Is BNB chain’s dominance about to decline? New data suggests…

- BNB chain’s affairs could slow down due to declining dApp activity.

- The altcoin’s DeFi state remains strong as TVL grows.

BNB, one of the largest cryptocurrencies in terms of market cap, recently posted data showcasing high activity on its network.

According to the tweet, the number of weekly active users on the network stood at 2.78 million. Interestingly, the number of average daily transactions on the BNB network reached a high of 2.87 million over the last week.

Read BNB’s Price Prediction 2023-2024

The low fees taken from users for transactions were cited as one of the reasons behind the high activity.

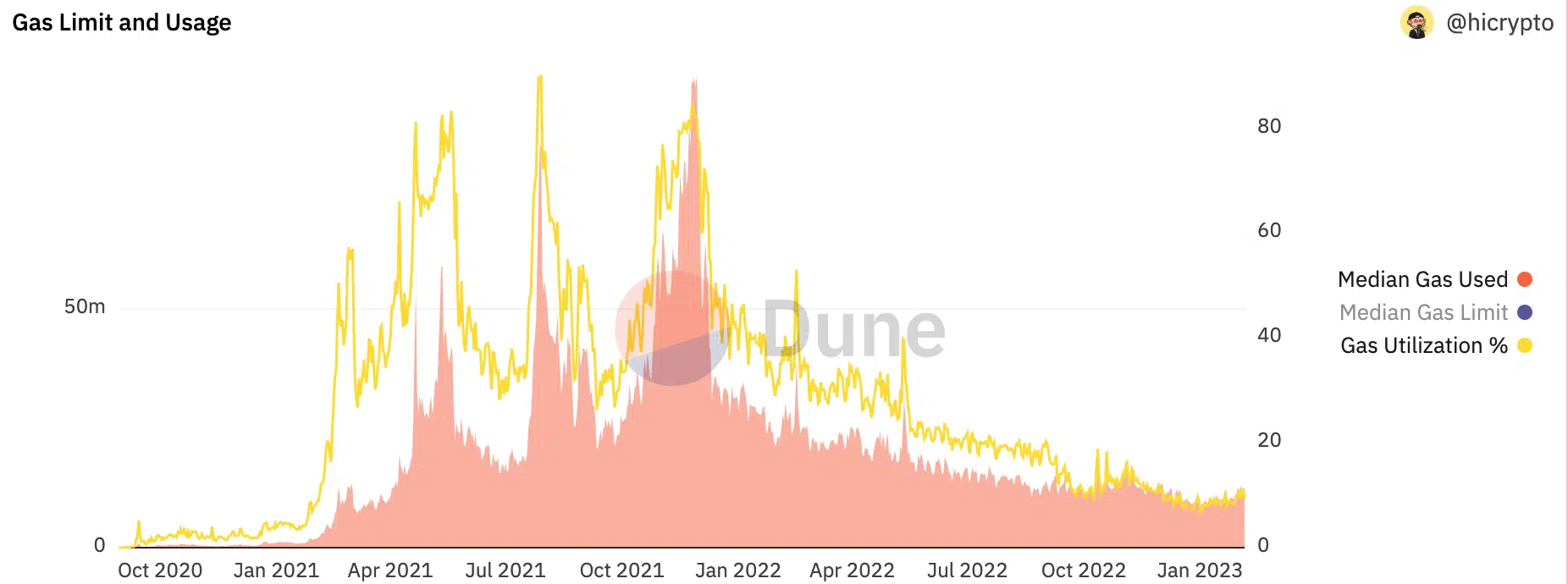

However, there have been recent developments that could undermine BNB’s dominance in terms of activity. According to Dune Analytics, BNB’s gas usage declined.

BNB’s dApps and DeFi

One of the reasons for this decline in gas usage could be the decrease in dApp activity on BNB.

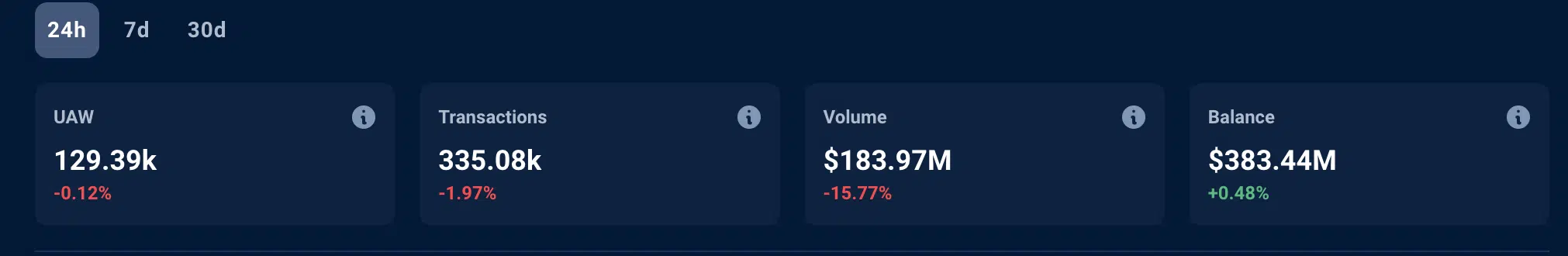

Data from Dapp Radar showed that the number of unique active wallets on BNB declined significantly in the past month.

dApps such as PancakeSwap, ApeSwap, and MOBOX witnessed a fall of 6.45%, 3.72%, and 9.75%, respectively. In fact, PancakeSwap, one of the largest DeFi protocols on the BNB chain saw a decline in terms of volume and number of transactions.

Despite this decline in dApp activity, the overall health of BNB’s DeFi state remained strong. The TVL for BNB increased from $4.2 billion to $5.08 billion, according to data from DefiLlama, implying a growth of around 20.95%.

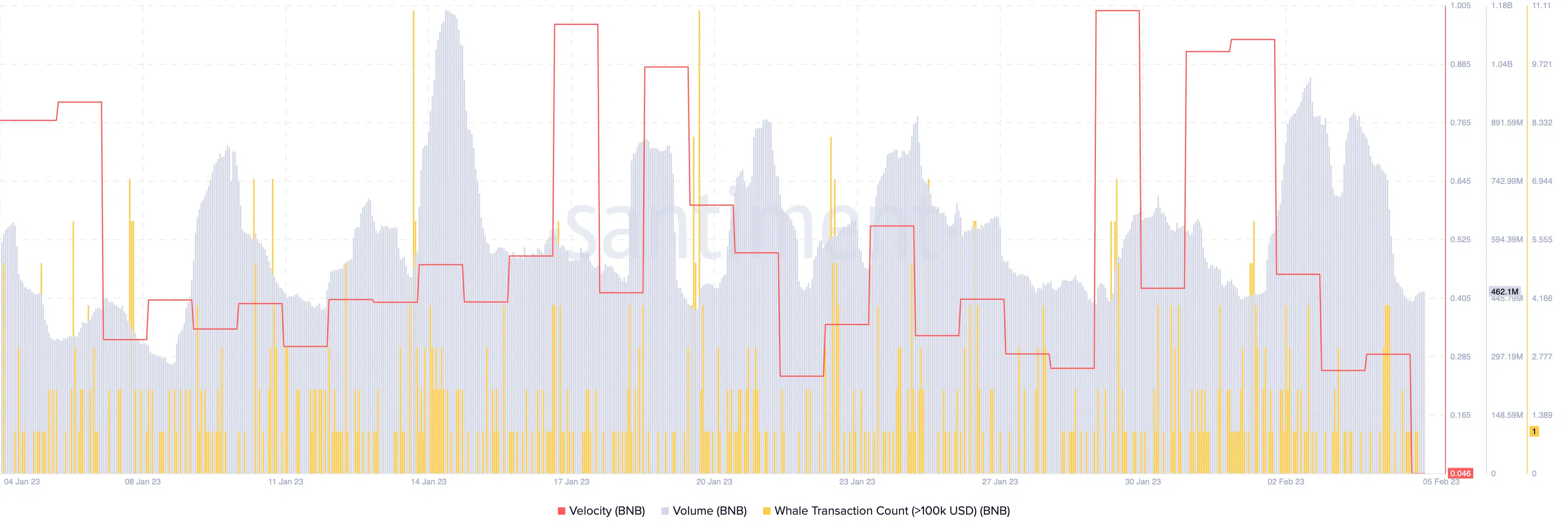

Although BNB showed growth in the DeFi department, this did not translate into success on the price chart. The overall trading activity for BNB decreased, with volume declining from 912 million to 412 million, according to data from Santiment.

Is your portfolio green? Check out the BNB Profit Calculator

Another indicator of the decline in activity for BNB was its decreasing velocity, which fell by a significant margin.

One of the reasons for the decline in activity could be the falling number of whale transactions. Whales, or large crypto holders, play a significant role in driving market activity.

In conclusion, BNB’s DeFi state remained strong, with an increase in TVL. However, the declining gas usage, dApp activity, and trading volume suggest that activity on the BNB network may start to decline.

Well, it will be interesting to see how BNB responds to these developments in the coming months.