Is Cardano’s price recovery sustainable? Key indicators to watch are…

- Cardano hiked by over 4% in 24 hours

- Altcoin’s Open Interest declined on the charts, despite the hike

In the last 24 hours, Cardano has demonstrated early signs of a recovery, rebounding from a series of recent declines. This positive movement in price is a welcome change for investors and holders. However, sustaining this uptrend will require broader support from additional key metrics.

Cardano sees recovery in trends

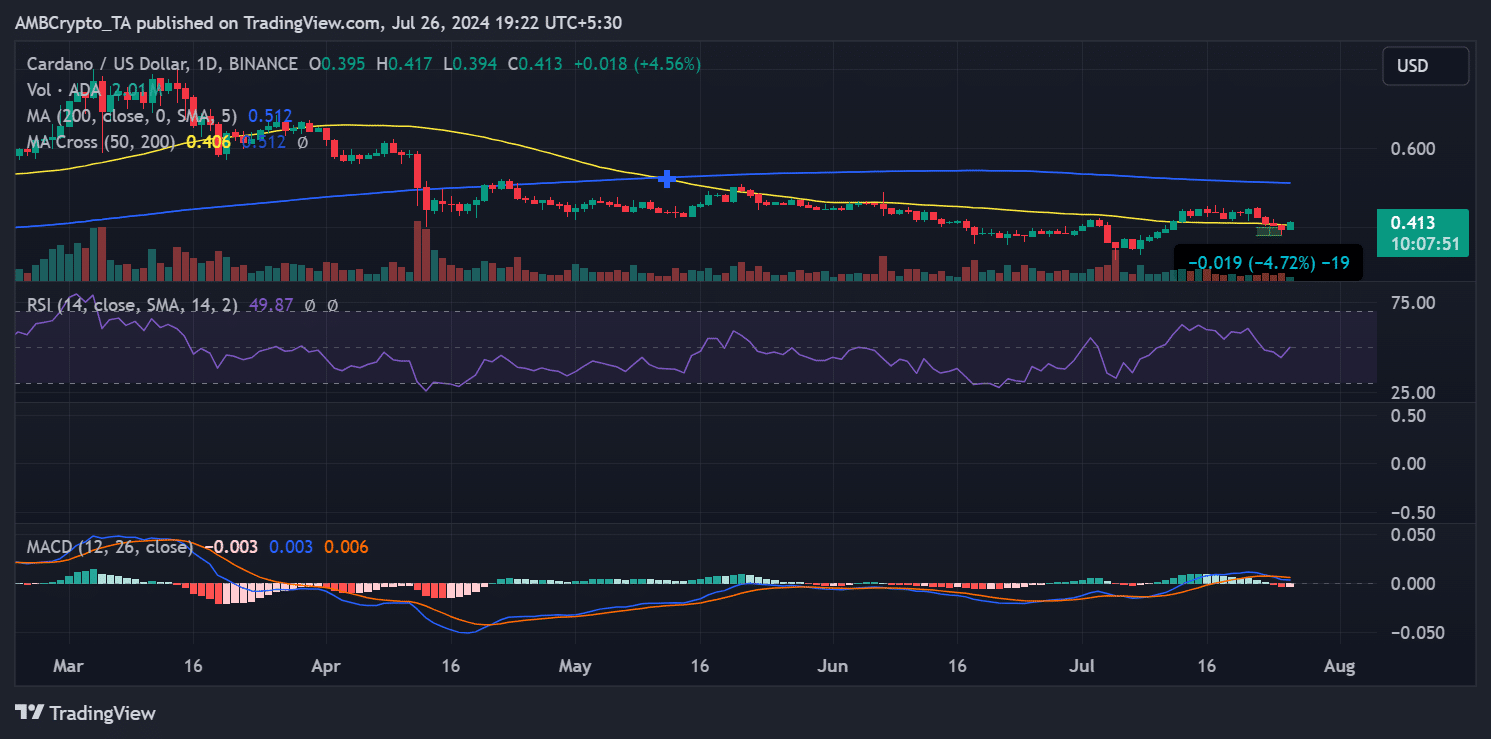

The recent price trend for Cardano, as analyzed on a daily time frame, indicated a recovery following a notable downtrend.

According to AMBCrypto’s analysis, ADA registered a decline of over 4% from 22 to 26 July. Its price fell from around $0.4 to approximately $0.39 during this period.

However, in the last 24 hours, there has been a significant reversal. The price appreciated by over 4%, returning it to around $0.41. This resurgence has effectively halted its previous decline, reinstating ADA to the $0.4 price zone.

Additionally, the altcoin’s press time price movement brought Cardano to the brink of crossing the neutral line on its Relative Strength Index (RSI). Typically, an RSI value of 50 represents a neutral market dynamic, neither distinctly bullish nor bearish.

ADA’s RSI nearing this point suggests that bearish momentum is losing strength, potentially paving the way for a stable market condition or a bullish trend if the recovery continues.

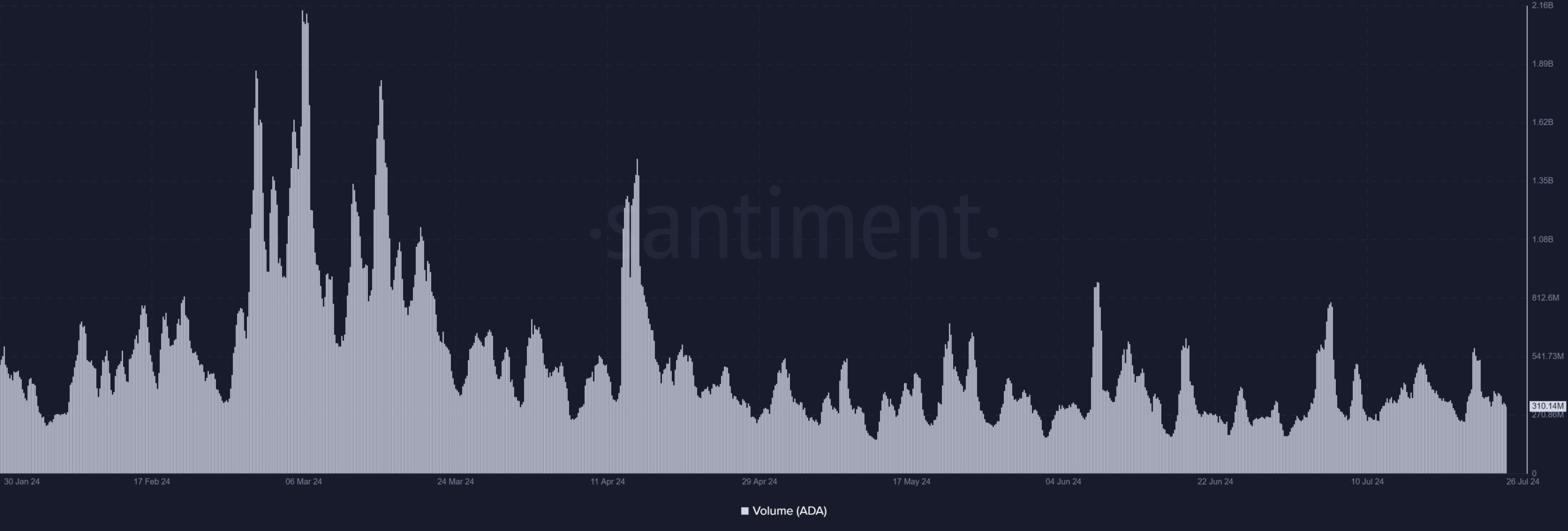

Cardano’s volume declines

The trading volume for Cardano (ADA) recorded a significant fall in the last 24 hours though. The volume moved from around $390 million on 25 July to approximately $310 million. This decline of over 15% in trading volume is a critical aspect to consider, especially considering ADA’s recent price discovery.

For ADA, the observed reduction in trading volume might pose a challenge to maintaining its ongoing uptrend.

If the trading volume continues to decline or remains low, it could indicate weakening demand at higher price levels. This might lead to price stabilization or even a reversal if sellers dominate.

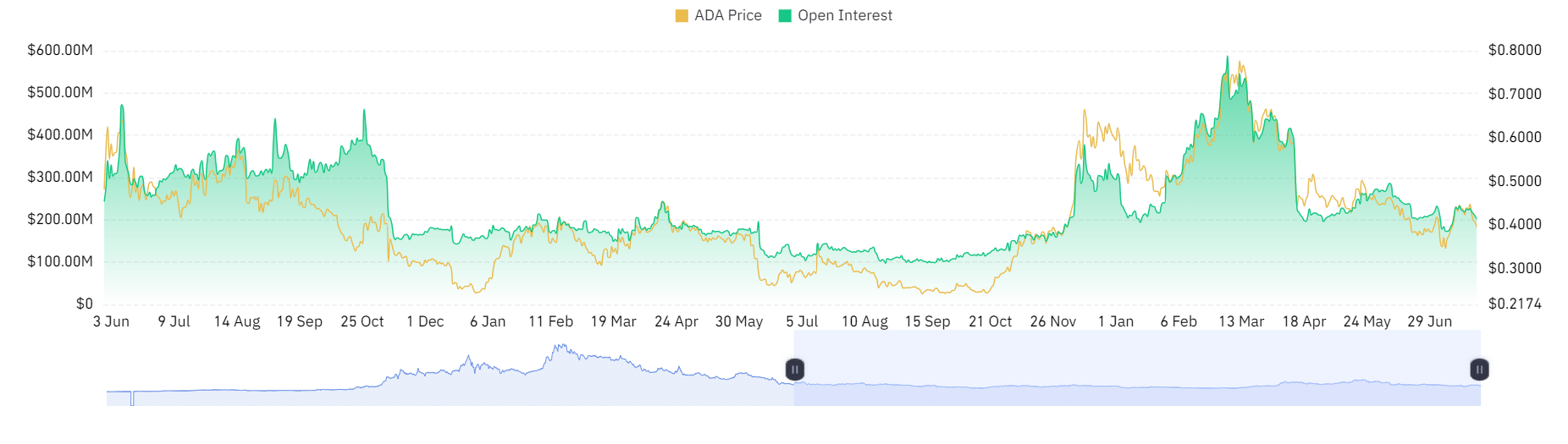

Declining interest in ADA

An analysis of Cardano’s Open Interest from Coinglass indicated a slight decline over the last 24 hours. It fell from approximately $208 million in the previous trading session to around $201 million.

Open interest measures the total number of outstanding derivative contracts (like futures and options) that have not been settled. A fall in Open Interest typically suggests that some traders are closing their positions.

– Is your portfolio green? Check out the Cardano Profit Calculator

For Cardano, this drop in open interest could imply a decrease in market confidence or a reduction in speculative activity, especially if this trend continues.

It suggests that new trading interests do not strongly support recent price movements, affecting the sustainability of ongoing price hikes.