Is BNB the breakout altcoin of Q2? Why Bitcoin investors think so!

- BNB has shown strong resilience among high-cap altcoins, supported by rising on-chain demand.

- Could its expanding user base signal a shift in capital rotation toward BNB?

Binance Smart Chain’s [BSC] Q1 performance highlights increased on-chain demand as evidenced by a surge in transaction fees and network activity.

In fact, the chain recorded a 70% QoQ revenue growth, driven by heightened user engagement and DeFi expansion.

Meanwhile, its total value locked (TVL) reclaimed its early February peak of $6.82 billion, signaling renewed liquidity inflows.

Concurrently, Binance Coin [BNB] has remained one of the most resilient high-cap altcoins, bouncing nearly 6% from its $524 dip to around $558.42 at press time.

This uptick in TVL, coupled with increasing decentralized exchange (DEX) volume, points to potential capital rotation into BNB.

If this trend sustains, could BNB solidify its position as a key altcoin to watch in the coming months?

BSC’s on-chain engagement

According to the chart below, applications on BSC raked in approximately $170.2 million in fees during Q1 2025. Network fees serve as a key on-chain metric, often correlating with user adoption.

Notably, this stands in sharp contrast to Ethereum [ETH], where network fees have plunged to a five-year low, signaling a slowdown in transactional activity and capital deployment.

Price action further highlights this divergence. ETH closed Q1 with a 46% drawdown, whereas BNB demonstrated resilience, ending just 14% below its quarterly open of $702.

Despite this relative strength, both assets remain below pre-election levels, wiping out all post-election gains.

The question now is whether BSC’s sustained outperformance in key network metrics can fuel another wave of BNB dominance in Q2.

BNB’s Q2 outlook

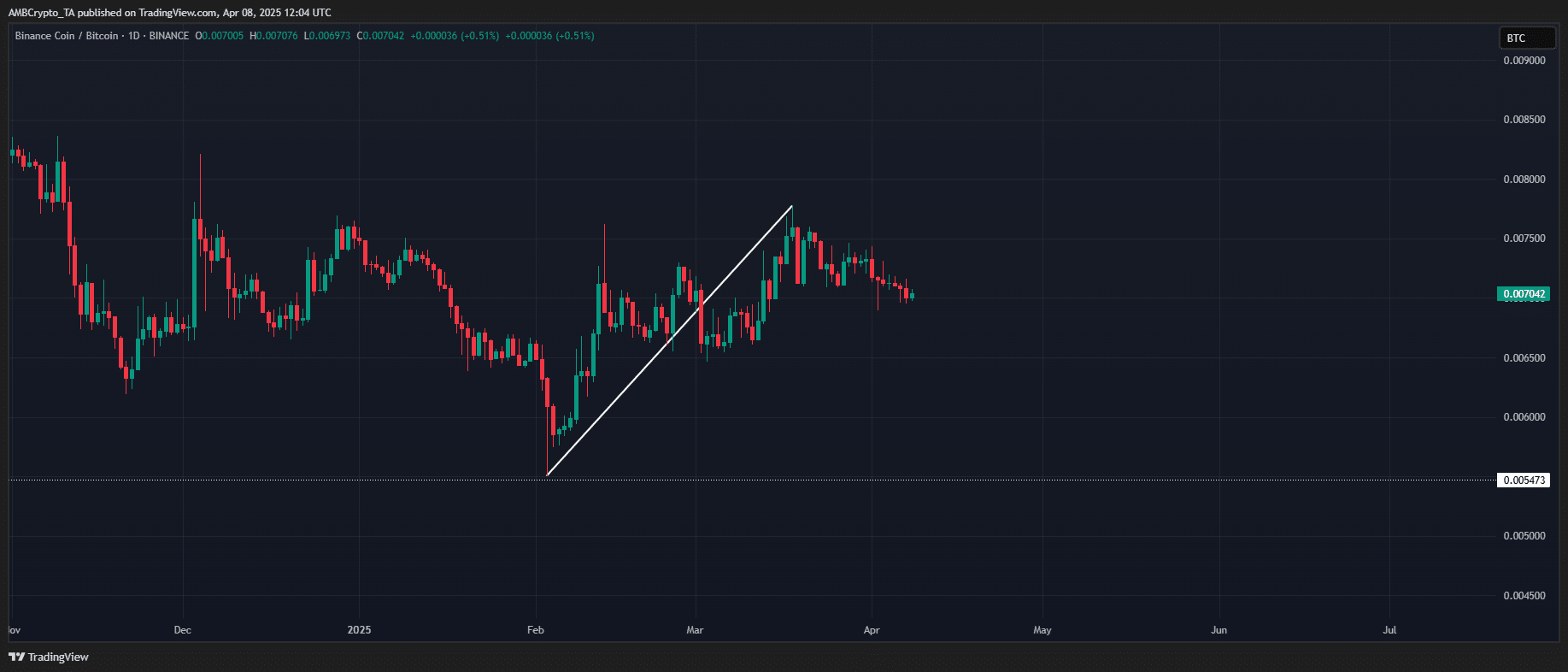

Capital rotation remains evident in the BNB/BTC pair, which has been on an upward trajectory since February.

Notably, in mid-March, Binance coin broke out against Bitcoin [BTC], reclaiming its early December highs – signaling sustained investor confidence.

In fact, this shift aligned with Bitcoin’s sharp correction over the same period. As BTC plunged from $100k to $78k, liquidity rotated into BNB, acting as a buffer against deeper losses.

The result? BTC posted an 11% drawdown, while BNB defied broader selling pressure with a 10% gain.

This sustained capital rotation underscores BNB’s resilience, especially as Ethereum and Solana posted multi-year lows against Bitcoin during Q1.

Unlike its rivals, BSC’s rising network fees and expanding DeFi ecosystem have bolstered BNB’s appeal during Bitcoin’s high-FUD periods.

With the RSI flashing a bullish divergence after being deeply oversold, the BNB/BTC pair could soon shift into the green. If this momentum holds, Binance coin might emerge as one of Q2’s standout performers.