Is Dogwifhat poised for bullish reversal? – THIS can spark WIF’s next rally

- WIF was approaching a key support level after its 35% correction from its recent all-time high.

- Metrics signaled a potential price reversal.

Dogwifhat [WIF] saw a massive 35.95% decline from its recent all-time high, dropping to its current trading price of $3.0673 at press time.

This sharp pullback has formed what appears to be a bullish flag pattern on the daily chart.

What do these bullish flag patterns imply?

Historically, bullish flag patterns are continuation patterns. This suggests the prior WIF bullish run will likely resume after the correction phase is completed.

The recently broken upper trendline of the flag could now act as a support level. This may potentially launch the next rally. With WIF approaching this key support zone, a bounce from this level could signal the start of the next upward movement.

Additionally, the stochastic RSI is at an oversold position. This increases the likelihood of a reversal after the ongoing price corrections.

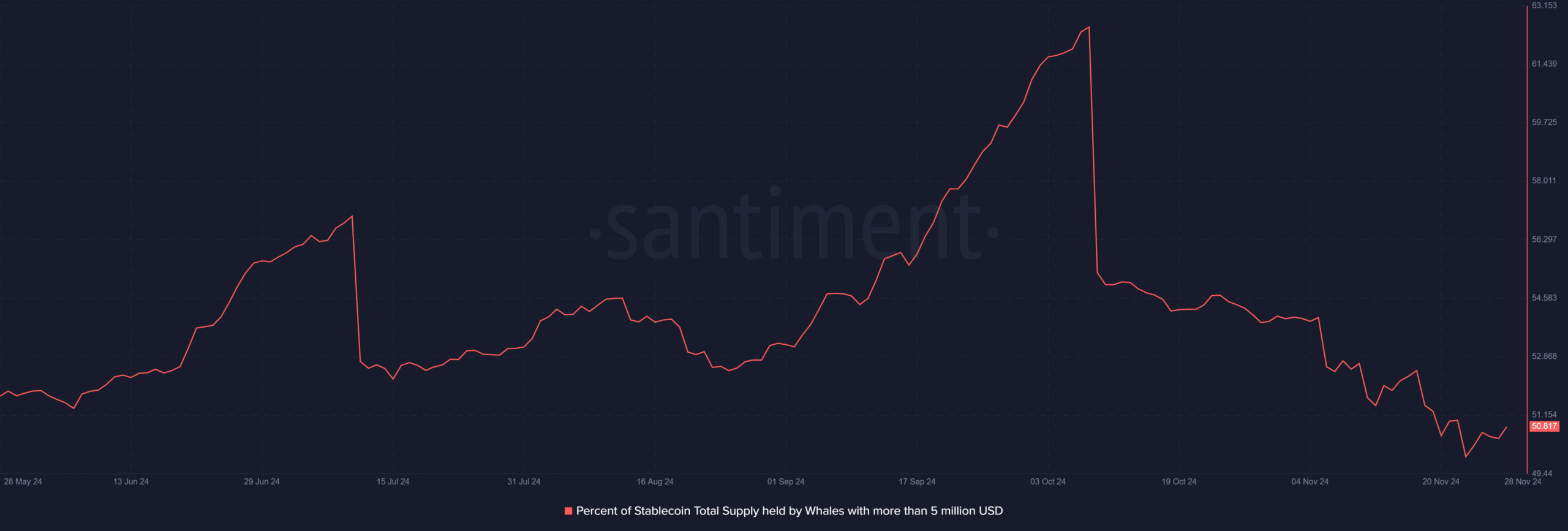

Whales continue to accumulate WIF

Interestingly, our analysis of the on-chain data reveals that wallets holding over 5 million WIF have continued to increase their positions during this pullback.

This suggests that large institutional investors see value in the memecoin at these levels and are actively accumulating the token.

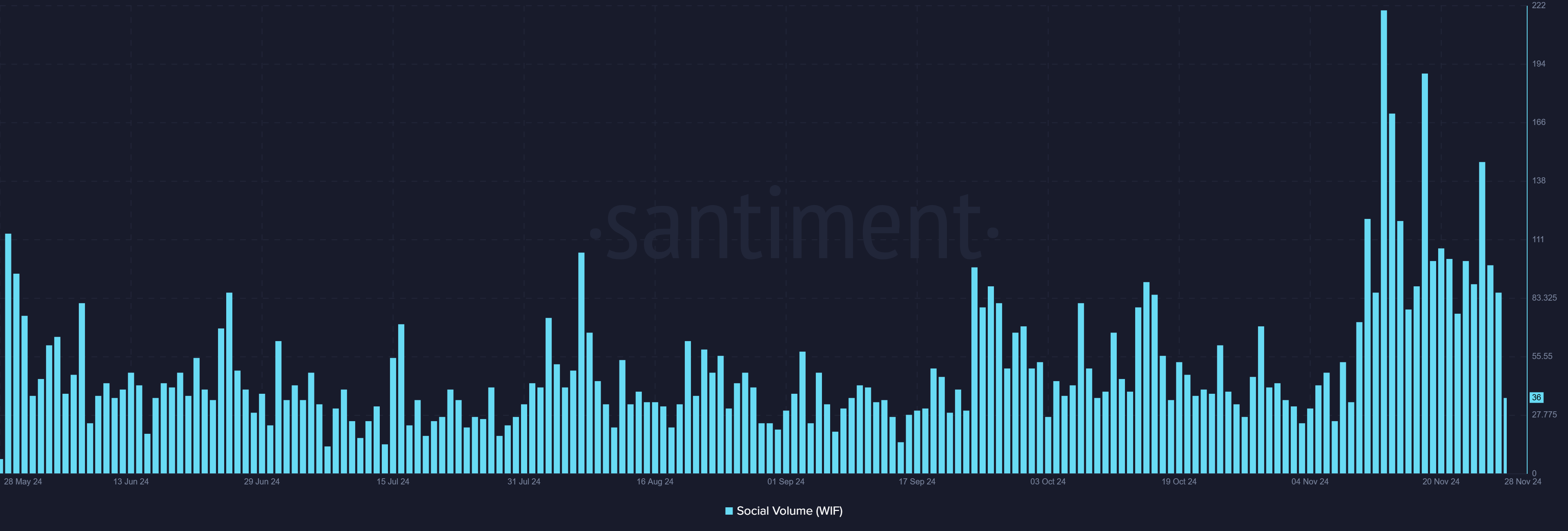

Social volume and long-short ratio indicate…

Despite the recent pullback, Dogwifhat’s social volume has generally increased since the beginning of November, indicating sustained interest and engagement from the crypto community.

However, the social mentions have declined in the last 3 days. This could signal a short-term correction for the memecoin before resuming its overall positive trajectory.

Besides, the WIF Long-Short Ratio has not dropped significantly, suggesting that traders are still more inclined to open long positions rather than short the asset.

These positive sentiments suggest that the bullish sentiment around WIF remains strong, even during the current correction phase.

The path ahead for WIF

With both technical and on-chain metrics remaining optimistic, WIF’s bullish reversal could be on the cards as investors wait for a confirmed bounce off the flag support before entering long positions.

Realistic or not, here’s WIF’s market cap in BTC’s terms

A successful bounce-off from this key support level could provide the basis for a potential bullish run.