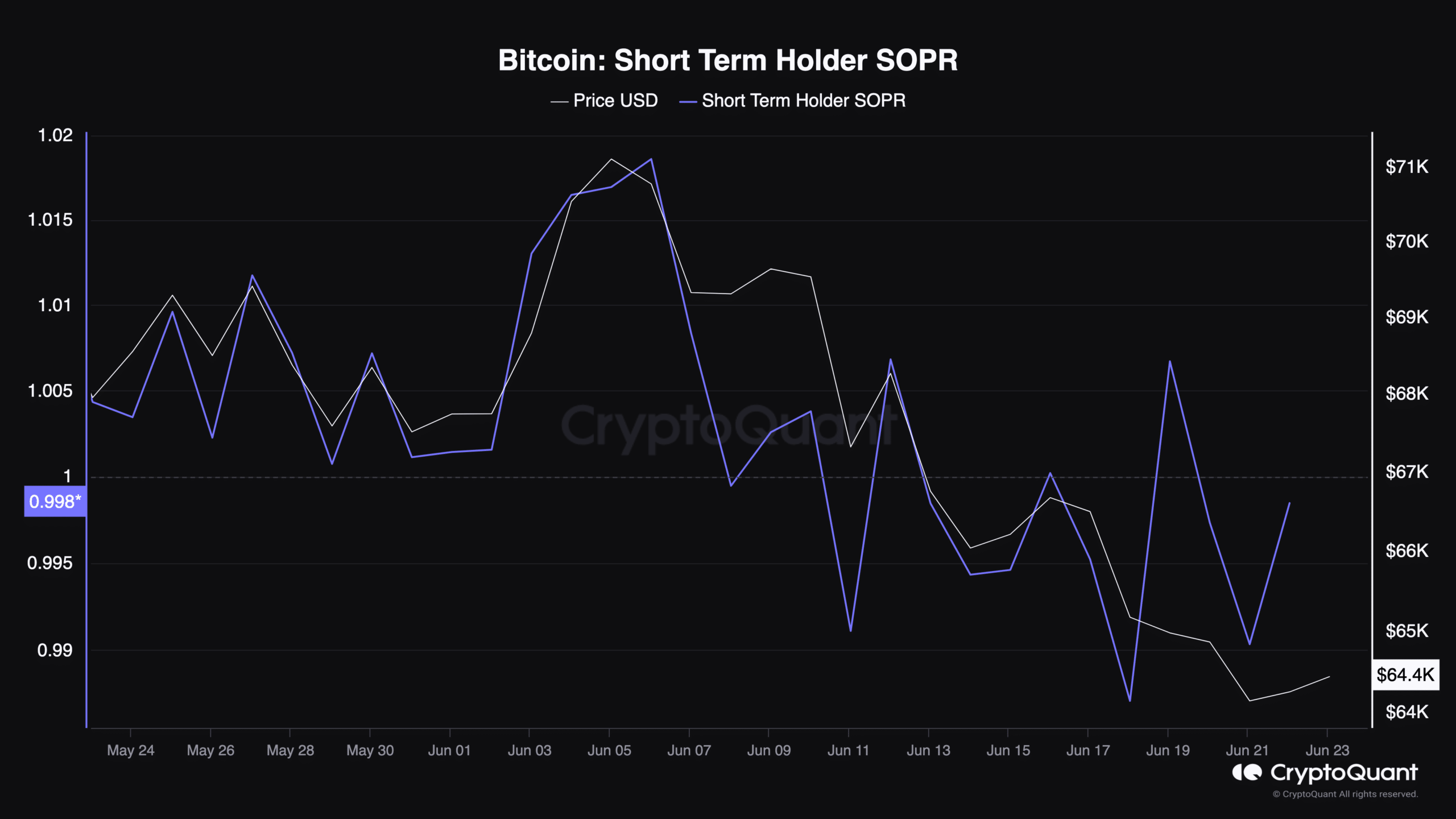

The STH-SOPR is one of the reasons for this prediction. STH stands for Short-Term Holder. SOPR is an acronym for Spent Output Profit Ratio (SOPR).

When combined, the metric shows if Bitcoin holders who bought the coin within a 155-day window are selling at a loss or profit.

Change is closer than you think

If the value is below 1, it indicates the holders are selling at a loss. However, values above 1 suggest that they are selling at a loss.

At press time, AMBCrypto found, via data from CryptoQuant, that the reading was exactly 0.99. This reading makes it a crucial point for BTC, as it could go either ways.

In past times, the reading below 1 marked the end of a downtrend. Therefore, if the STH-SOPR remains below the threshold for some time, Bitcoin’s price could be getting ready to erase some of its recent losses.

However, that does not imply that Bitcoin’s prediction to $61,000 or $60,000 would not come to pass. But it means that the value of the coin might not slip as low $54,000 before a reversal to the upside begins.

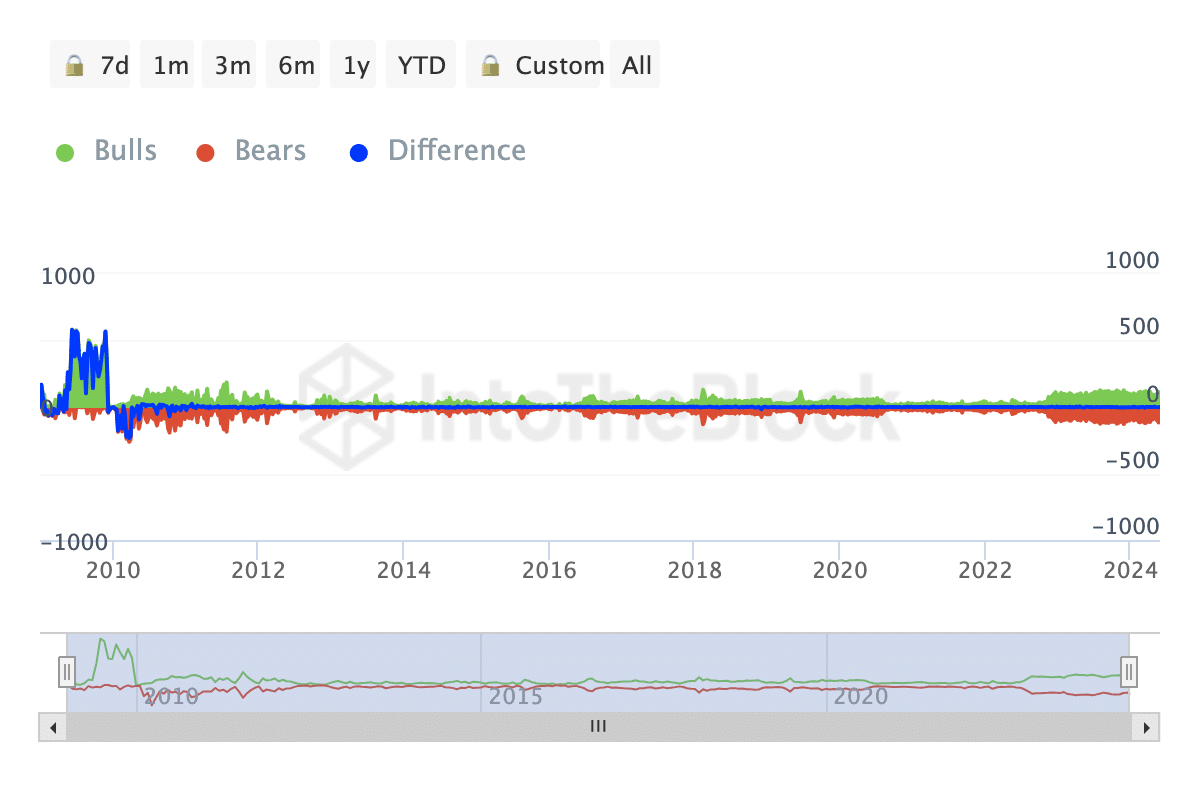

Another indicator fueling the forecast is the Bulls And Bears provided by IntoTheBlock.

This metric compares the addresses that bought more than 1% of the 24-hour trading volume, and those that sold more than 1% within the same period.

Bulls set for low inflation

If the addresses that bought outweighed the addresses that sold, then it is a bullish sign. However, if the addresses that sold are more, it is a bearish outlook.

As of this writing, the Bulls And Bears indicator was +2 in favor of bulls. While this might not have an immediate effect on BTC, sustaining the position over the coming days to weeks could help Bitcoin correction end.

Should this be the case, Bitcoin’s price can begin a move that takes it back to $66,000. Last on the list of metrics supporting a price increase in the Stock to Flow ratio which spiked to 640 on the 23rd of June.

The Stock to Flow ratio measures an asset’s vulnerability to inflation and its scarcity. If the reading is low, it means that there is high inflation rate. As such, it could be difficult for the price to increase in the mid to long-term.

Read Bitcoin’s [BTC] Price Prediction 2024-2024

However, the high reading suggest that Bitcoin has a low inflation rate. Also, it means the value might retain a high level of price increase as time goes one.

Considering the state of the data mentioned, BTC might recover within a short period. However, the prediction could be invalidated if large investors in BTC continue to sell some of their holdings.