Is dogwifhat poised to reach $4? What key data says

- WIF’s Long/Short Ratio was at 1.07, indicating strong bullish market sentiment.

- WIF’s Open Interest Funding Rate was at +0.0023%, indicating bullish sentiment toward the asset.

Popular memecoin dogwifhat [WIF] was poised for a notable price surge as it approached a crucial breakout point.

Overall market sentiment has shifted from a downtrend to an uptrend, with major cryptocurrencies like Bitcoin [BTC] and Ethereum [ETH] experiencing notable price surges in the past 24 hours.

If anyone is wondering how far WIF can go from its current level, it all depends on its upcoming price momentum. We could either see a massive rally or a 20% price decline.

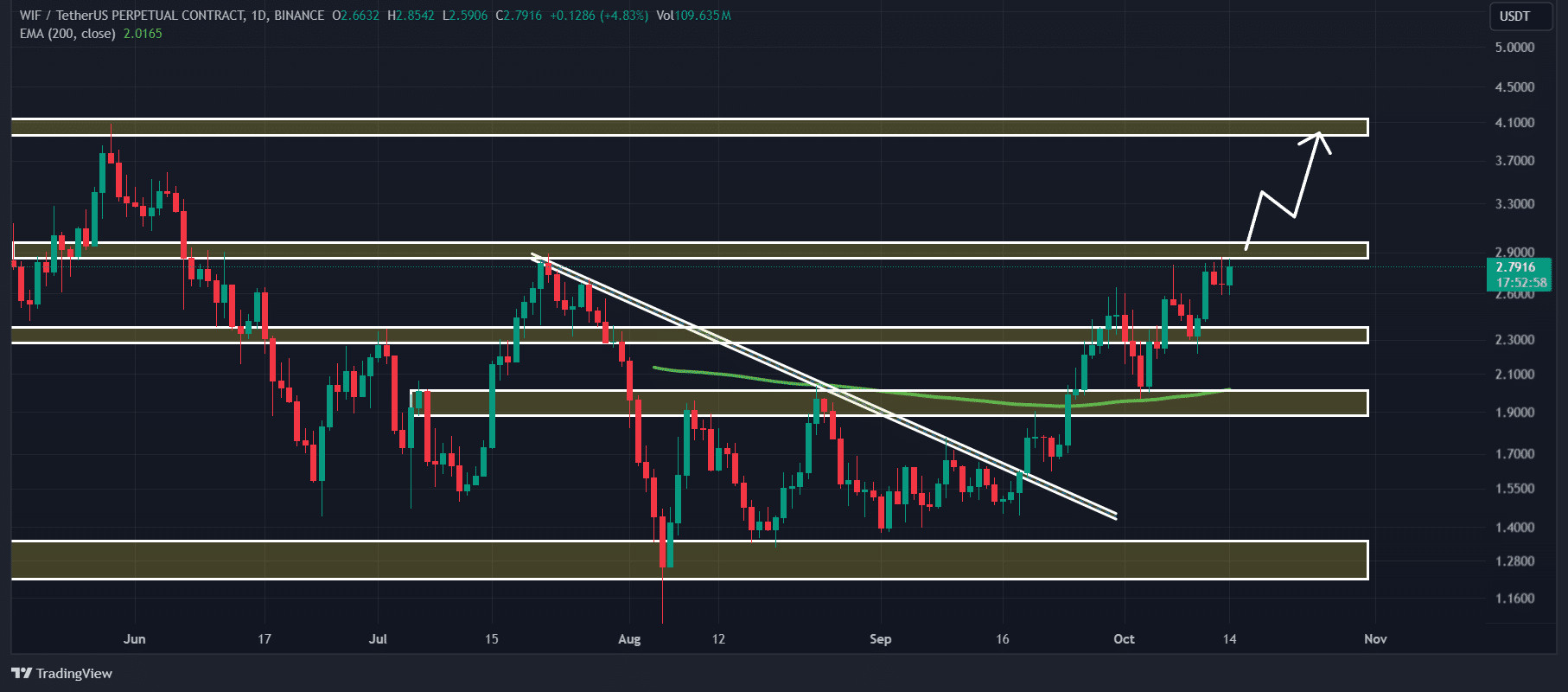

dogwifhat technical analysis and key levels

Per AMBCrypto’s technical analysis, WIF appeared bullish at press time, facing strong resistance around the $2.88 level.

If the memecoin follows the recent trend and closes a daily candle above the $2.96 level, there is a strong possibility it could soar by over 30%, reaching the $4 mark in the coming days.

On the other hand, if WIF, along with major cryptocurrencies fails to sustain the current market sentiment, there is a possibility that it could face a 20% price decline in the coming days.

Currently, the memecoin was in an uptrend, as it was trading above the 200 Exponential Moving Average (EMA) on a daily time frame.

Bullish on-chain metrics

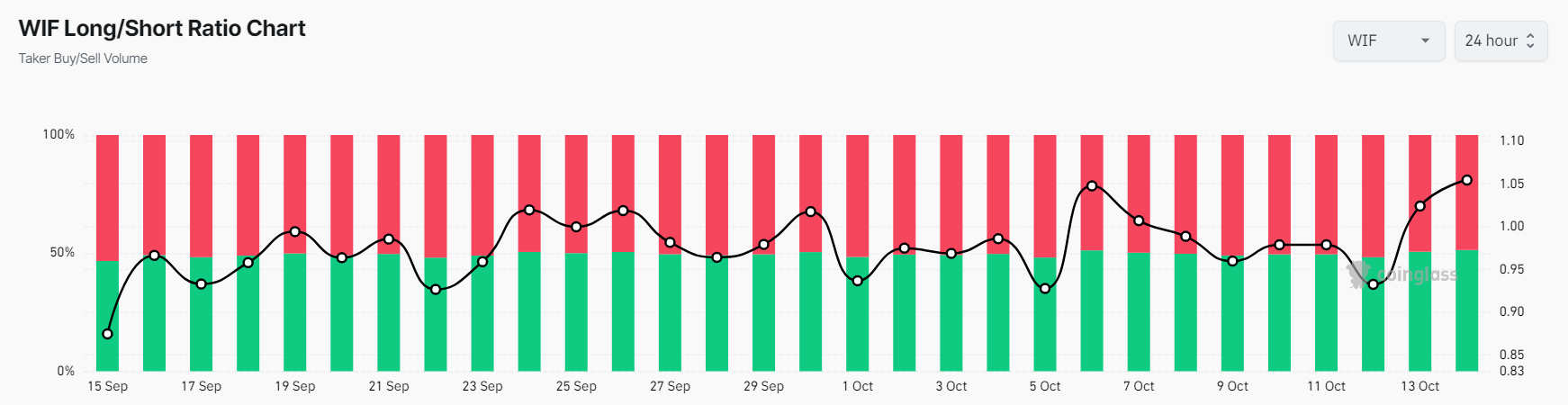

This positive outlook was further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, WIF’s Long/Short Ratio was 1.07, indicating strong bullish market sentiment among traders.

Additionally, its Futures Open Interest has jumped by 10.68% in the past 24 hours and has been steadily increasing. This suggested increased trader engagement, with many potentially betting on long positions.

Meanwhile, WIF’s Open Interest Funding Rate was +0.0023%, indicating bullish sentiment toward the asset.

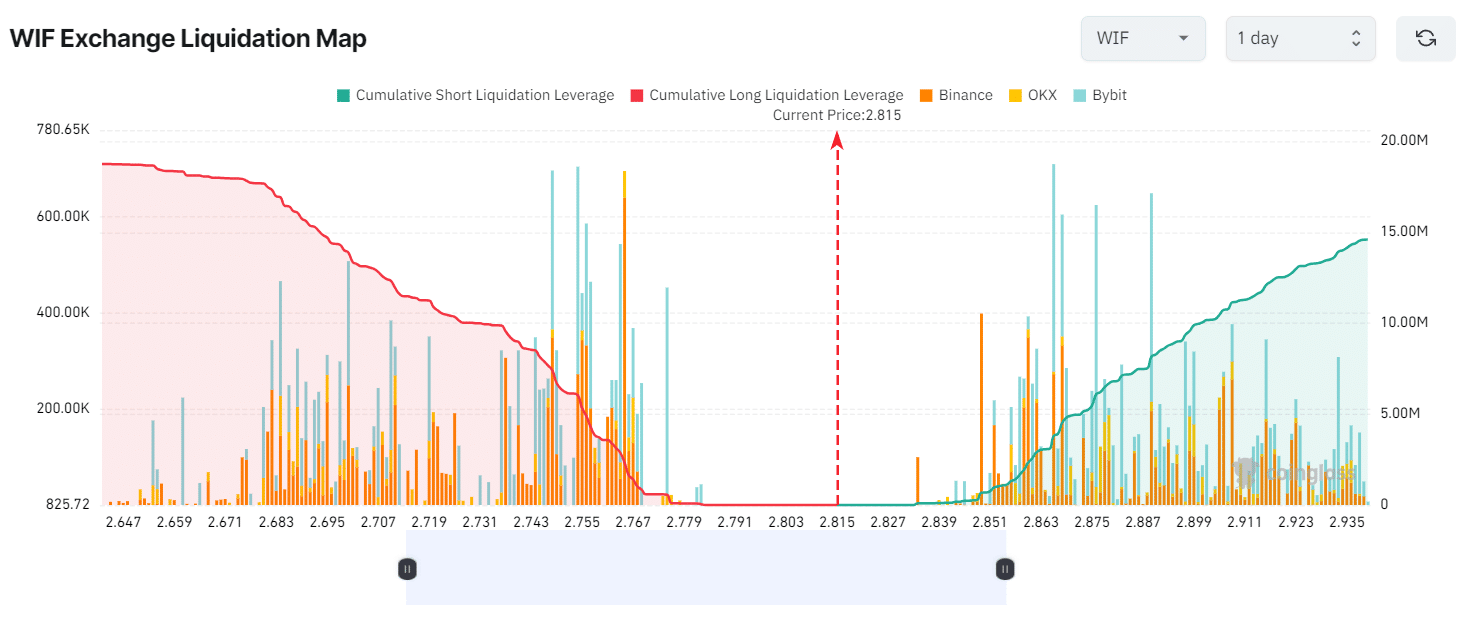

Major liquidation levels

As of now, the major liquidation levels were at $2.748 on the lower side and $2.866 on the upper side, with traders over-leveraged at these points, according to Coinglass data.

If market sentiment remains unchanged and the price breaches the $2.866 level, nearly $3.80 million worth of short positions will be liquidated.

Conversely, if sentiment shifts and the price falls to the $2.748 level, approximately $7.40 million worth of long positions will be liquidated.

This data suggests that bulls’ long bets are currently higher than bears’ short bets.

Combining these on-chain metrics with WIF’s technical analysis indicates that bulls are dominating the asset and may help breach the upcoming resistance level.

Read dogwifhat’s [WIF] Price Prediction 2024–2025

Current price momentum

At press time, WIF was trading near $2.80 and has experienced a modest price decline of 1.15% in the past 24 hours.

During the same period, its trading volume jumped by 25%, indicating higher participation from traders and investors amid bullish market sentiment.

![Bittensor [TAO] tops the AI charts once again, but 3 hurdles loom](https://ambcrypto.com/wp-content/uploads/2025/04/420567A0-9D98-4B5B-9FFF-2B4D7BD2D98D-400x240.webp)