Is Chainlink likely to rally soon as development activity surges?

- Chainlink’s development activity began to rise.

- Whales showed interest. However, the price of LINK fell.

In the crypto sector, Chainlink[LINK] has been known for its high number of collaborations with different types of companies in the space. With an increasing array of oracles and services to provide, Chainlink has shown growth across various verticals.

Realistic or not, here’s LINK’s market cap in BTC’s terms

Devs begin to Link up

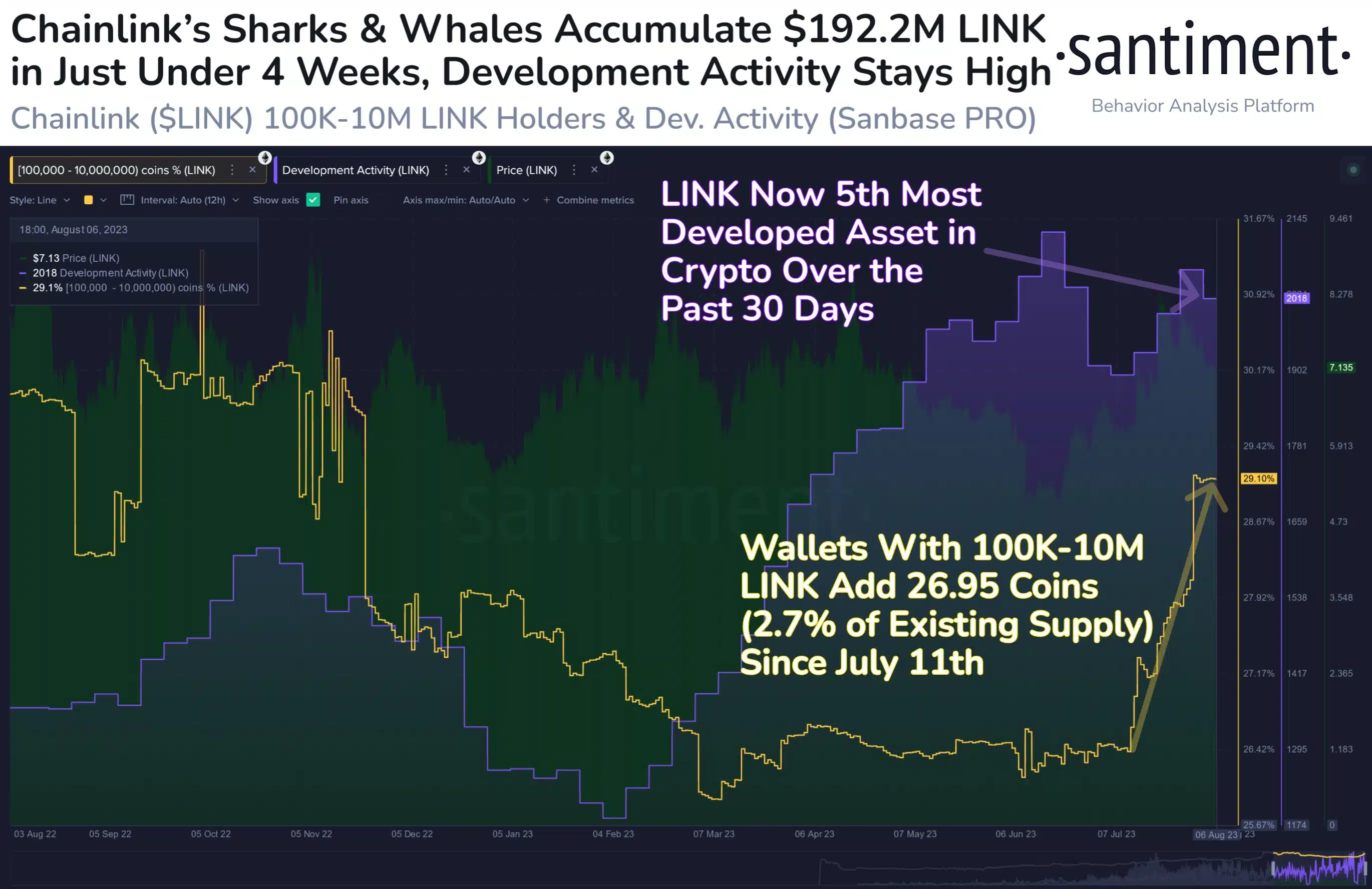

Along with the rise in collaborations, there was also a surge in development activity on its network. Santiment’s data revealed a significant surge in Chainlink’s GitHub development activity during the summer months.

As a result, the cryptocurrency rose to secure a position among the top 5 most actively developed assets within the space. This increase in development signified growing attention and efforts being directed toward Chainlink’s advancement and innovation.

In conjunction with the surge in activity, there has been a noticeable uptick in the interest of large investors. According to Santiment’s data, individuals categorized as whales and sharks, holding between 100K to 10M LINK, have accumulated the highest number of coins since December 2022.

The accumulation by significant holders suggested a growing confidence and commitment to Chainlink’s potential.

However, the rising number of large investors of whale holders could also imply that retail investors are losing interest in LINK. Furthermore, a high concentration of whale investors could make retail investors more vulnerable to whale behavior.

An instant sell-off of LINK by the whales could impact retail LINK holders negatively.

Price takes a trip down south

Despite the rising whale interest and rising development activity, the price of LINK began to fall materially after 21 July.

Read Chainlink’s Price Prediction 2023-2024

After testing the $8.464 resistance level, the price fell by 4.65%. During this period, LINK’s price movement demonstrated multiple lower lows and lower highs, establishing a bearish trend. If the trend persists there is a possibility that the price will test the $6.995 support levels before seeing a reversal.

The RSI was mostly neutral and was at 49.09. This suggested that the price momentum for LINK was slightly favoring the bears. In tandem with the RSI, the CMF of LINK also fell, implying that the money flow was with the bears at the time of writing.