Is BONK ready to rally? Memecoin’s metrics, indicators suggest…

- BONK’s price appreciated on the charts, fueled by a 34.44% hike in trading volume

- Following its listing on Gemini, BONK saw a surge in trading interest and adoption

Popular memecoin BONK (BONK) is causing a stir among market participants. With a press time price of $0.00001812, the altcoin’s value hiked by 1.59% during the last 24 hours. BONK’s trading volume skyrocketed over the same period though – By 34.44%.

Owing to the strong investor interest and growing trading activity, BONK had a market cap of just over $1.35 billion.

BONK to gain momentum after Gemini exchange listing?

Trading interest spiked following BONK’s recent listing on the Gemini exchange. As a result, there has been more adoption too. The exchange now supports BONK deposits and withdrawals, including asset movement, and provides investors with immediate transfers.

However, BONK is just the latest in a lineup of popular memecoins Gemini has embraced among its crypto offerings. In fact, Gemini already has DOGE, PEPE, SHIB, and WIF offerings on the exchange.

Worth noting, however, that this is an important listing to have. Especially since BONK can now reach a much wider userbase, a userbase that will allow the memecoin to expand its market share rapidly.

Symmetrical triangle pattern points to rally

According to crypto analyst @cryptojack, the BONK/USDT pair flashed a symmetrical triangle pattern on the charts. Such a pattern is formed when a trend continues in a new direction, which could mean a potential bullish breakout when trading volume kicks in. However, this pattern has been forming for some months now. As it approaches an obvious breakout point, there could be higher levels of volatility soon.

A breakout could push BONK towards new all-time highs if volume increases, alongside the breakout. Symmetrical triangles are typically seen as indicators of trend continuation, meaning BONK may extend its upward momentum. This technical setup has drawn significant attention, with traders closely watching for signs of higher volume that could confirm the trend.

If BONK can break out backed by high volumes, it could result in new highs if it attracts a lot of investor confidence.

However, this breakout could open the door for short-term traders and long-term investors to enter the uptrend. BONK’s price action recently created room for new all-time highs. This will likely see BONK aligning with market optimism.

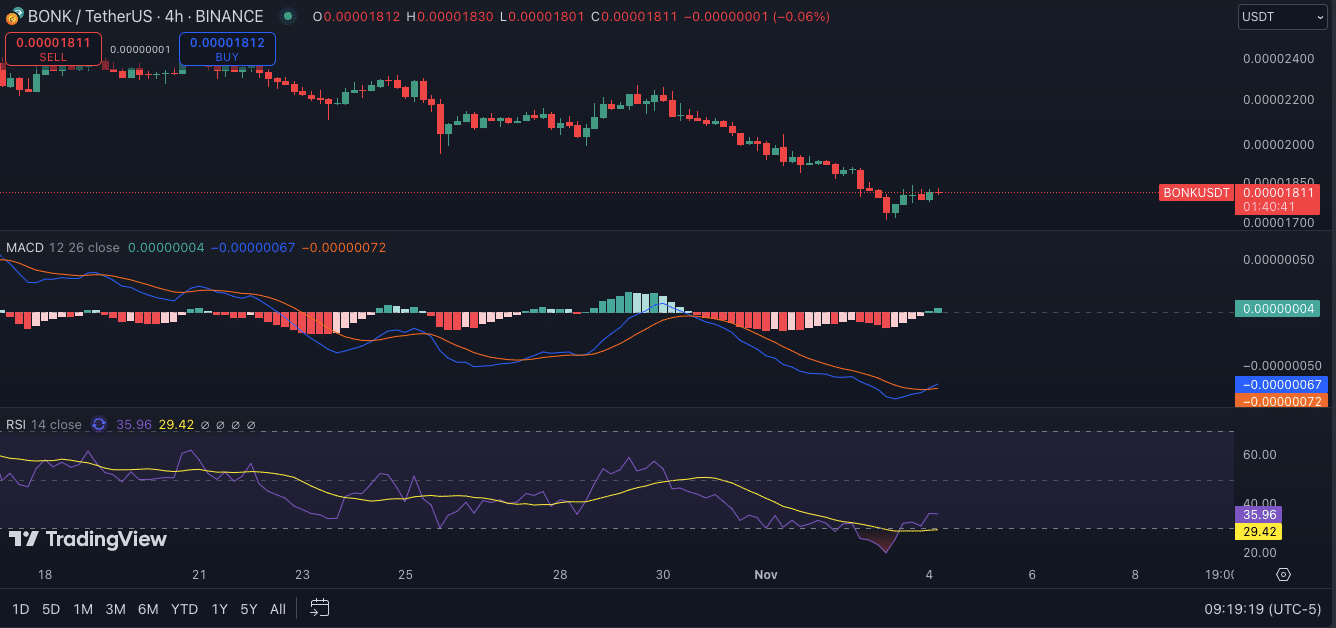

MACD and RSI in favour of BONK’s upswing

On the 4-hour chart, the Moving Average Convergence Divergence (MACD) indicator suggested a possible shift in momentum, with a potential bullish crossover. This pattern, combined with the histogram bars shifting from red to light red, signaled a fall in bearish momentum.

If this trend continues, this MACD’s movement could indicate an early-stage reversal, attracting traders interested in a potential upward move.

Meanwhile, the Relative Strength Index (RSI) for BONK seemed to be approaching oversold levels at 38.51 – A sign of diminishing selling pressure. As the RSI trends upwards, traders may anticipate a bounce if it breaks above 50, further supporting a bullish sentiment if accompanied by volume.

A potential RSI rebound, alongside a bullish MACD, would add to the technical indicators supporting a price recovery. Higher volumes and sustained buying pressure likely validate this shift, enhancing confidence among both buyers and traders. This combination of indicators can lead to rising interest as BONK approaches critical technical levels.

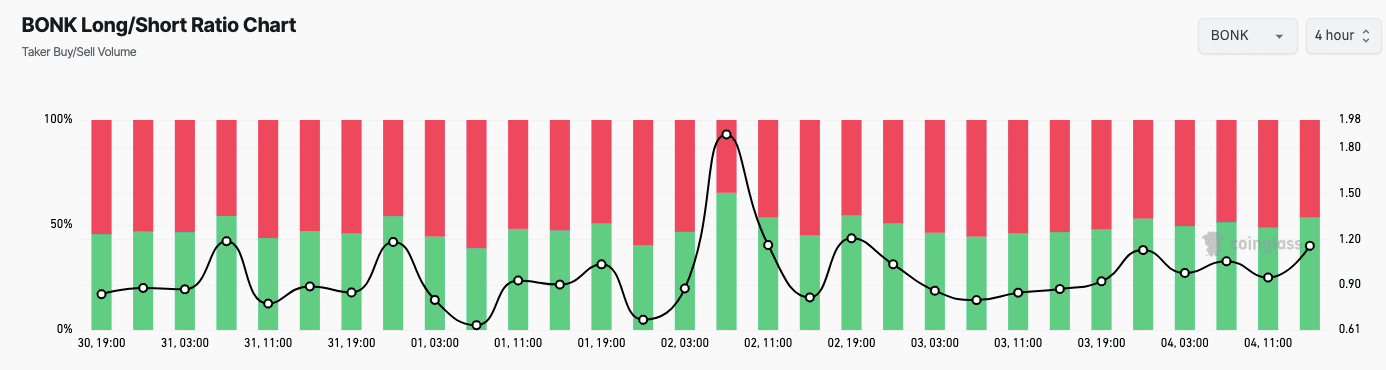

BONK’s Long/Short ratio

According to Coinglass, a look at BONK’s Long/Short Ratio revealed a balance between bullish and bearish sentiment among traders. The chart, which uses green bars to represent buy volume and red bars for sell volume, projected recent hikes in buy volume.

At press time, the Long/Short ratio hovered above 1.0, indicating growing optimism for a potential price hike in the short term.

Fluctuations in the ratio suggest that traders remain divided, but recent spikes in buy volume are a sign of higher bullish sentiment. This pattern is in tune with the broader market’s optimistic outlook for BONK, with the the Long/Short ratio signaling a potential shift towards buying pressure. With the ratio favoring buy volume, some analysts predict that BONK’s price could soon see greater volatility.

If buy volume remains strong, this trend could solidify BONK’s upward trajectory, potentially encouraging more traders to enter long positions. This boom in trading interest could drive BONK’s price higher in the coming days, further solidifying its position in the memecoin market