Dogecoin

Is Dogecoin’s 16% price drop the first step to a new ATH?

History might rescue DOGE investors from their recent struggles.

- Dogecoin registered a double-digit price decline last week

- If a bullish breakout happens, then DOGE might first reclaim $0.13 on the charts

Dogecoin [DOGE] investors were having a hard time last week as the memecoin recorded a double-digit decline. However, there may be more to the story here.

In fact, latest data suggests that DOGE may following a historical trend, one which previously resulted in DOGE hitting new ATHs.

Is history repeating itself?

CoinMarketCap’s data revealed that Dogecoin saw a 16% price correction last week. This bearish price trend continued in the last 24 hours too, as the memecoin’s value fell by more than 3.5%. At the time of writing, the world’s largest cryptocurrency was trading at $0.1127 with a market capitalization of over $16.8 billion, making it the 8th largest crypto.

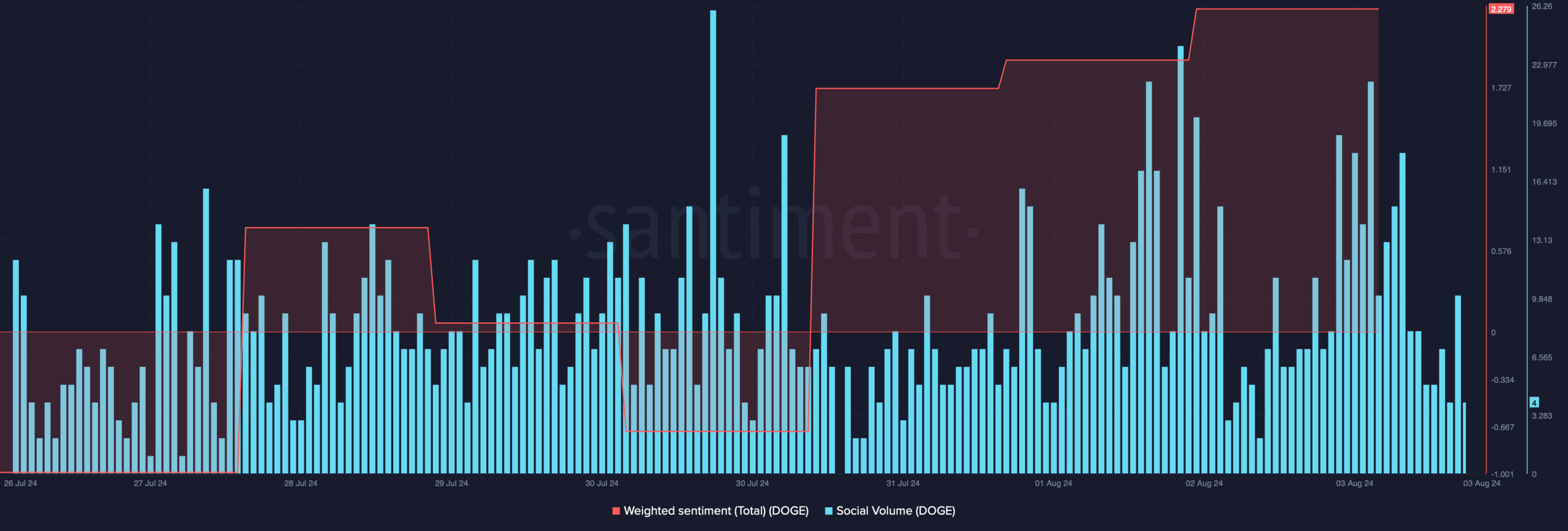

Its social volume remained high, reflecting its popularity. However, it was surprising to note that despite the said price drop, the memecoin’s weighted sentiment improved – A sign that bullish sentiment around the memecoin has been rising.

A possible reason behind this confidence in investors might be because of a trick Dogecoin has up its sleeves.

Kevin, a popular crypto analyst, recently shared a tweet highlighting a pattern that the world’s largest memecoin may be following. Notably, a similar pattern emerged on its chart twice before, both of which resulted in DOGE touching new ATHs in 2018 and 2021.

At the time of writing, DOGE was consolidating on the charts. And, in the event of a breakout, investors might see history repeating itself.

What are the odds though?

AMBCrypto then planned to check the memecoin’s on-chain data to see whether metrics supported the possibility of a bullish breakout. Our analysis of Santiment’s data revealed that DOGE’s MVRV ratio dropped, which was a bearish signal.

Nonetheless, its network activity remained high, as was evidenced by its stable daily active addresses. Its velocity also spiked, meaning that DOGE was used more often in transactions within a set timeframe.

At press time, DOGE’s fear and greed index had a reading of 32%, meaning that the market was in a “fear” phase. This suggested that there were chances of a bullish breakout soon. However, the

long/short ratio was bearish as it registered a sharp downtick.Is your portfolio green? Check out the DOGE Profit Calculator

Finally, we checked Dogecoin’s liquidation heatmap to see its possible targets if a bull rally is initiated.

We found that DOGE’s liquidations would rise sharply near $0.137. Therefore, in the event of a bull rally, DOGE might first reclaim that level. However, if the bears continue to dominate, then DOGE might drop to $0.09.