Is Ethereum in any position to trigger a DeFi summer right now

The DeFi’s market movement has been quite dismal over the past few weeks. Right from MKR, AAVE, and COMP to UNI, SUSHI, and YFI, almost all the top tokens from this space have been incurring losses.

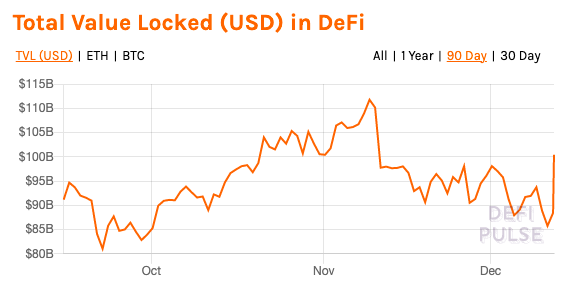

Amidst the larger downtrend or ‘winter’ phase going on, the aggregate value locked in DeFi slipped to $85 billion yesterday – A level that was last observed in early October.

Curiously, the losses were negated right after as this metric registered a sharp hike over the last few hours. At the time of writing, DeFi TVL’s was north of $100 billion. The expeditious ‘W-shaped’ recovery can be seen on the chart attached below.

Source: DeFiPulse

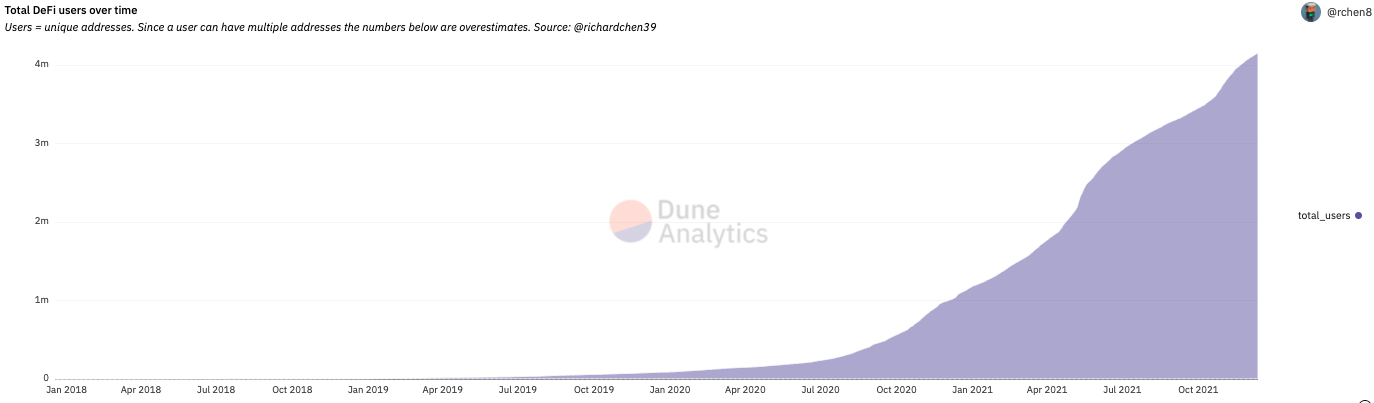

Interestingly, this rise in TVL has been accompanied by an increment in user count. Even though the reading of this metric has been sloping up since July last year, it should be noted that it suffered quite some turbulence mid-way.

As can be seen from the snapshot attached below, the pace at which DeFi users have been entering the ecosystem has increased this week, when compared to last week.

Source: Dune Analytics

So, is DeFi Summer finally on the cards?

As highlighted above, participants’ interest with respect to DeFi has started brewing over the past day or so. Nonetheless, the odds of summer unfolding right at this point seem to be unlikely.

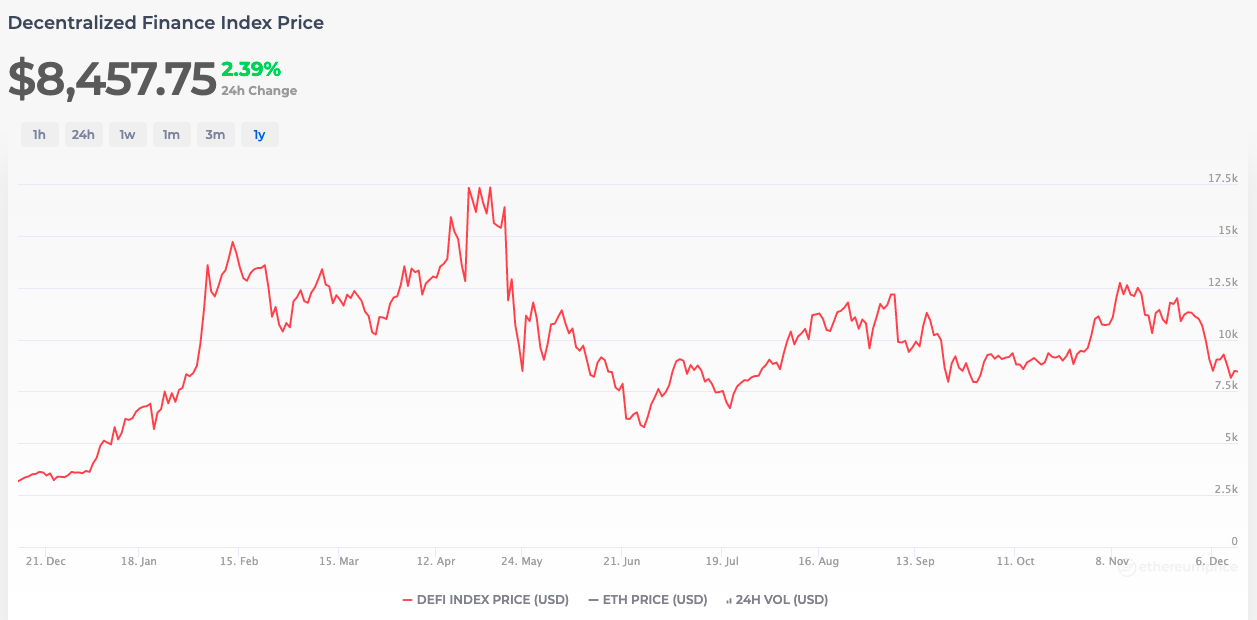

More so, because the state of DeFi on Ethereum is pretty much in a lousy state right now. Despite the 2.3% rise over the last 24 hours, the DeFi index’s price has been oscillating around its multi-month low.

In fact, the aforementioned hike didn’t even hinder the ongoing downtrend phase much.

During most summer phases, this index has steeply risen. However, looking at its current state, it doesn’t look like it will change its trend anytime soon.

Source: ethereumprice.org

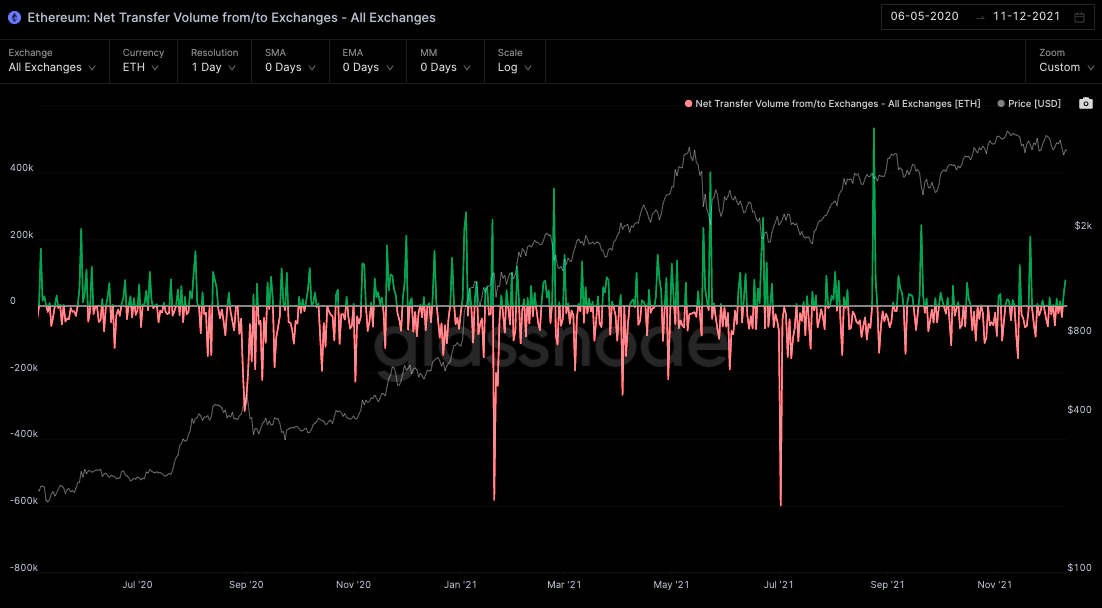

Another major factor that can be considered at this stage is the net transfer volume of Ethereum. At press time, this metric was positive. This means that net inflows have been dominating net outflows of late.

Now, one may wonder what do ETH flows have to do with the performance of DeFi. Well, there’s a connection – Ethereum is the base collateral for most DeFi assets. So, a substantial part of the outflows from exchanges resonates with the tokens’ drift into the DeFi ecosystem, apart from private wallets and cold storage.

Past summer phases, may it be September last year or during the initial few months of this year, have been mainly marked by huge Ethereum outflows from exchanges. So, this time around too, things ought to change for DeFi tokens to rally.

Source: Glassnode

What’s more, most of the industry’s coins do well when Bitcoin does well. Similarly, DeFi tokens have historically fared better during Ethereum’s bullish phases.

Ergo, if Ethereum starts recovering and eventually prospering, the market might just see another DeFi summer. However, if Ethereum’s choppy phase prolongs itself, DeFi tokens would find it challenging to rally.