Is Ethereum set for a breakout? 2 factors hold the key

- Whale activity and a 79% volume surge suggested potential bullish momentum for Ethereum.

- On-chain metrics remained mixed, but bulls held a slight edge in the Long/Short Ratio.

An Ethereum [ETH] ICO participant, who initially gained 150,000 ETH (now valued at $389.7 million), made a significant move by depositing 3,510 ETH ($9.12 million) into Kraken after remaining inactive for over two years.

This large-scale transaction suggests growing confidence in Ethereum’s future. With Ethereum trading at $2,656.39, up by 3.02% at press time, the market is now focused on whether this whale movement will spark a bullish momentum.

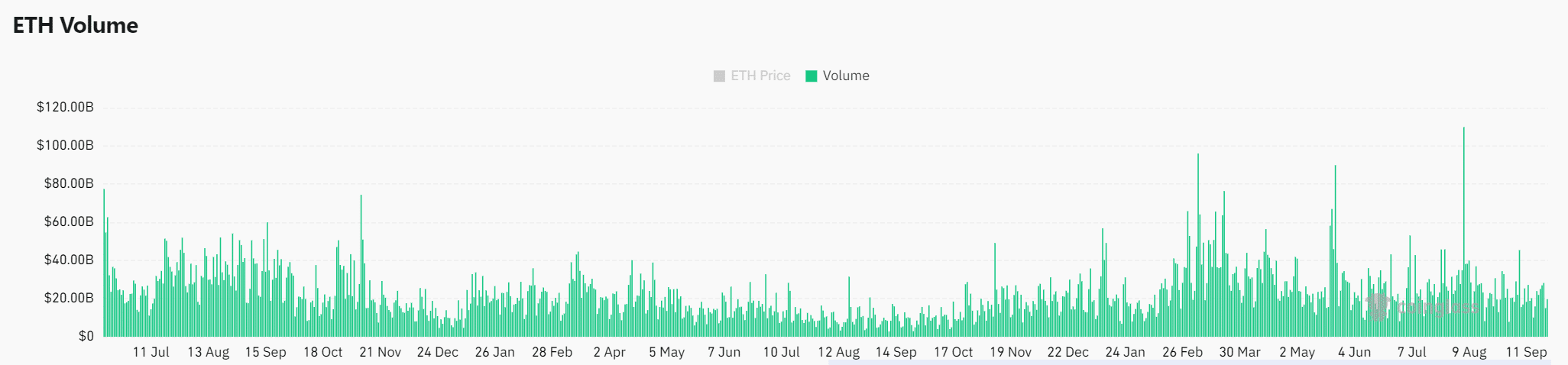

Ethereum’s volume surge: A bullish signal?

Ethereum’s trading volume has seen a sharp increase, rising by 79.30% over the last 24 hours to $28.21 billion at press time.

This surge typically signals a growing appetite among traders, which often leads to higher price volatility.

Therefore, increased volume can drive the market higher if buyers continue to dominate. However, if the volume subsides without follow-through buying, it could signal hesitation, potentially leading to a price dip.

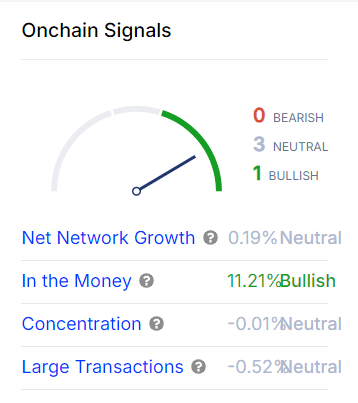

On-chain metrics: Mixed signals for Ethereum

Looking at the on-chain metrics, AMBCrypto found a mix of signals.

Ethereum’s Net Network Growth remains neutral at 0.19%, showing no significant influx of new users.

However, the In the Money metric, a key indicator of how many investors are currently in profit, shows a bullish reading of 11.21%.

This suggests a considerable portion of Ethereum holders remain in a profit position, which can reduce selling pressure and support price stability.

On the other hand, metrics like Concentration and Large Transactions also present neutral trends, with no significant changes in whale accumulation.

Therefore, while the whale deposit into Kraken hints at renewed market activity, it has not sparked a massive shift in Ethereum’s on-chain dynamics yet.

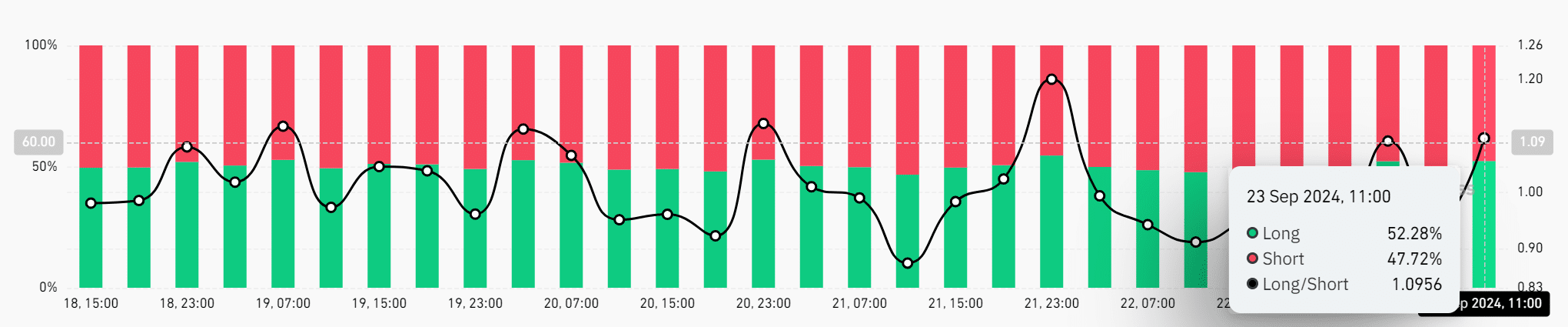

Bulls hold an edge

The Long/Short Ratio is slightly tilted in favor of bulls. As of the 23rd of September, 52.28% of traders held long positions, while 47.72% were shorting the market.

This slight majority indicates that traders are leaning toward Ethereum’s price increasing further. If the ratio continues to favor the bulls, Ethereum could maintain its upward momentum.

Read Ethereum’s [ETH] Price Prediction 2024-25

Ethereum’s recent whale activity and the sharp rise in trading volume suggest bullish potential. However, mixed on-chain metrics show the market remains cautious.

The Long/Short Ratio gives bulls a slight edge, but broader market dynamics will ultimately dictate the direction.