Is Cardano at risk? Addressing the impact of profit-taking in ADA’s market

- Cardano’s price is hovering near $1, with long-term holders providing crucial support against selling pressure

- Profit-taking and declining network activity have limited ADA’s recovery

In recent weeks, Cardano [ADA] has faced significant price volatility, struggling to reclaim a solid footing above the crucial $1-level. The broader market sentiment has leaned neutral to bearish, limiting any significant upward momentum. However, amid this turbulence, long-term holders have remained steadfast, providing much-needed support and preventing any major downturns in price.

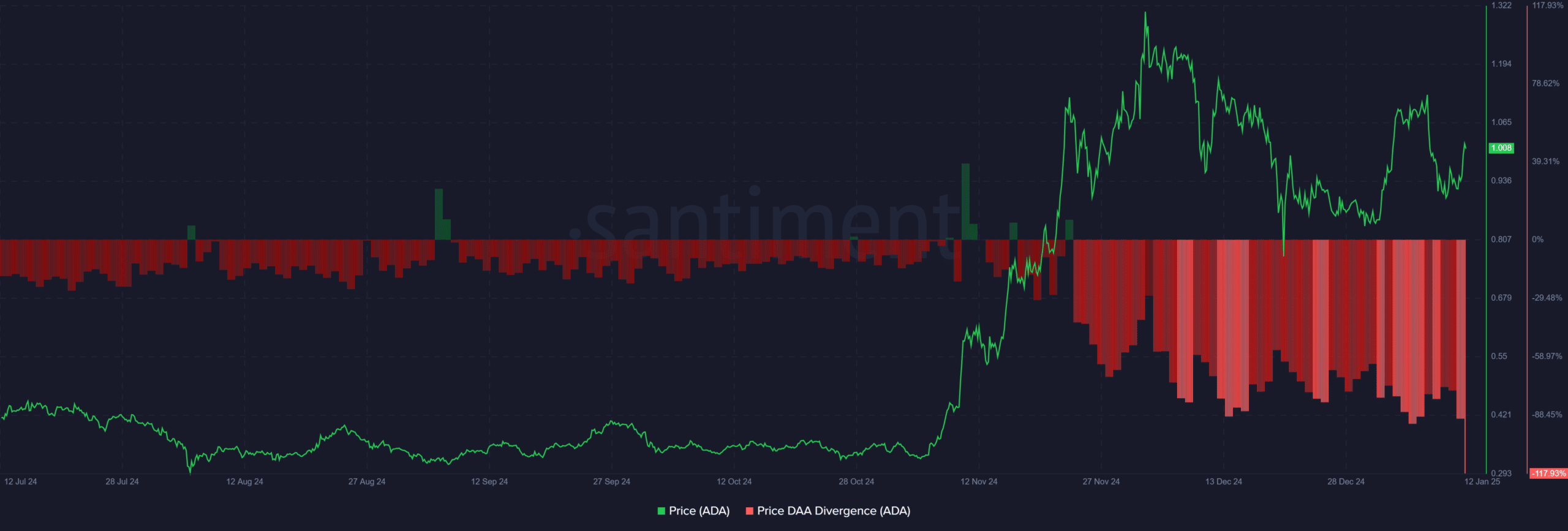

ADA’s price-DAA divergence highlights investor caution

Cardano’s Price DAA Divergence indicator has flashed persistent sell signals in recent weeks, signaling a disconnect between price action and network activity. The negative divergence indicated that while ADA’s price has struggled to sustain momentum above $1, daily active addresses have not matched the level of enthusiasm required to support a bullish breakout.

This declining participation from investors reflects growing caution in the market, exacerbated by the broader bearish sentiment. Without a hike in network engagement or a decisive shift in market dynamics, ADA’s recovery prospects may remain limited, keeping buyers on the sidelines.

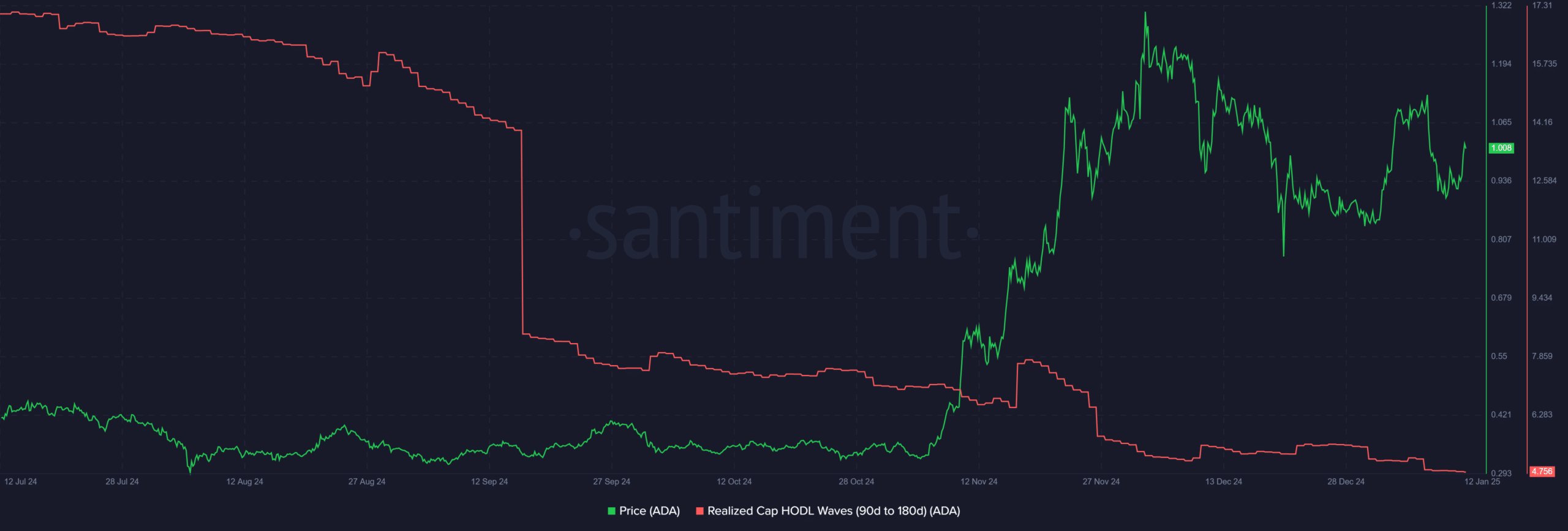

Realized capital HODL waves reflect shifting market dynamics

The Realized Capital HODL Waves for Cardano revealed a sharp decline, indicating that mid-term holders have been exiting their positions during recent price surges.

This drop alluded to profit-taking behavior as ADA approached its critical resistance levels near $1 – Further highlighting the market’s cautious sentiment.

Meanwhile, long-term holders have remained relatively stable, underscoring their commitment despite short-term volatility. This divergence between mid-term and long-term holder behavior is a sign of ongoing uncertainty, with a clear preference for de-risking among some investors.

Without renewed confidence or stronger market catalysts, ADA‘s momentum could face additional hurdles.

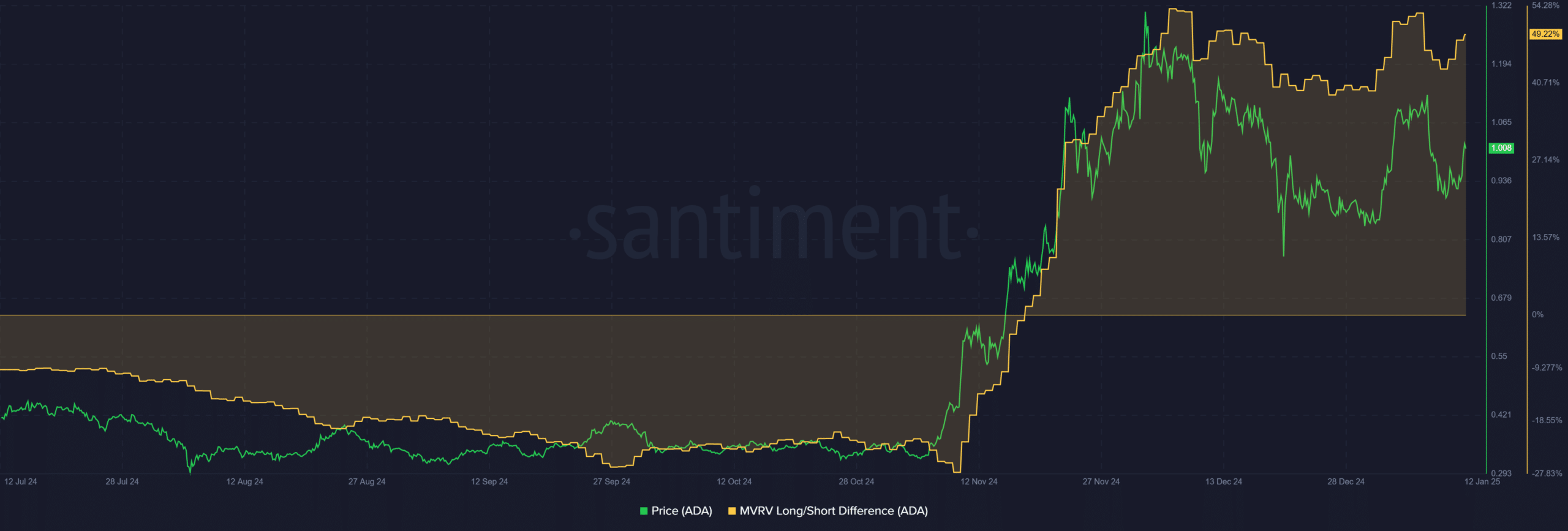

Tension between short-term profit-takers and long-term holders

Additionally, the MVRV Long/Short Difference revealed a critical shift in profitability dynamics. As ADA’s price surged past $1, the MVRV gap expanded, signaling a significant divergence in unrealized gains between long-term and short-term holders. This metric pointed to heightened profit-taking pressure from short-term holders, who likely accumulated at lower levels during ADA’s consolidation phase.

Meanwhile, long-term holders appear more resistant to selling, indicative of broader confidence in sustained price growth. This divergence underscores the market’s bifurcated sentiment, where short-term volatility-driven participants clash with steadfast long-term investors. However, if short-term profit-taking persists, ADA could face headwinds in sustaining its upward momentum.

Is your portfolio green? Check out the Cardano Profit Calculator

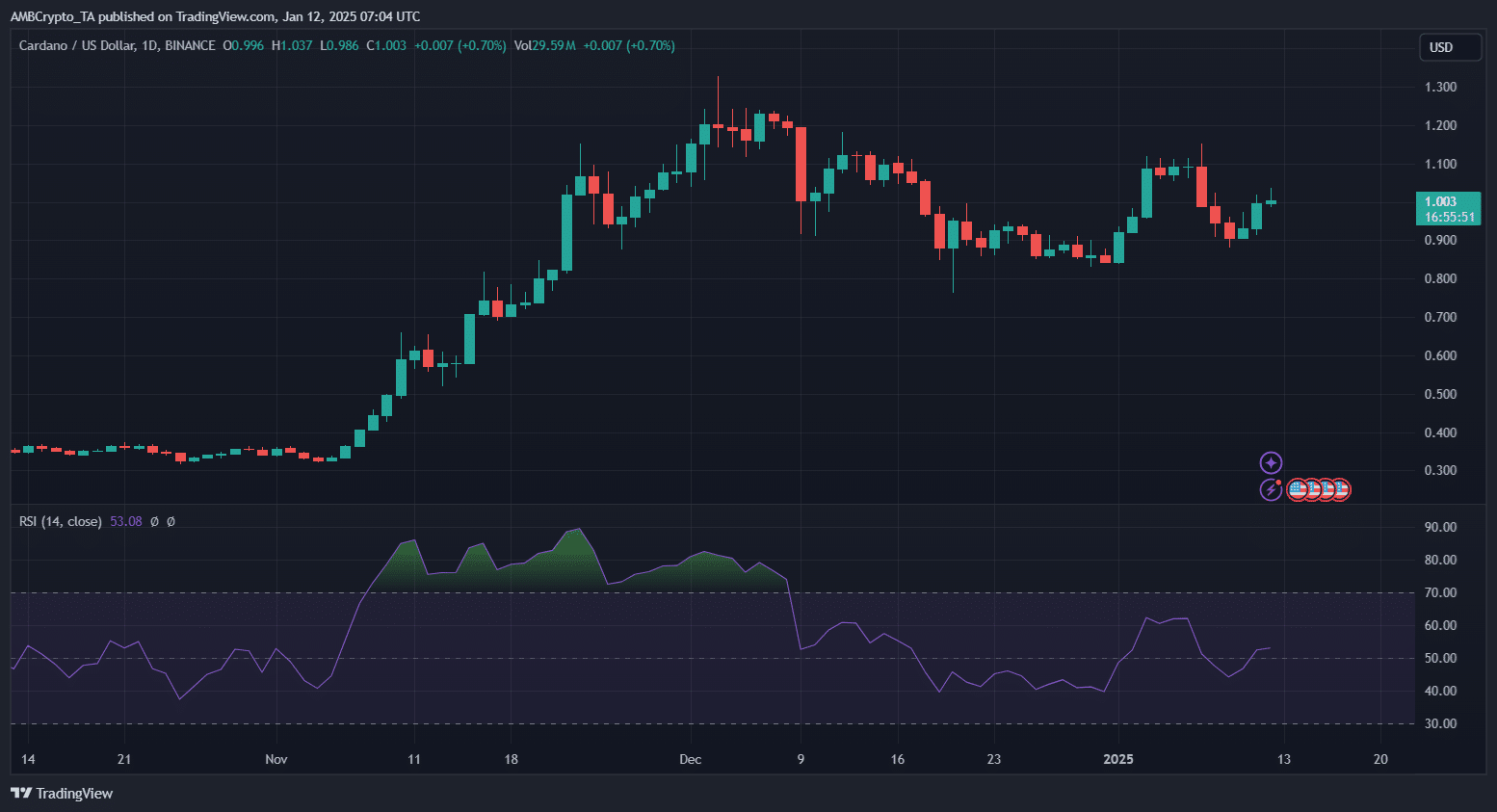

Price analysis and potential scenarios

Cardano’s price, at press time, seemed to be caught between short-term selling pressure and long-term investor resilience. Establishing support at the $1-level is critical amid growing market skepticism. A bullish scenario could unfold if ADA reclaims the $1.10 resistance, potentially sparking investor confidence. Increased network activity and daily active addresses would be pivotal in driving momentum towards the $1.30 resistance, provided broader market sentiment aligns.

On the downside, losing support at $0.95 risks further declines, with possible retests of $0.85 and $0.75. Persistent sell signals and profit-taking by mid-term holders heighten bearish risks, especially with muted network engagement.

ADA’s price trajectory depends on balancing short-term volatility with long-term holder confidence. Monitoring key levels and network metrics will be essential in gauging its next move.