Dogecoin

Is Dogecoin a Buy? Examining why LTHs are still betting on it

Dogecoin’s price is in a tricky position right now, but LTHs could offer a solution.

- Dogecoin’s market sentiment seemed far from bullish

- Memecoin’s indicators hinted at a bearish takeover soon

Dogecoin [DOGE] has been on some sort of rollercoaster ride with its volatile price action lately. Investors were happy last week after the memecoin’s price gained significantly on the charts. However, this might not last for long as at press time, the long-term perspective wasn’t very promising for Dogecoin.

Dogecoin’s long-term troubles

The world’s largest memecoin’s price soared by more than 16% in the last seven days. This bullish trend continued over the last 24 hours as DOGE’s value surged by over 6%. At the time of writing, Dogecoin was trading at $0.1274 with a market capitalization of over $18.5 billion.

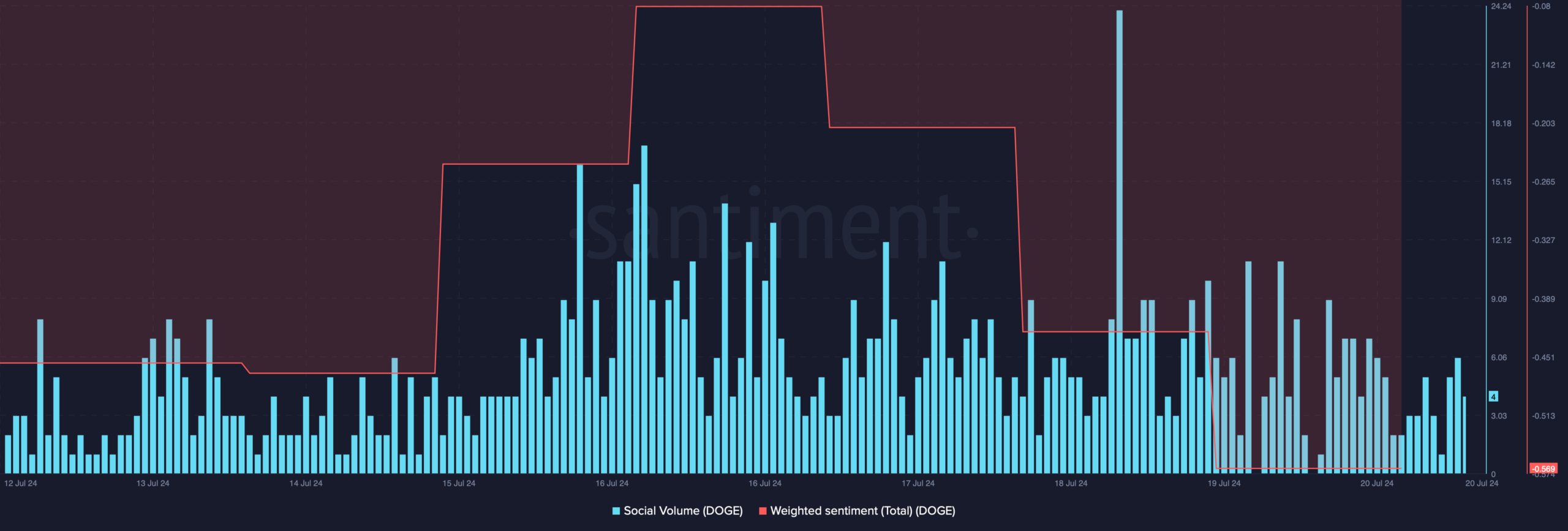

AMBCrypto’s analysis of Santiment’s data revealed that the memecoin’s social volume spiked, reflecting its popularity. However, despite the double-digit price hike last week, DOGE’s weighted sentiment declined sharply.

This suggested that bearish sentiments retained their dominance in the memecoin’s market.

Meanwhile, Santiment recently shared a tweet revealing a notable trend. According to the same, DOGE has been among many assets that have extreme losses on the mid and long-term end.

When considering “buy low, sell high” opportunities, understand that when you are buying low, it is based on buying low relative to how other traders are performing. This was the case as its 60, 90, 180, and 365-day MVRV ratios stood at -9%, -10%, -17%, and -6%, respectively. This indicated that DOGE’s price would drop in the long term.

Despite the bearish trend, however, AMBCrypto’s analysis of IntoTheBlock’s data revealed that long-term holders have some confidence in Dogecoin.

This seemed to be the case, especially as the number of investors holding DOGE for more than a year was increasing at press time. Meanwhile, traders who held DOGE for less than 1 month seemed to be dropping.

What to expect in the short term?

AMBCrypto then checked Coinglass’ data to better understand which way the memecoin might be heading in the short term. We found that DOGE’s long/short ratio increased sharply.

This is a bullish signal, as it means that there were more long positions in the market than short ones.

The MACD flashed a bullish advantage in the market, hinting at a sustained price hike. However, the Money Flow Index (MFI) was bearish as it registered a downtick.

A similar declining trend was also noted by the Chaikin Money Flow (CMF), which suggested that the rally might end soon.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

Finally, the possibility of a trend reversal seemed high as a significant amount of DOGE got liquidated recently. If this happens again, then investors might soon see the memecoin dropping to $0.116 on the charts.