Is Fetch.ai’s bull run coming to an end?

- DWF Labs deposited FET tokens worth thousands of dollars on ByBit

- Selling pressure on FET was high, and market indicators were bearish

Fetch.ai [FET] had a comfortable week as its price rallied by a promising margin, allowing investors to enjoy profits. However, DWF Labs later deposited a substantial number of FET tokens on an exchange, after which FET’s price action changed direction. Will the recent deposit increase selling pressure on FET in the days to follow?

Realistic or not, here’s FET market cap in BTC terms

Fetch.ai is witnessing high sell pressure

CoinMarketCap’s data revealed that FET’s price surged by more than 3% in the last seven days, which looked quite optimistic. However, while the token’s price was increasing, Lookonchain’s data revealed a sell-off.

As per the tweet, DWF Labs deposited 200,000 FETs worth more than $45,000 to ByBit. After the deposit, DWF Labs still had FET tokens worth more than $1.7 million in its portfolio.

DWF Labs(@DWFLabs) deposited 200K $FET($45K) to #Bybit 15 mins ago.

And currently has 7.8M $FET($1.76M) left.https://t.co/LfFFhtbumi pic.twitter.com/AF1t505nvR

— Lookonchain (@lookonchain) October 3, 2023

It was interesting to note that after the deposit, FET’s price action started to go down. In fact, in just the last 24 hours, Fetch.ai’s value plummeted by over 3%.

At the time of writing, FET was trading at $0.2192 with a market cap of over $178 million.

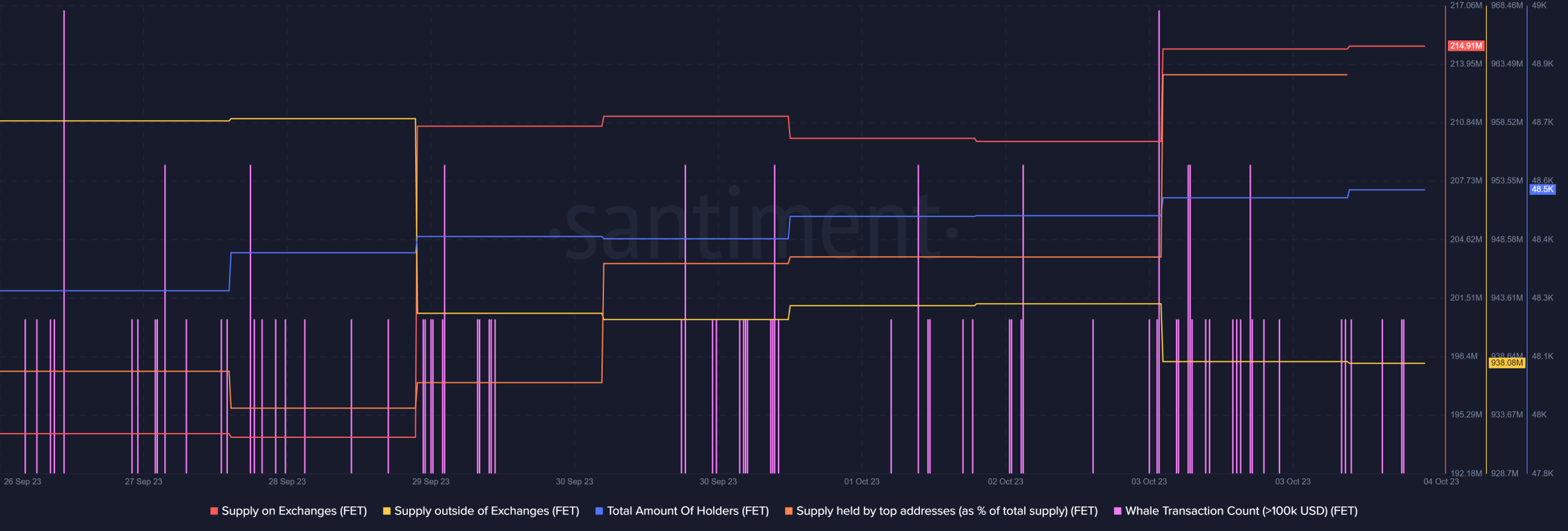

A closer look at Santiment’s data revealed that selling pressure on FET was high. This was evident from the rise in its supply on exchanges while its supply outside of exchanges dropped. However, the larger crypto market still had faith in FET, as its total amount of holders increased slightly last week.

Moreover, whales actively traded FET last week as its whale transaction count increased. Not only did whales trade FET, they bought more tokens as FET’s supply held by top addresses spiked.

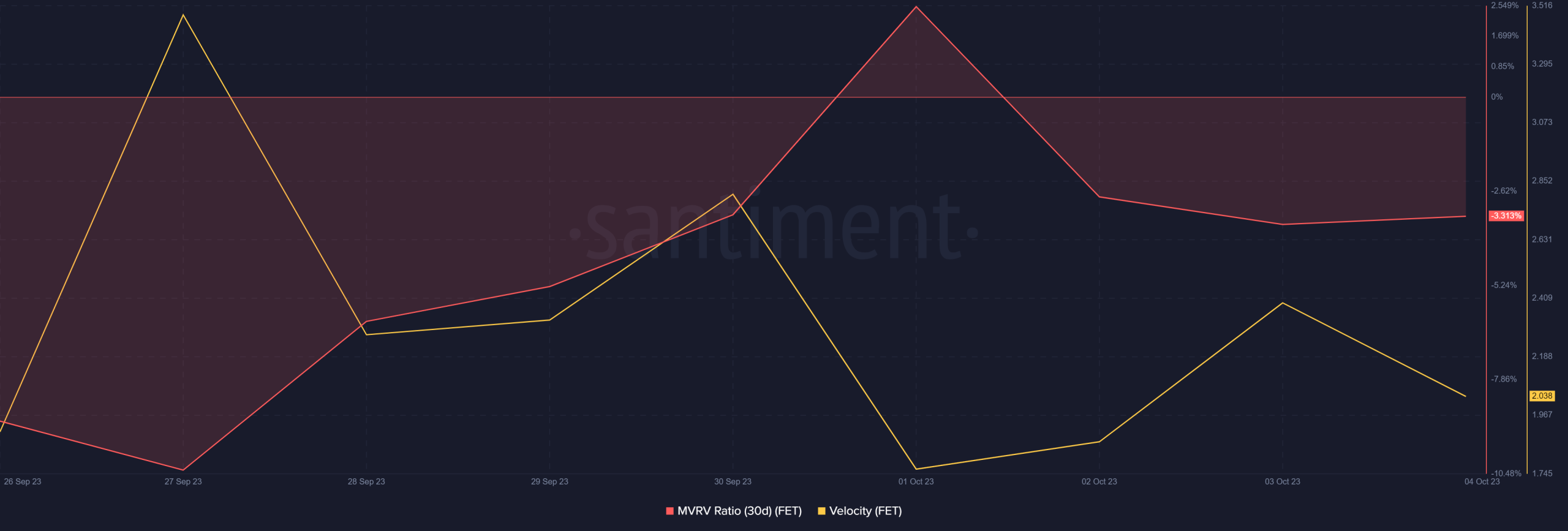

The price downtick also affected a few other key metrics of the blockchain. For example, the MVRV ratio registered a decline over the last 24 hours. FET’s velocity also dropped. This meant that FET was used less often in transactions during a set time frame.

How much are 1,10,100 FETs worth today

Going forward

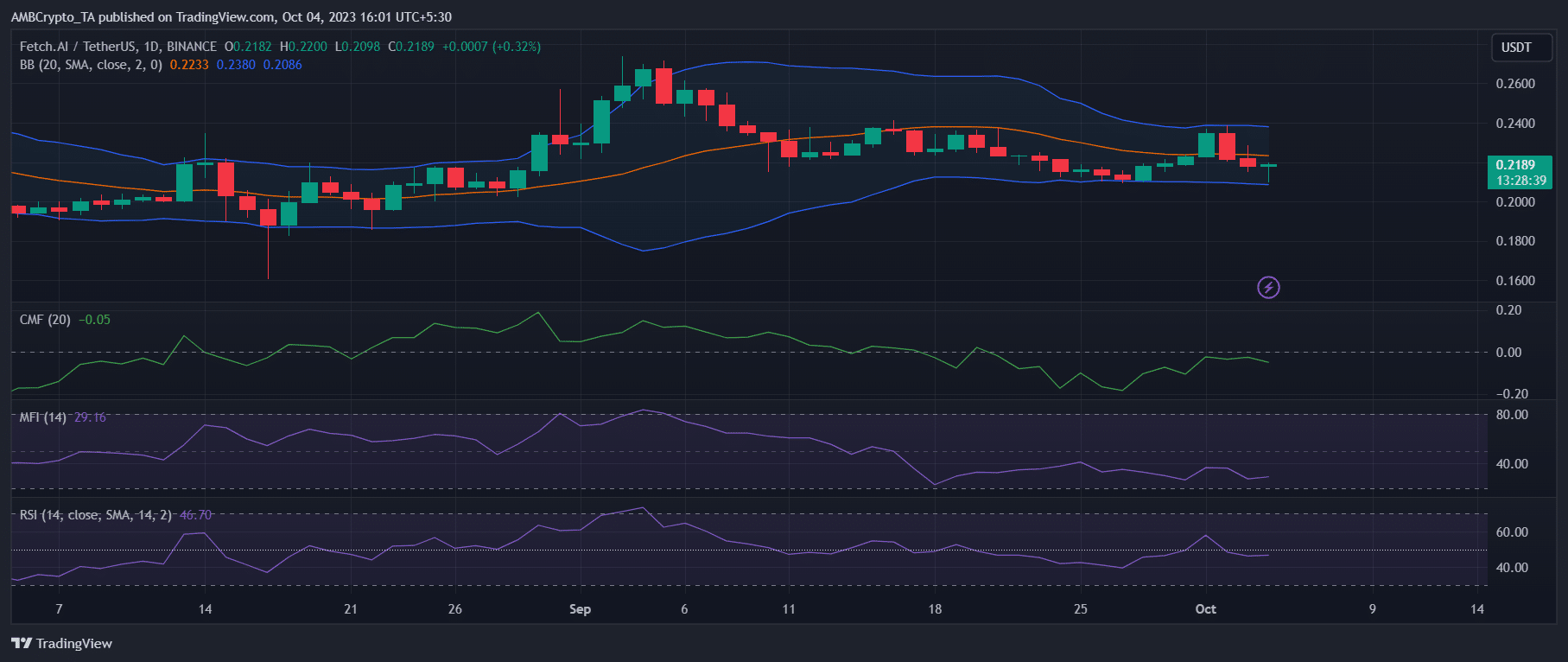

Apart from the metrics, the token’s market indicators also turned bearish. Fetch.ai’s Relative Strength Index (RSI) and Chaikin Money Flow (CMF) both went under the neutral mark.

Its Money Flow Index (MFI) was also considerably low, increasing the chances of a continued downtrend. Nonetheless, FET’s Bollinger Bands pointed out that FET’s price was in a less volatile zone, which can prevent the token price from falling at an unprecedented rate.

![Kaspa [KAS] on a long-term downtrend? Here's why it should worry investors!](https://ambcrypto.com/wp-content/uploads/2025/06/Kaspa-Featured-400x240.webp)