Is Ethereum still cheap at $2,600? Hike in selling pressure suggests…

- Whales have continued to accumulate ETH as the supply held by top addresses increased

- A bullish trend reversal might allow ETH to reclaim $2.9k soon

Ethereum [ETH], at the time of writing, had once again reclaimed $2,600 on the charts – A sign that another price hike might be on the way soon. And yet, that might not be the case since a significant amount of ETH was moved to exchanges just recently.

Hence, the question – Will Ethereum face headwinds going forward because of this sell-off?

Is selling pressure rising on Ethereum?

CoinMarketCap’s data revealed that ETH’s weekly and daily charts remained red, but it somehow managed to trade close to $2.6k. Valued at $2,602.78, the altcoin had a market capitalization of over $313 million at press time.

That’s not all though as when AMBCrypto analyzed Ethereum’s rainbow chart, we found that ETH’s price was in the “still cheap” zone. This suggested that investors might consider accumulating the token before it gains bullish momentum.

Is that happening though? Well, a recent update by Whale Alert on X might have something to contribute to this discourse.

According to the same, 12,461 ETH – Worth more than $32 million – were transferred from an unknown wallet to Coinbase, indicating a sell-off.

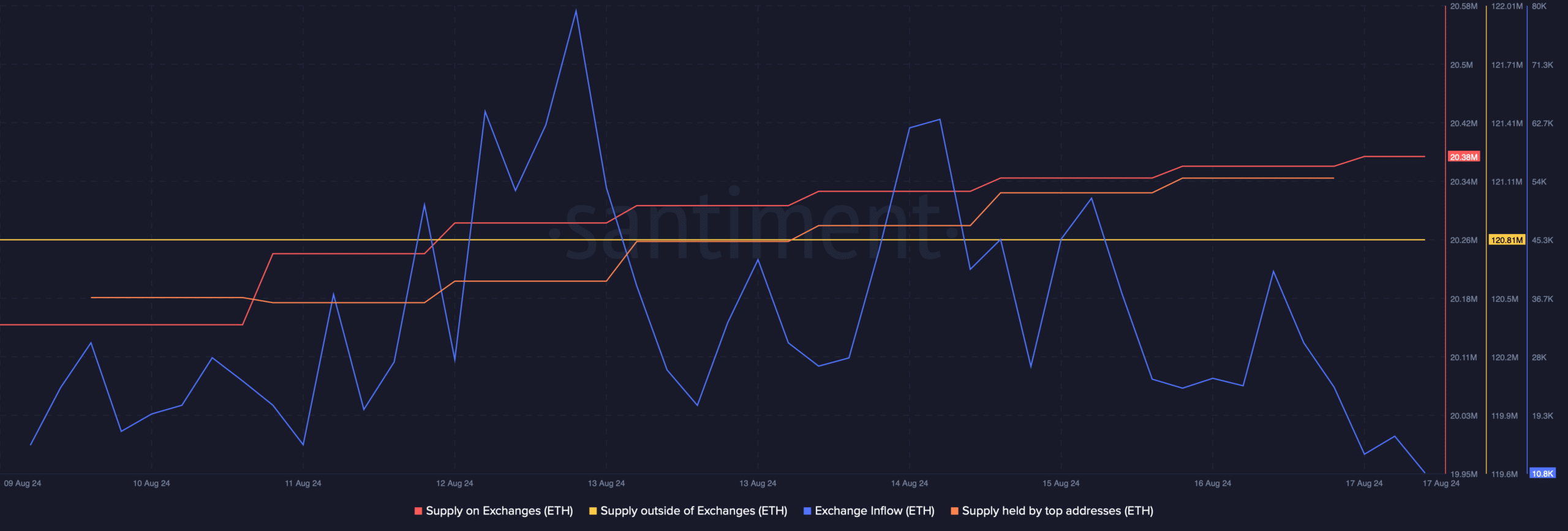

AMBCrypto then took a look at Santiment’s data to find out whether selling sentiment was dominant in the overall market. As per our analysis, Ethereum’s supply on exchanges increased last week while its supply outside of exchanges dropped slightly, hinting at a rise in selling pressure. The fact that investors were selling was further proven by the hike in ETH’s exchange outflows on 12 and 14 August.

However, while investors at large were selling, whales acted differently as the supply held by top addresses increased.

This suggested that big-pocketed players still have faith in ETH and are expecting its value to surge in the coming days.

Odds of ETH turning bullish in the near term

AMBCrypto then checked Coinglass’ data to see what derivatives metrics suggested regarding Ethereum’s path ahead. As per our analysis, Ethereum’s long/short ratio registered an uptick.

A rise in the metric means that there were more long positions in the market than short positions, indicating a hike in bullish sentiment around a token.

Moreover, ETH’s funding rate also dropped along with its price, which generally results in a trend reversal.

Finally, AMBCrypto assessed Hyblock Capital’s data to look out for ETH’s immediate targets.

Read Ethereum’s [ETH] Price Prediction 2024-25

We found that in the event of a bullish trend reversal, ETH’s price might as well march towards $2.9k. However, if the bearish trend continues, then the token might fall to $2.4k on the charts.